Manage your money with N26 Spaces

Go premium, and get 10 additional sub-accounts with individual IBANs. Stay on top of your bills, send and receive money, save easily, and find a better way to budget—all in one place on your smartphone.

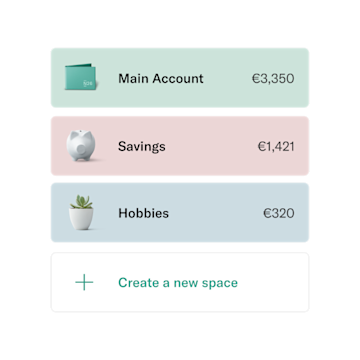

Sub-accounts for whatever your need

Organizing your money, or simply saving up for that big purchase? As a premium feature, N26 Spaces lets you create up to 10 additional sub-accounts that sit alongside your main account. Get a unique IBAN for each space, and easily send and receive payments directly in your sub-accounts. It’s a fast, flexible way to put money aside whenever you want.

Discover Spaces

Share money with friends and family

Enjoy a better way to save and manage money with others, thanks to Shared Spaces. As a premium customer, create sub-accounts and invite up to 10 participants to join and manage funds together.

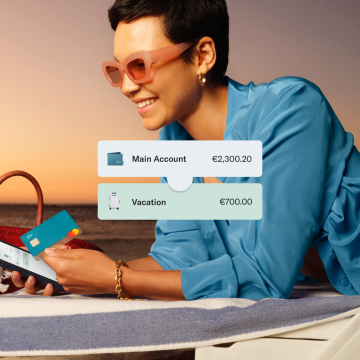

Pay from a Space and stay in control

Instantly link your virtual or physical Mastercard to a Space—and switch it up as often as you like. So whether you’re off to a wild bachelorette party or a bucket-list adventure, you’ll only be able to spend what’s in the linked Space. Relax, everything’s under control.

Create Rules, then forget them

Always forgetting to put money aside? Thanks to Rules with Spaces, set up recurring transfers between your main account and your spaces—simply set the amount and frequency, and watch that savings pile grow.

Less life admin, more living.

Spending hours keeping up with your bills and subscription payments? Spaces can help. On payday, move some money into Spaces with IBANs to cover your bills. Then pay automatically via direct debit, or set up repeat transfers for each month! You’ll never forget a bill—and you’ll have more time for what you love. Win-win.

Spend to save with Round-Ups

To reach your financial goals even faster, round-up your card purchases to the nearest euro. The difference will be automatically stashed away into your chosen space—it’s the most effortless way to save.

Make the most of Spaces. Get the most out of your money.

Move money between spaces

Transfer funds whenever you want—in real-time. Each space is a separate sub-account, and you can drag and drop money between them by tapping the button next to the spaces’ name.

Send and receive payments

Get up to 10 Spaces with individual IBANs. Easily send or receive SEPA transfers, set up standing orders for recurring payments, or pay bills via direct debit—right from each space.

Get a complete overview

Keeping track of multiple saving goals has never been easier. They’re all in one place—just give each space a descriptive name, and you’ll never forget what you’re saving for.

Set savings goals

Make progress towards your dreams, or just motivate yourself to save more. Each space lets you set a total amount, and shows you how close you are to reaching your goal.

Save and budget with N26 Spaces

New customer? Sign up for an N26 premium account to start saving up and budgeting your way. And if you already have one, simply log into your N26 app or WebApp to create your first space.FAQ

N26 Spaces are sub-accounts that sit parallel to your main N26 bank account. It’s similar to a savings account—spaces can hold your money aside, but can’t be used for spending with your N26 Mastercard. As a premium feature, you can create 10 Spaces sub-accounts with individual IBANs, allowing you to set up standing orders for recurring payments, pay via direct debit, and send or receive SEPA transfers—right from each space.

We called them Spaces to keep their purpose undefined. That’s up for you to decide, whether it’s saving or organizing your finances. While many sub-accounts are simply for saving, Spaces is a general tool that serves your needs, regardless of function.

Absolutely nothing! Your main account will continue to function like it did before. All your purchases, transfers, standing orders, and deposits will happen there.

As a premium customer, you can pay from a Space with your N26 card or by bank transfer, direct debit, or standing order.

To pay from a Space with your virtual or physical card, just go to the ‘Cards’ tab then tap on ‘Card Settings’ and choose the Space you want to link your card to.

To pay by bank transfer, direct debit, or to set up a standing order for regularly recurring payments, you’ll need to create a Space with its own unique IBAN. To create a Space with an IBAN, go to the ‘Finances’ tab, tap on ‘Create a Space’ and select ‘Bills and Payments’.

If you have an N26 premium bank account, you can create up to 10 Spaces sub-accounts. These sit alongside your main account, and you can create and delete these as often as you want.

We’ll immediately move the money back into your main account. If you’re deleting a space with an IBAN attached, the IBAN will be blocked from future incoming or outgoing transfers, including existing direct debit payments. Remember, you can create up to 10 Spaces with IBANs—but once you delete an IBAN, it’s gone forever. In order to not lose an IBAN, we recommend that you repurpose your Spaces with IBANs by giving it a fresh new name and icon.

Navigate to your N26 Finances overview. Your total balance sits right at the top above your spaces.

You can create up to 10 Spaces with an N26 premium bank account. Open yours now, and tap on the ‘Finances’ tab in your N26 app to get started.

If you’re an N26 Standard customer who opened an account before 16/02/2021, you can also create up to 2 Spaces sub-accounts.