Why IBAN numbers were created

The IBAN system was designed to simplify the transfer of money overseas—but they’re used in some countries for domestic transfers as well. Separate from your account number and sort code, they include information about the account holder’s specific bank, the country that this bank is in, and a combination of other account details. This added level of coded security reduces transaction errors, rejected payments, and transfer delays across borders. IBANs can only be used to send or receive funds, and they can’t be used for other transactions, such as cash withdrawals.IBAN characters, explained

Each character set of an IBAN number shares a specific piece of information with banks. They begin with a two-letter country code—such as ‘FR’ for France and ‘DE’ for Germany. The next two digits are control checks, acting as a security layer specific to your bank. The remaining numbers are domestic banking details, also known as your Basic Bank Account Numbers (BBAN). The BBAN information will typically include a bank code and branch reference, as well as the account number—although formats can differ across IBAN regions.How an IBAN number works

When you make a cross-border transaction, the characters that make up your IBAN number are run through the payments system used by your bank. By verifying the numbers and letters against their database, the system is able to confirm the sender’s account and that of the recipient. Special algorithms are used to digest and check the account information. If it’s valid, the payment will be processed.How an IBAN number works

When you make a cross-border transaction, the characters that make up your IBAN number are run through the payments system used by your bank. By verifying the numbers and letters against their database, the system is able to confirm the sender’s account and that of the recipient. Special algorithms are used to digest and check the account information. If it’s valid, the payment will be processed.

Who uses IBAN numbers?

Although IBAN numbers were originally designed for payments between Eurozone banks, they’re now used in 70+ countries worldwide. In places like Canada or the US, IBAN numbers haven’t been adopted, and they’re not required for transferring funds to those countries. However, they are needed when making an international transaction to a country that has adopted the system.

Where can I find my IBAN number?

Here are some tips for finding you IBAN number:

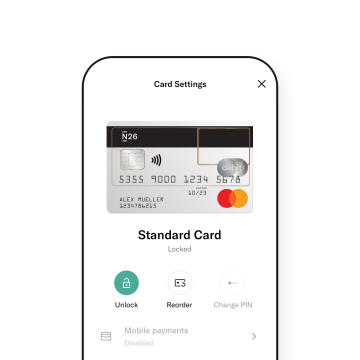

- Check your debit card! Some countries display IBANs directly on their bank cards, while others don’t.

- Get in touch with your bank to request it—as long as you’re in a dedicated region, they’ll be able to provide you with the details you need.

- Check the top of bank statements or your bank’s online banking app. For example, N26 account holders can access their bank IBAN number right in their app.

Open online bank account

How to use an IBAN number generator

You can also find out your IBAN using an online IBAN calculator. Because the system is an internationally accepted coding system, the calculator tool is able to generate it for you using the preset configuration set by the system and your country; simply enter your country code, sort code, and account number. You can also validate that the number your recipient has provided is active via an IBAN number checker.How safe is an IBAN?

Using an IBAN number to transfer funds is considered safe by Eurozone finance regulators, and is routinely used to make payments across borders. The key security benefit is that although other consumers can make money transfers into your account using your IBAN, it’s not possible to withdraw money or transfer funds from your account. This means that there is no security risk for your funds.The difference between IBAN, SWIFT, and BIC codes

When making an international payment, you may be asked for an IBAN number, SWIFT code, or a BIC. SWIFT codes and Bank Identifier Codes (BIC) do the same job—they identify the specific country, bank, and branch your recipient's account is held with. An IBAN identifies the specific account details involved in the transaction, as well as the bank and branch. A BIC or SWIFT code is up to 11 characters

Learn the main EU banking acronyms

International money transfers

By reducing international transfer errors, using your IBAN number can help avoid extra fees that may occur when your bank needs to reverse an incorrect payment. It also speeds up transfer times. Transferring funds overseas from your bank account can sometimes be costly and time consuming. Want to learn how to send and receive money internationally the quick and easy way? Check out our tips for the best ways to send money online internationally.N26 international transactions with SEPA

At N26, all our accounts allow Eurozone transactions through SEPA. By using your IBAN number to transfer money between accounts, SEPA Credit Transfer can process a payment in as little as one working day. In a hurry? If both your account and the recipient’s are SEPA Instant Credit-registered, the transfer will be completed within 10 seconds of confirmation—offering instant international transfers at the click of a button. Learn more about SEPA transfers with N26. Open an N26 account in minutes for quick and secure international payments between accounts, with SEPA Credit Transfer and SEPA Instant Credit Transfer.Find a plan for you

N26 Standard

The free* online bank account

Virtual Card

€0.00/month

A virtual debit card

Free payments worldwide

Deposit protection

POPULAR

N26 Go

The debit card for everyday and travel

€9.90/month

Up to 5 free withdrawals in the Eurozone

Flight and luggage delay cover

Medical emergency cover

Winter activities insurance

Pandemic coverage

N26 Metal

The premium account with a metal card

€16.90/month

An 18-gram metal card

Up to 8 free withdrawals in the Eurozone

Purchase protection

Phone insurance

Dedicated N26 Metal line

All of N26’s IBANs start with DE (Germany), FR (France), IT (Italy), or ES (Spain), followed by two control digits and our bank code (10011001). They’ll then finish with your 10-digit account number.

On top of safe, quick transfers with SEPA, you can also send money overseas in over 30 currencies at real-market exchange rates thanks to our partnership with Wise.

Not to be confused with an account number or sort code, an IBAN is a set of characters attached to your bank account for domestic and overseas transactions. Created to simplify sending or receiving money internationally, an IBAN number provides data to verify your account number, your bank’s country of origin, and other account information. This code is checked via the IBAN register when you make a payment in order to confirm that the recipient is correct. The IBAN system is now used in 70+ countries worldwide.

Up to 34 characters long, an IBAN is a combination of letters and numbers. It starts with a two-character country code, two bank control digits, and a Basic Bank Account Number (BBAN) that contains data specific to your bank and account. The format of an IBAN varies between countries—although all variations are in line with the coding system. The BBAN portion of an IBAN usually includes your specific bank code and your bank branch reference.

If an IBAN number is entered incorrectly and there is no corresponding account with that IBAN, the transaction will bounce. However, if you enter an IBAN that corresponds to an account at that bank, even if the recipient’s name is incorrect, the transfer will likely go through and can’t be reversed without the recipient’s permission. If you think you may have entered an incorrect IBAN number, contact your bank for further support.

The IBAN system has specialized algorithms that are uniquely accurate, and the system was designed to help spot errors by verifying the IBAN against the account holder’s information. Your details are validated against the international database for structural and formatting checks to keep transaction errors to a minimum. This system was agreed with multinational banking institutions and financial regulators to ensure consistency and so that the necessary verification processes are implemented. IBAN numbers can only be used to send or receive money between accounts, not for withdrawing money or transferring account ownership.

A SWIFT code is used to determine which specific bank you are using for transactions, and the IBAN determines the specific bank account you are using to make payments. SWIFT codes are a standardized format of Business Identifier Codes (BIC) which banks use when transferring money between each other, enabling information to be shared via a secured and regulated network.

You may be able to find your IBAN number directly on your bank card. If not, check your bank statements or mobile app to see if it’s listed there. Alternatively, you can contact your bank to access it. N26 customers can check out this article to learn how and where to find their IBAN numbers.

While the IBAN system was originally developed to streamline payments in the EU, it has now been adopted by many other countries and regions, including the Caribbean and Middle East. As of May 2020, 77 countries were offering IBANs. You can find a full list of all the countries using the system here.