The free business bank account for freelancers

Your free virtual N26 Mastercard

Enjoy 0.1% cashback every month

Your free business bank account

No hidden fees

Enjoy transparent online banking with no account maintenance fees, minimum deposit amounts, or cash withdrawal fees.

Always secure

The N26 Mastercard linked to your free business bank account uses 3D Secure—a 2-factor authentication process that makes online payments even safer.

Free business transactions

Your free N26 business bank account comes with unlimited free business transactions.

Deposit protection up to €100,000

N26 is a fully licensed German bank. Thanks to the statutory Deposit Protection Scheme, the money in your online business account is covered at all times up to €100,000.

Stocks and ETFs the simple way

8 minutes

to open your business bank account

Customer support

7 days a week

Deposit protection

of up to €100,000

A full banking license

since 2016

Our Customer Support speaks your language

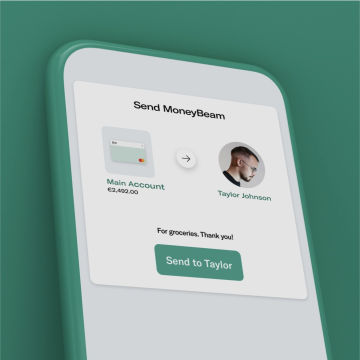

Get paid faster with SEPA and MoneyBeam

Sort your expenses with Insights

Print your transactions list

We're mobile, but for easier tax returns and invoicing, export and download your transaction list as CSV or PDF files for easy printing.

Banking on the big screen

First, sign up to N26 using the mobile app. Then, you can use the web application to view your account from a desktop or other device.

View scheduled transfers at a glance

Easily set up standing orders and direct debits for recurring payments. See all your upcoming transfers right in your app.

#Tag your transactions

Categorize your business expenses with custom, individual hashtags so you can find them more easily later on.

Plan ahead with N26—save money with Spaces

Invest in yourself with N26 Business Metal