N26 x Accenture—Global Digital Banking Index 2021

"It is clear that building and earning trust is a significant factor in our industry’s future, especially as we do not have centuries of legacy that traditional banks do. However, the pandemic showed that we must be focused on the future, not the past. That's why N26 is building banking for the 21st century and continues to earn the trust of millions of customers around the world", said Alex Weber, Chief Growth Officer of N26.

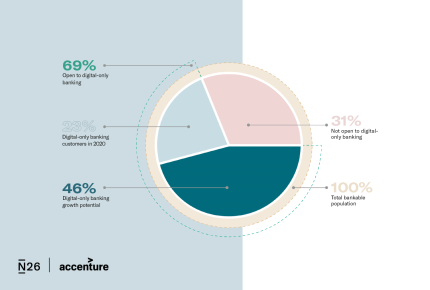

1 in 4 customers are already using a digital-only bank

Across the 28 countries surveyed, the number of consumers with a digital bank account represented 23% of the population—an estimated 450 million customers. But estimates from our analysis reveal that the number of consumers with a digital bank account could grow to at least 70% in most of the regions. The desire to make bank branches a thing of the past is strong. Plus, nearly half of the consumers surveyed who don’t currently have a digital bank account say they would be motivated to open an account so they could access typical digital banking features. Together, these findings suggest there’s still a largely untapped market for digital banks—potentially as many as 1.4 billion customers across the 28 countries.

Drivers and barriers to digital-only banking

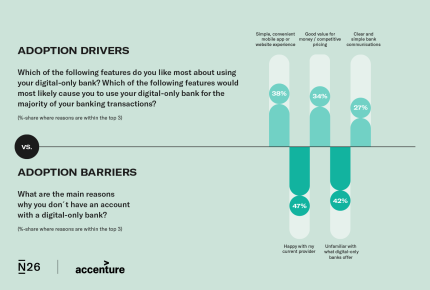

Drivers for digital-only banking

When it comes to digital banking, trust in the financial institution is key. We learned that the main drivers of digital bank adoption worldwide include the simple, convenient mobile app and website experience, clear and simple bank communications, and competitive pricing. These factors were also emphasized by customers who don’t currently bank digitally as incentives that might convince them to switch. These findings suggest that digital-only banks could gain loyal consumers by emphasizing these competitive advantages over traditional competitors.

The barriers that remain

Despite these drivers, there will likely continue to be a proportion of consumers who remain skeptical of digital banks. 28% of all consumers surveyed say none of the typical digital-only banking features would motivate them to open a digital only banking account. Some are simply happy with their current provider, while others are unfamiliar with the offerings of digital banks. Although 35% of the bankable population in Europe say typical digital banking features wouldn’t motivate them to open a digital-only bank account, 65% could still be converted to digital banks because of their clear value proposition.

Countries taking the lead in switching to digital-only banking

Despite undeniable adoption across markets, certain countries are leading the charge when it comes to digital-first banking. Saudi Arabia, United Arab Emirates, Brazil, and China boast the largest share of their respective populations already using a digital bank. It’s also clear that Western European countries are catching up quickly. Between 2018 and 2020, customer acquisition accelerated in the countries with relatively low adoption rates: Spain, Germany, Belgium, Italy, and the Netherlands. Globally, the countries with the strongest growth in digital banking adoption between 2018 and 2020 were Switzerland, Brazil, Ireland, the UK, and France. Looking forward, China and the United States will likely see strong digital-only banking adoption. These markets could soon have a total of 771 million and 148 million digital bank customers, respectively.

Digital banking: Conversion trends in the studied countries

| The Netherlands | 7 | 8.4 | 42.4 | 50.7 | 20% |

| Germany | 7.5 | 10.1 | 44.2 | 54.3 | 35% |

| Belgium | 9.6 | 12.5 | 43.5 | 56 | 30% |

| South Africa | 10 | 13.9 | 65.9 | 79.8 | 39% |

| Spain | 10.6 | 15.3 | 48.2 | 63.5 | 44% |

| Mexico | 14.5 | 18.5 | 62.5 | 81 | 28% |

| United States | 14.3 | 18.7 | 40.7 | 59.4 | 31% |

| Canada | 16 | 18.8 | 37.8 | 56.6 | 18% |

| France | 12.9 | 19.7 | 34.9 | 54.6 | 53% |

| Ireland | 14.9 | 23.2 | 51.2 | 74.4 | 56% |

| Italy | 20.5 | 26.1 | 45.6 | 71.7 | 28% |

| Russia | 27.6 | 32.2 | 48.5 | 80.7 | 17% |

| Japan | 36.4 | 41.2 | 37.4 | 78.6 | 13% |

| China (mainland) | 34.6 | 42.5 | 41.1 | 83.6 | 23% |

| China (Hong Kong) | 15.6 | 24.3 | 50.3 | 74.6 | 55% |

| Brazil | 25.4 | 44 | 43.4 | 87.4 | 73% |

| United Arab Emirates | 48.7 | 50.7 | 41.4 | 92.1 | 4% |

| Denmark | 11.4 | 14 | 38 | 52.1 | 23% |

| Finland | 5.8 | 7.4 | 51.1 | 58.4 | 27% |

| Norway | 11.1 | 15.7 | 45.5 | 61.2 | 41% |

| Sweden | 7.5 | 10.5 | 40.6 | 51.1 | 40% |

| Switzerland | 7.7 | 14 | 46.5 | 60.5 | 82% |

| Australia | 7.7 | 12.1 | 46.3 | 58.4 | 58% |

| Israel | 7.6 | 9.6 | 60.4 | 70 | 26% |

| Malaysia | 16.1 | 23.6 | 53 | 76.6 | 46% |

| Saudi Arabia | 54.3 | 54.3 | 38.9 | 93.2 | 0% |

| Singapore | 16.1 | 20.3 | 60.8 | 81 | 26% |

| United Kingdom | 9.5 | 14.7 | 43.8 | 58.5 | 55% |

Women may be driving the next wave of digital banking

In the early years of digital banking, customers tended to be high-income earners and male. However, the tide is turning. Brazil has seen slightly more women open a digital-only bank account—an exciting indicator with implications for other markets—and adoption among women is growing in Ireland, Germany, Sweden, Belgium, France and Norway too. We also gained insights into the diverse incomes of digital-bank customers. Though the majority of customers are on the higher end of the income spectrum, this is also seeing a shift. Spain, for example, has the highest adoption of the service among middle-class customers in Europe, while Ireland, Finland, Norway, Italy and France continue to see their share of low-income digital banking customers increase. Another fascinating trend is the age of digital-bank users. Often considered a service for the younger generations, digital banking in Europe is taking off among middle-aged customers too—like in Italy, where nearly one in two customers is over 45 years old. This shows that the benefits of digital banking are compelling to a broad range of customers, regardless of gender, age, or income."As digital banks continue to grow at a rapid pace and scale internationally, we see a huge opportunity for these players to create value for banking customers that the world has not seen before. From our research, it is clear that a new path for banking - one that is digital and driven by innovation - has been accelerated by the pandemic. However, digital banks must remain committed to winning trust with the bankable population to drive the lasting change they wish to see in the industry". Dr. Nils Beier, Managing Director, Banking & Public Sector Strategy Lead at Accenture