The bank account for expats in Belgium

Banking made simple

Forget paying for the basic stuff

With your virtual Mastercard, you can do all your payments online, in apps and in stores via your digital wallet. And we’ll always offer a feeless checking account that does what you need.

Contactless made effortless

You can use Apple Pay with your iOS device, and Google Pay with your Android. All set so you can enjoy mobile payments everywhere.

Real-time notifications

Stay up to date. Get a push notification immediately after all account activity, including card payments, direct debits, and transfers.

Full control over your card

Mobile banking allows you to control all the parameters of your account. Lock and unlock your card, activate and deactivate payments online or abroad, manage your payment limits... All in real time.

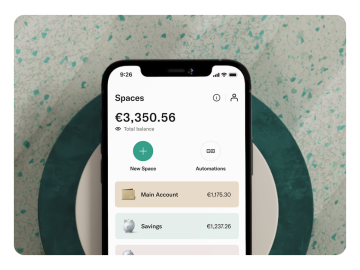

Save money with Spaces

Join the banking revolution taking over Belgium

N26 Metal: Make a statement

Our banking license

N26 is a fully-regulated bank that holds a European banking license and is controlled by the German banking regulator.

We’re here for you. In several languages

If you have any questions or run into any problems, our Customer Service team will be on hand to help you in English, French, German, Spanish and Italian.

Mobile or desktop

Manage your N26 account 24/7 from the mobile app or the N26 WebApp, using your browser of choice. Download your transaction history in CSV or PDF format along with your monthly bank statements whenever you want

3D Secure

Your online purchases are automatically protected by Mastercard 3D Secure (3DS), an advanced 2-factor authentication step.

What's next?

Open your bank account in minutes and start using your virtual card instantly

1. Sign up

Hit the button above and enter your personal details in order to create your account.

2. Verify your identity

Please have a valid ID at hand. We don't have branches so you can verify your identity within the app.

3. Add your card to your wallet

Your N26 virtual debit card is ready to use.

4. Enjoy your N26 account!

You're good to go! You can already top up your account and start using your virtual card.

+ 3 millions

de clients en France

~ 1.800M $

Investis

2013

Création

Frequently asked questions

- Be over the age of 18

- Live in an eligible country

- Have your own smartphone

- Not yet have an online account with N26

- Have a valid ID