Risk indicator for all N26 accounts.

1

/6

N26 is a member of the German Deposit Guarantee Fund. The fund guarantees deposits up to 100,000 euros per account holder and entity.

Still don't know N26?

N26 gives you €20 welcome bonus

Want to know why N26 is my trusted bank?

- Best currency exchange

- No fees on payments worldwide

- No conditions

- 24/7 customer service

Terms and conditions of the promotion

Promotion offered by N26 Bank AG, Branch in Spain, with address at Paseo de la Castellana 43, 28046, Madrid. Tax identification number (NIF) W2765098E. Promotion valid from 01.05.2025 to 30.06.2025. The promotion applies to new customers who open an N26 Standard, N26 Smart, N26 You and N26 Metal account with the promotional code MADURAN. Only one promotional code can be used per customer. When the customer makes a transaction with their Mastercard N26 card of at least €20, they will receive another €20 in their account within one to two business days. The customer can upgrade to a premium membership, and can close their account at any time.

Save flexibly. Earn 1.30% AER.*

Grow your money without locking it away. Earn our best interest rate on your savings with N26 Metal.

Discover Instant Savings

Free trades every month

Explore the possibilities of investing with flexible investment plans and unlimited free trades in stocks and ETFs.****

Discover Stocks & ETFs

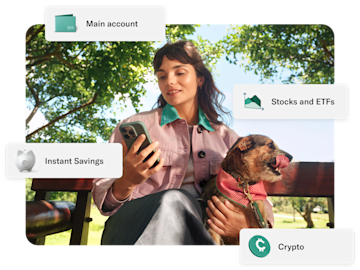

All in one app

N26 combines everyday banking and investing in a seamless way. That means you can manage your stocks, ETFs, and crypto portfolios without having to download another investment app. With N26, all the tools you need to build your financial wealth are in one place.

Security you can bank on

N26 is a fully licensed German bank. That means we have the same security regulations as any other bank. It also means your funds are protected up to €100,000 by the German Deposit Protection Scheme.

N26 accounts — your money deserves an upgrade

N26 Standard

The free online bank account

Virtual Card

€0.00/month

0.5% NIR/AER* interest on your N26 Instant Savings

Worldwide payments and no foreign transaction fees

Up to 3 free domestic ATM withdrawals

- -

*Need a physical card? Order a transparent debit Mastercard card for an one-time €10 delivery fee.

N26 Go

Travel with premium perks

€9.90/month

All benefits of N26 Smart, Plus

0.1% NIR/AER* interest on your N26 Instant Savings

Unlimited free withdrawals in foreign currencies

Insurance for delay and theft of luggage

Medical emergency cover

N26 Metal

Our most premium plan

€16.90/month

All benefits of N26 Go, Plus

1.5% NIR (1.3% AER)* interest on your N26 Instant Savings

An 18-gram metal card

Up to 8 free ATM withdrawals per month

Priority customer hotline

To benefit from this offer, you’ll need to open an N26 bank account. After that, you may open a separate N26 Instant Savings account to earn interest alongside everyday banking.

N26 Bank SE, Sucursal en España with NIF W2765098E, is a permanent establishment in Spain of the German entity N26 Bank SE, registered at the Bank of Spain with entity number 1563 and head office at Paseo de la Castellana 43, 28046, Madrid. N26 Instant Savings account from 0 euros and without limit of amount. See conditions at https://n26.com.

*Information on Instant Savings applicable to customers who joined before 12/03/2025. Interest is settled monthly and applies to any amount deposited in the Instant Savings account, with no maximum limit. Under the current 1.30% AER (1,50% annual NIR) with N26 Metal (annual cost of the subscription of 202,8 euros), maintaining a daily balance of €100,000 in an N26 Metal Instant Savings account for 12 months would generate €1,500 in gross interest. With 0,10% AER (0,50% annual NIR) with N26 You, 0,30% AER (0,50% annual NIR) with N26 Smart and 0,50% AER (0,50% annual NIR) with Standard, maintaining a daily balance of €30,000 for 12 months would generate €150 in gross interest.

1 The new limited-edition festive virtual cards can be activated at no extra cost. Up to six virtual cards can be activated at one time.

There is no account management fee for N26 Standard. For other plans, a fee could apply. The current fees can be found in the List of Prices and Services.

2 Valid only for new customers who open a new N26 Metal account from 19/02/2025 onwards. The interest rate for the N26 Instant Savings account corresponds to the current European Central Bank deposit facility rate (2% starting on 11/06/2025) and is subject to change by N26 any time. Terms and conditions apply.

For existing customers, N26 Instant Savings account interest rates are based on their main N26 plan, for both personal and business accounts: from 11/06/2025 onwards, 0.30% p.a. for Standard and Smart, 0.50% p.a. for N26 Go, and 1.50% p.a. for Metal (before taxes). Please note that rates per plan can be changed by N26 over time. This offer is available at no extra cost in the N26 app in Estonia, Finland, Greece, Ireland, Latvia, Lithuania, Luxembourg, the Netherlands, Portugal, Slovakia, and Slovenia.

3 These statements are intended to provide general information and do not constitute investment advice or any other advice on financial services and financial instruments such as Stocks, ETFs and Ready-made funds. These statements also do not constitute an offer to conclude a contract for the purchase or sale of Stocks, ETFs and ready-made funds. Stocks, ETFs and Ready-made funds can be subject to high fluctuations in value. A decline in value or a complete loss of the money invested are possible at any time. The values depicted are fictional and for illustrative purposes. Stocks and ETFs are currently available for eligible customers in Germany, Austria, France, Spain, Ireland, Belgium Denmark, Estonia, Finland, Greece, Latvia, Lithuania, Norway, Poland, Portugal, Slovakia, Slovenia and the Netherlands. Using the N26 Broker service is always subject to eligibility.

Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

4 The market for crypto assets constitutes a high risk. A complete loss of the money spent is possible at any time. N26 Crypto is powered by Bitpanda.

5 Eligible spending: Detailed T&Cs for customers who sign up before July 17 and after October 15 can be found here: https://n26.com/hb-ex