The N26 Business account is free, the app is sexy and easy to use. The Customer Service is very good, we are very far from what the traditionnal banks offer. Thank you ! ❤️ Alexis Minchella - Creator of Tribu Indé

Go global with a Mastercard debit card

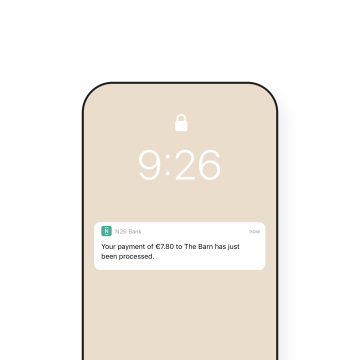

Stay on top of business in real-time

Earn 0.1% cashback

You’ll get 0.1% cashback for all your purchases when you pay using your N26 Mastercard and reinvest the profits straight back into your business.

Mastercard 3D Secured payments

Mastercard 3D Secure (3DS) is an extra layer of security that helps prevent fraud when making payments online using your N26 account.

No minimum deposit needed

You don’t have to deposit a certain amount or meet earning threshold requirements, so you can open a free business account even if you’re just starting out.

#Tag your transactions

#client, #office, #bizness… create your own personal hashtags and attach them to your transactions to organize them better.

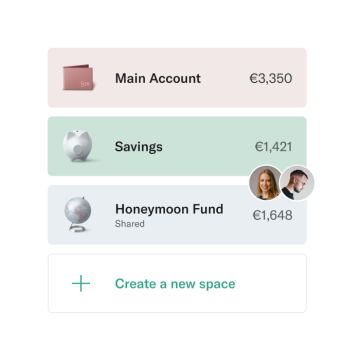

Spaces for your plans

Automatic categorization. Get a breakdown of your spending

Print your transactions list

We're mobile, but for easier tax returns and invoicing, export and download your transaction list as CSV or PDF files for easy printing.

Banking on the big screen

First, sign up to N26 using the mobile app. Then, you can use the web application to view your account from a desktop or other device.