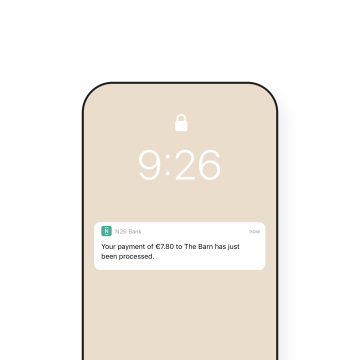

Real-time banking

Take control of your finances. With just one app.

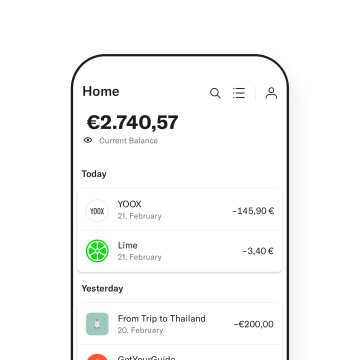

Automatic categorization of your expenses

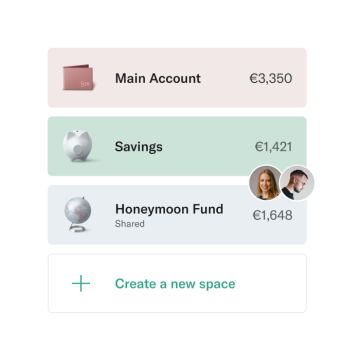

Save money with Spaces

Go further with a premium account

Your funds are guaranteed up to €100,000

N26 is supervised by the Financial Markets Regulator and meets all European regulatory requirements. Our clients' funds are guaranteed up to €100,000 by the Deposit Protection Fund.

We’re here for you. In several languages

If you have any questions or run into any problems, our Customer Service team will be on hand to help you in English, French, German, Spanish and Italian.

What's next?

Open your account now and start using your virtual card instantly.1. Sign up

Hit the button below and enter your personal details in order to create your account.

2. Download the app, verify your identity

Download and log in to the N26 app, so we can verify your identity. Have a valid ID ready.

3. Set up your virtual card

Once verified, your virtual N26 debit Mastercard is ready to use. Add it to your digital wallet like Apple Pay or Google Pay.

4. Enjoy your N26 account!

You're good to go! You can top up your account and start making transfers.

+ 3 millions

de clients en France

~ 1.800M $

Investis

+ 2 milliards €

de transactions mensuelles

2013

Création

Frequently asked questions

- Be over the age of 18

- Live in an eligible country

- Have your own smartphone

- Not yet have an online account with N26

- Have a valid ID