Digital wallets — a new way to pay

A digital wallet stores your virtual bank cards securely on your phone, so you can pay in stores or online with just a tap.Open bank account

What’s a digital wallet?

Your digital wallet lets you pay in stores by tapping your phone, or online without having to type in your card details every time. Your card information is protected by your phone’s security — like Face ID or your fingerprint.

Pay safer and faster

Speedy

Pay instantly by tapping your phone — no searching for your card.

Secure

Your details are encrypted and protected by your phone’s security.

Handy

Use it in stores, online, or in apps without typing card numbers.

Most common digital wallets

Apple Pay

Pay straight from your Apple devices, including the Apple Watch.

Learn more

Google Pay

Just tap and go — with your Android phone or Wear OS device.

Learn more

Samsung Pay

Your Samsung device becomes your wallet — fast, secure, simple.

Learn more

Garmin Pay

Leave your phone behind and pay right from your wrist.

Learn more

Basic types of wallets

Open wallet

An open wallet lets you store most credit cards, debit cards, and gift cards, and use them to pay in stores and online.

Closed or semi-closed wallet

A closed or semi-closed wallet is limited to a specific app, store, or service. Typically, you can only use the money stored in the wallet to pay at the store or provider that issued it.

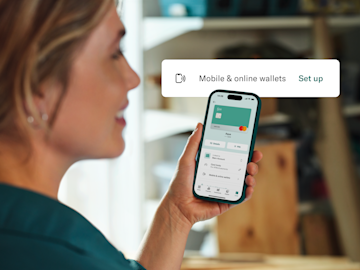

How to add your N26 card

Enter your card details into your digital wallet and you’re ready to go.

Or head to the Cards tab in the N26 app, select ‘Mobile and online wallets’ > ‘Set up’ and follow the steps.

FAQ

Yes. Your card details are encrypted and stored securely in your digital wallet. Make sure you're using a well-known and trusted digital wallet like Apple Pay, Google Pay, Samsung Pay, or Garmin Pay.

Once you've added your N26 card to your digital wallet, you can leave your physical card at home. Your virtual card will be accepted anywhere Mastercard is accepted.

Apple Wallet lets you store the digital form of pretty much anything you’d put in your normal wallet — from theater tickets to boarding passes to credit cards. To start using it, simply open the Wallet app on your iPhone and add whatever you like to it. If you want to use Wallet to make purchases, you’ll need to connect your N26 card to Apple Pay. To do this, simply open your Wallet app, tap ‘Add Card’ and follow the prompts to verify your card.

To use Google Wallet on your Android device, you’ll need to download it from the Google Play Store. Then, set up a Google Wallet PIN to log in for the first time. If you already have debit or credit cards paired to your Google account, you can choose one from the list to pair to your Google Pay, and you’re ready to go.

When you buy tickets online for flights, trains, buses, or events, you can add them to your wallet by selecting the ‘Add to Wallet’ icon in your email or browser. You may also be able to scan a code when you buy something in-person.