Germany's most popular bank in 2023

The free bank account that makes life easy

Financial products

Overdraft

Apply for an N26 Overdraft of up to €10,000 right in your N26 app with just a few taps. Manage all your finances directly from your smartphone, and easily keep an eye on your spending as well as your daily overdraft costs.

Consumer credit

Want more financial flexibility? Request a loan of up to €25,000 directly in-app with N26 Credit—no paperwork involved. Compare loans and manage your payments easily right from your smartphone.

N26 Insurance

Choose an N26 premium membership for insurance coverage that protects the things you value. N26 Go and Metal include a package of travel insurance for lost baggage and trip cancellation, and N26 Metal-exclusive insurance covers your mobile phone and includes purchase protection.

Installment loans

If you need money for an urgent purchase, you can simply get an installment loan for a payment you've made in the past. This way you can increase the funds in your N26 account quickly and stay flexible.

Withdraw and deposit cash

Get Insights into your spending habits

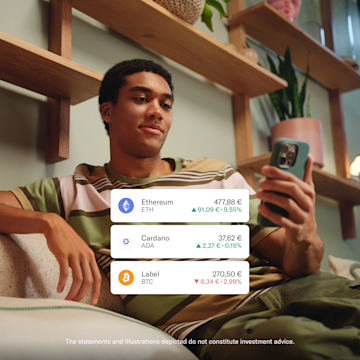

N26 Crypto — so easy to use

Your safety is top priority

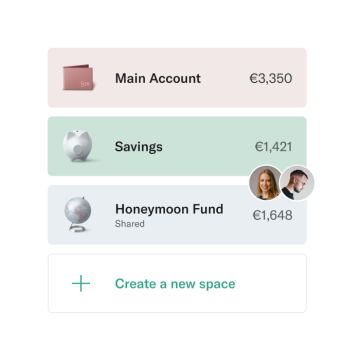

Reach your financial goals with N26 Spaces

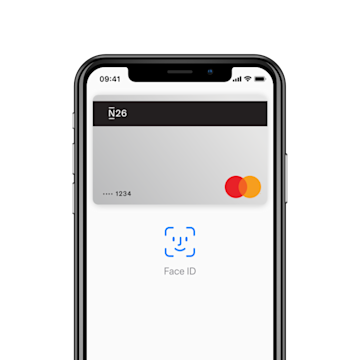

Make payments the easy way with Apple Pay

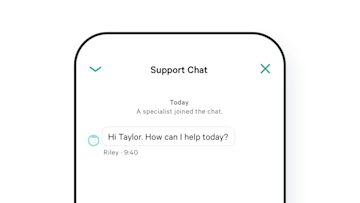

Customer Support in your language