Business banking for freelancers and the self-employed

- 0,1% cashback on all purchases

- No monthly fees

- Free and unlimited SEPA Transfers

- Free card payments worldwide

Go global with a Mastercard debit card

1

Register online

2

Verify your identity in a short videocall

3

Receive your N26 Mastercard

4

Enjoy the bank the world loves to use

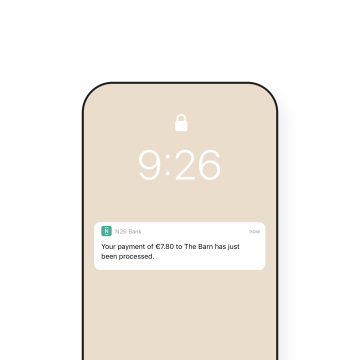

Stay on top of business in real-time

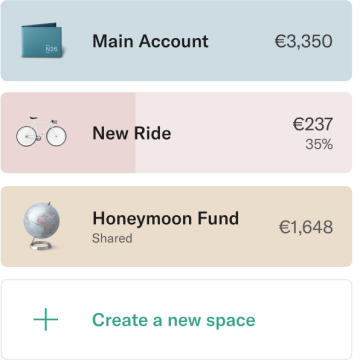

Organize your money with Spaces

Earn 0.1% cashback

Get 0.1% cashback for all purchases when you pay with your N26 Mastercard, and have it automatically deposited into your account each month.

Free + unlimited SEPA transfers

Making and receiving SEPA transfers with your N26 IBAN is easy and free of charge. You can find your IBAN details straight away in the N26 app, when you open your account.

Zero mark-up fees

Whether you’re paying in Pounds Sterling or US Dollars, you’ll only pay for what you spend—without added fees.

Up to 3 free withdrawals per month

With your N26 Mastercard, get up to 3 free ATM withdrawals per month within the eurozone.

Automatic categorization. Get a breakdown of your spending

Banking on the big screen

First, sign up to N26 using the mobile app. Then, you can use the web application to view your account from a desktop or other device.

Print your transactions list

We're mobile, but for easier tax returns and invoicing, export and download your transaction list as CSV or PDF files for easy printing.

Discover N26 Business Metal, with 0.5% cashback

German deposit security scheme

+8 Million

customers

~1.8B USD

Invested

+1500

Employees

~$1.8B

Invested