N26 Smart

The bank account that gives you more control

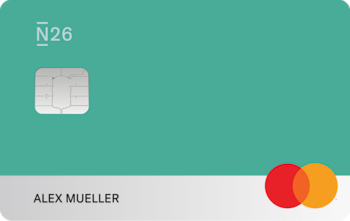

Your colorful Mastercard, accepted worldwide

Start earning interest

Stocks and ETFs the simple way

Stay on top of your finances with Spaces

Pay via card from your Spaces

Keep track of your expenses by linking your N26 Mastercard to a Space of your choice—and easily set and stick to your holiday budget.

10 sub-accounts with individual IBANs

Receive and make SEPA transfers or set up direct debits and standing orders to pay subscriptions, invoices, or your rent—directly from your Spaces.

Save automatically with Round-Ups

Save money regularly—and without even noticing—by activating Round-Ups. Every time you pay with your card you’ll save the change in a Space of your choice.

Automatically sort your income into Spaces

With Income Sorter, you can automatically set aside a portion of your incoming transfers into your Spaces. Put aside enough money for bills and your next vacation without having to think about it.

Treat yourself with N26 Perks

Simple. Fast. 100% flexible.

Customer Support for premium customers

Secure online banking

Protected up to €100,000

With N26’s German banking license, your money is fully protected up to €100,000 by the German Deposit Protection Scheme.

3D Secure

Safely shop online thanks to Mastercard 3D Secure—the 2-factor authentication step that adds an extra layer of protection.

Instant push notifications

Immediately receive alerts on your smartphone after each transaction. With N26 Smart, you’ll always know what’s coming in and out of your bank account.

Biometric identification

Securely log in to your bank account with fingerprint identification or FaceID, so no one can access your bank account unless it’s really you.

FAQ

- What do I need to open my N26 Smart account?

- How do I open my N26 Smart account?

- How long does it take to open a bank account with N26?

- What are the benefits of an N26 Smart account?

- How much does N26 Smart cost?

- What are Spaces sub-accounts, and how can I use them?

- How many bank accounts am I allowed to have?

- How can I switch my bank account to N26?

- Is there a bonus for referring a friend to N26?

- Can I open a bank account with N26 that comes with a credit card?

- What kind of bank card do I get with an N26 Smart account?