N26 Business Standard

N26 Business banking for freelancers and the self-employed

✓ 0,1% cashback ✓ No monthly fees ✓ Fast sign-up process in minutes ✓ 100% app-based banking: no paperwork required

Free + unlimited SEPA transfers

Making and receiving SEPA transfers with your N26 IBAN is easy and free of charge. You can find your IBAN details straight away in the N26 app, when you open your account.

Up to 3 free withdrawals per month

With your N26 Mastercard, get up to 3 free ATM withdrawals per month within the eurozone.

Zero mark-up fees

Whether you’re paying in Pounds Sterling or US Dollars, you’ll only pay for what you spend—without added fees.

Real-time notifications

Stay up to date. Get a push notification immediately after all account activity, including card payments, direct debits, and transfers.

*Up to €50,000 balance, after which a deposit fee may apply. Please find the Terms & Conditions for more information.

Automatic categorization

Forget clunky spreadsheets. The N26 online business bank account uses artificial intelligence to automatically categorize your spending – you’ll always receive an up-to-date overview of your current expenses.

Create your own #tags to personalize your spending even further — #client, #office, #bizness… organizing your transactions has never been easier.

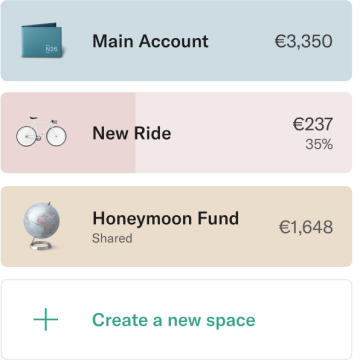

Plan ahead with N26 Spaces

Setting money aside for taxes, or saving for a future project? Effortlessly organize your business finances with Spaces sub-accounts, available with an N26 premium subscription.Create up to 10 Spaces, give each space a name, then easily put money aside to budget in real-time. Set Rules to automate your savings, or try Round-Ups to save up the spare change every time you pay by card.

Discover the premium feature spaces

Go premium with N26 Business You and Business Metal

Do you want to get the most out of your business? Upgrade to Business You for travel and lifestyle insurance, 0.1% cashback on your purchases, partner offers and a Mastercard your choice of card color. And if you really want to take it to the next step, N26 Business Metal—our most premium plan—offers you an exclusively-designed Mastercard in stainless steel, 0.5% cashback, smartphone insurance, priority Customer Support, and much more.

Compare Accounts

+8 Million

customers

~1.8B USD

Invested

+1500

Employees

~$1.8B

Invested

Frequently asked questions

- You will use the account primarily for business purposes.

- You’re not already an N26 user.

- You reside in a country where N26 operates: Germany, Austria, France, Italy, Spain, Portugal, Ireland, Greece, the Netherlands, Belgium, Luxembourg, Finland, Latvia, Estonia, Lithuania, Slovakia, Slovenia, Switzerland

N26 Business is free to open online with no account management fees. It’s the easiest business bank account to open if you’re a freelancer or self-employed.

No. You can only ever have one bank account with N26 at a time. So, if you already have a private account with us and would prefer to have a free business bank account, then you’d first have to close your private account. After that, you can open your free business bank account in a matter of minutes.

Automatically! We calculate 0.1% cashback on every purchase you make using your N26 Mastercard, and deposit it onto your free business bank account every month—you don’t have to worry about a thing!

The free business bank account is primarily intended for commercial finances so it’s a good idea to mainly use it for that purpose. You can use it for personal expenses on occasion, but these shouldn’t be the majority of your transactions.