Risk indicator for all N26 accounts.

1

/6

N26 is a member of the German Deposit Guarantee Fund. The fund guarantees deposits up to 100,000 euros per account holder and entity.

The world is waiting for you

N26 is The Mobile Bank, helping you manage your bank account on-the-go, track your expenses and set aside money in real-time. And with the world opening back up soon, we’re giving everyone a free year of our premium N26 You account with travel insurance that covers COVID-19 related claims.Open your bank account online in just 8 minutes, and use the promo code N26YOUTELVA.

N26 Standard – the free online bank account

Discover N26 Standard, the free online bank account with zero hidden fees. Sign up online in minutes, and start spending right away with your free virtual debit Mastercard in apps, in stores, and online. Prefer a physical card? Order yours now for a one-off €10 delivery fee.

Your N26 account with Spanish IBAN

We’re a licensed bank, 100% digital and secure. Every N26 bank account is guaranteed by the Compensation Scheme of German Banks up to €100,000.

Get a free year of N26 You

For too long, life has been on hold. But soon, the world will open up, and that’s why we’re giving everyone a free year of N26 You, our first premium bank account with travel insurance that covers COVID-19 related claims.

With N26 You, you also get a free Mastercard debit card in the color of your choice, free ATM withdrawals worldwide, 10 free sub-accounts and 24/7 customer care.

Get a free year of N26 You with the promo code N26YOUTELVA**.

Travel with confidence with N26 You

Get Insights into your spending habits

Not sure where all your money's going? Our Insights feature automatically categorizes your spending in real time. Track regular expenses, keep a pulse on your costs, and spot opportunities for savings. Everyday budgeting has never been easier.

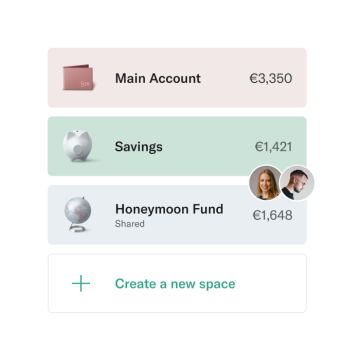

Learn about Spaces

How to save money with Spaces

Make saving a breeze with N26 Spaces and Shared Spaces sub-accounts, available with every N26 premium subscription. Automatically stash funds aside from your main account with Rules, or turn on Round-Ups to save up the spare change in your chosen space with every card transaction.Living in a shared household, or making group plans? Try creating a Shared Space to easily manage your money together with other N26 customers.

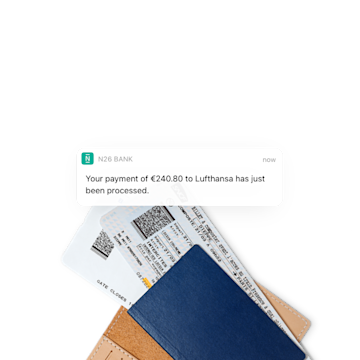

Push-notifications with your account activity

Stay up-to-date. Get a push notification immediately after all account activity, including card and mobile payments, ATM withdrawals, direct debits and transfers.

Discover our Business Mastercard for freelancers

N26 Business is free to open online, with no account management fees. It’s the easiest business bank account to open if you’re a freelancer or you’re self-employed.

- Spanish IBAN

- 0.1% cashback

- Fast sign-up process

- 100% app-based banking: no paperwork required

Discover N26 Business

Discover a new banking experience

Open your free N26 bank account from your phone. Just download the app and sign up in a few minutes.2013

Founded

~1,500

Employees

~8 Million

Customers

~1.8 B $

Funding

N26 Bank AG, Sucursal en España with NIF W2765098E, is a permanent establishment in Spain of the German entity N26 Bank AG, registered at the Bank of Spain with entity number 1563 and head office at Paseo de la Castellana 43, 28046, Madrid. N26 Metal Instant Savings account from 0 euros and without limit of amount.

These statements are intended to provide general information and do not constitute investment advice or any other advice on financial services and financial instruments such as Stocks, ETFs and Ready-made funds. These statements also do not constitute an offer to conclude a contract for the purchase or sale of Stocks, ETFs and ready-made funds. Stocks, ETFs and Ready-made funds can be subject to high fluctuations in value. A decline in value or a complete loss of the money invested are possible at any time. The values depicted are fictional and for illustrative purposes. The numbers of available Stocks and ETFs can vary per market.

*1.30% AER (1.50% annual NIR). With this interest rate, if you maintain a daily balance of 100,000 euros in your N26 Metal Instant Savings account for a period of 12 months, you will obtain a total gross interest of 1,500 euros. Monthly interest settlement. Applicable to any amount deposited in the instant savings account, with no maximum limit. See conditions at https://n26.com.

**0.50% AER (0.50% annual NIR) with N26 Standard. With this interest rate, if you maintain a daily balance of 100,000 euros in your N26 Instant Savings account for a period of 12 months, you will obtain a total gross interest of 500 euros. Monthly interest settlement. Applicable to any amount deposited in the instant savings account, with no maximum limit. See conditions at https://n26.com.

**0.50% AER (0.50% annual NIR) with N26 Smart. With this interest rate, if you maintain a daily balance of 100,000 euros in your N26 Instant Savings account for a period of 12 months, you will obtain a total gross interest of 500 euros. Monthly interest settlement. Applicable to any amount deposited in the instant savings account, with no maximum limit. See conditions at https://n26.com"

**0.50% AER (0.50% annual NIR) with N26 Go. With this interest rate, if you maintain a daily balance of 100,000 euros in your N26 Instant Savings account for a period of 12 months, you will obtain a total gross interest of 500 euros. Monthly interest settlement. Applicable to any amount deposited in the instant savings account, with no maximum limit. See conditions at https://n26.com

***Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

*****Eligible spending: Detailed T&Cs for customers who sign up before July 17 and after October 15 can be found here: https://n26.com/hb-ex

Promotion offer valid from 05.07.2021 until 28.07.2021

The promotion applies to new N26 customers which are residents in Spain, who sign up during the promotion period and may be used once per new N26 customer. New N26 customers may use the promotion code when signing up to the N26 You premium bank account, which comes with a one-year term and may be cancelled at any time. Once the promotion code is activated, the new N26 customer becomes a N26 You customer and will be exempt from paying the monthly N26 You premium bank account fee (€9.90/month) for the first 12 months of their yearly subscription, beginning from the date of activation. The T&Cs of the N26 You premium bank account apply and can be accessed via the website n26.com/eu-eu. When the promotion ends after 12 months, the N26 You customer’s yearly subscription to N26 You will remain active, and the N26 You customer will therefore remain subject to the T&Cs of N26 You and the corresponding monthly fees (€9.90/month). If the customer cancels their N26 You membership during/after the promotional period in line with section 5.2 of the applicable N26 You T&Cs, the customer will be downgraded to the N26 Standard account as it is offered at the time the customer's cancellation is becoming effective. To redeem the promotion code, the new N26 customer must provide it when prompted during sign up.