Become a homeowner in France in 6 steps

Have you been fantasizing about getting on the property ladder and becoming a homeowner in France like many renters? Here are the 6 steps for finding and buying the home-sweet-home of your dreams.

8 min read

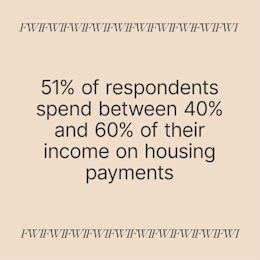

Have you been fantasizing about getting on the property ladder and becoming a homeowner in France like many renters? Here are the 6 steps for finding and buying the home-sweet-home of your dreams—while also avoiding some classic pitfalls.The first step towards buying a house or an apartment in France is to define your budget. Unless you can pay the property’s full price in cash, you’ll probably have to take out a mortgage. You can calculate the amount you could borrow based on factors like your income and how much you have available for a down payment. Our article on how to get the best home loan might help you with this step. Keep in mind that your debt ratio—the portion of your income spent on loan repayments—generally shouldn’t exceed 35%.Once your budget’s set, you can start thinking about what matters to you when creating your dream home—undoubtedly, one of the most fun parts of this journey. Make a list of your non-negotiables—what your new home definitely needs to have. If you’re buying as a couple or a group, this is also the time to discuss and compromise on priorities. Here are some things you might want to consider:Now that you’ve calculated your budget and the features of your ideal home, it’s time to face the reality of the real estate market. Can you afford the house or apartment of your dreams on your budget? Here are a few ways of finding how much your ideal property in France might cost:With your budget and wishlist in hand, it’s time to find real estate listings that match your search criteria. For an efficient search, try one (or all) of the following:Once you’ve fallen in love with an apartment or a house and decided you want it, it’s time to make an offer. It’s up to you to define the amount you want to offer, according to market prices you’ve researched and the condition of the property. If you have a real estate agent supporting you, they can also help you come up with a reasonable figure. It’s this offer—also called a purchase proposal— that will allow you to block the property and start the purchase process.Once the seller accepts the offer, a notary will gather all the documents necessary for the signing of a pre-contractual agreement between the owner and you. This can be a promise of sale (a contract in which a seller promises to reserve the property at a fixed price to the buyer for a certain period of time) or a preliminary sales agreement (a contract in which the seller and buyer agree to complete the sale). You still have a right of withdrawal for 10 days after this agreement is signed. After this 10-day cooling off period is over, however, if you change your mind and decide to cancel the purchase, you might lose the holding fee paid to the owner of the property.There’s generally a period of about three months between signing the preliminary sales agreement and the deed of sale—which we’ll discuss in the next step. In this time, you’ll have to get approval for the bank loan, sign the loan offer and wait for the release of the funds to the notary’s account before signing the deed of sale.It’s time to finalize the deal. The deed of sale is the legal document that will seal the transfer of ownership from the seller to you and allow you to formally become the property’s owner.The signing of this deal takes place before a notary, who’s also responsible for drawing up that deed. The process begins with the notary reading the document in full to the seller and the buyer. Then both parties sign the deed, followed by the notary—the whole transaction takes about two hours. Keep in mind that if either of the parties cannot attend, they can appoint a representative using a signed power of attorney. Once the deed is signed and you’ve paid the price of the property, the seller officially hands over the keys to you. It’s been a long process that requires patience and determination, but you are now officially a homeowner in France—Congratulations!Now might be a good time to find out how much it costs to remodel your home. Get your finances in shape with N26Saving up for a deposit for your dream home? N26 believes that managing your finances and planning for the future should be intuitive and accessible. With an N26 Smart account, you can use Spaces, a virtual piggy bank to help you save for your goals like a pro. Simply create a space, give it a name and drag-and-drop funds over from your main balance—all in a matter of seconds. And if you find yourself forgetting to stash your money, no stress—just set up Rules to move specific amounts over automatically, as often as you’d like. Shared Spaces also makes it easy to manage funds together with others. As a premium customer, you can invite up to 10 N26 customers to a Shared Space, be it your housemates, your business partner, family, or loved ones. Find the account that’s right for you and make saving simpler with N26.

Step 1: Define your budget

Step 2: Define the criteria for your property search

- The location: Set a search perimeter according to your priorities. Consider things like commute times, transport links and whether you want a residential or a lively neighborhood.

- The property type: Consider whether you want a house or an apartment, something old or new, with or without an elevator, and on the ground level or a higher floor.

- Size and number of rooms: How many rooms do you have in mind? Is closet space important to you?

- Orientation of the rooms: Fancy a south-facing living room? Bedrooms at the back?

- Whether you want an outside space—garden, terrace or balcony.

- The work you’re willing to take on, if necessary—including renovations and extensions.

Step 3: Become familiar with real estate market prices

- Consult the General Directorate of Public Finance database for “Land value queries”

- Use the Patrim tool, which allows you to browse selling prices of properties that are similar to the one you want.

- Ask a firm of notaries or consult the site of the French notary association.

Step 4: Browse and visit properties

- Use a local real estate agency. This can be especially reassuring if you’re buying a property for the first time. They’ll give you access to a network often inaccessible to the general public and help you evaluate market prices and the quality of the properties on offer. Keep in mind that agencies usually charge a commission of 3 to 6% of the property’s selling price.

- Contact owners directly via online ads on websites such as Le Bon Coin or PAP. This is usually a good option for people who have time on their hands and a good knowledge of the real estate market.

- Consult online auctions.

- If possible, before the viewing, ask for information on the context of the sale. Has the property been on the market for a long time? Are the owners in a hurry to sell? Are there a lot of viewings booked? All of this will give you an idea of how much leeway for negotiation you have.

- Check the real estate diagnostics—a kind of technical inspection of a home. They provide valuable information about the condition of the property and possible co-ownership regulations.

- On site, check the condition of the property—roof, walls, ceiling and floors, electrics, plumbing, and heating.

- Find out about the amount of property tax, residence tax, and co-ownership fees for the property.

Step 5: Make an offer and sign the preliminary sale agreement

Step 6: It’s closing time—sign the deed of sale!

Find similar stories

BY N26Love your bank

Related Post

These might also interest youLIFESTYLECould AI help you manage your money?86% of people are open to using AI for financial planning, but is it safe? Learn how AI is already transforming money management, and discover the pros and cons.

4 min read

LIFESTYLEUnderstanding tariffsFrom higher grocery bills, pricier electronics, and stock market swings, tariffs can impact your wallet and your investments.

5 min read

LIFESTYLEDe-hyping the no-spend challengeThis extreme challenge promises to transform your finances, but is it really the game-changer it claims to be?

4 min read