How much is VAT in Austria, and what do you pay it on? And which tax rate actually applies in which circumstances? Find out this and much more here.

4 min read

How modern couples manage joint finances

Whether you’re polyamorous or monogamous, married with kids or parenting pets, money matters in every relationship. But the way partners organize their finances can differ greatly.

6 min read

Joint account or N26 Shared Spaces? Comparing the options

Want to take the next step with a partner and manage your finances together? Read on to get a side-by-side-comparison of the options and features, so you can decide what’s best for you.

9 min read

Popular articles

N26 x Booking.com: discover smarter travel

Travel smarter with Booking.com—get up to 10% discount when you book a stay with your N26 Mastercard, and more.

1 min read

N26 x FlixBus—explore Europe by bus with this special offer

Need to get away for the weekend? Take advantage of 10% off your next ticket with this special FlixBus offer.

1 min read

Technology & Security

Helping you keep your money safe from scams, threats, and other potential dangers.

5 popular holiday scams to watch out for this season

Don’t let scammers ruin your holidays. Get informed about these 5 popular holiday scams to protect your wallet.

5 min read

How N26 will contact you — and how we won’t

Scammers and fraudsters may pose as representatives of N26 to try to steal customer data. Here, we dive into how N26 will and won’t contact you, so that you can spot the scams.

8 min read

Banking Basics

All things banking and money, to empower you make you the most out of your finances.

The myth of starting early: Why it’s never too late to start investing

Are your finances doomed if you don’t start setting money aside early? We explain why investing early is more difficult than it seems, and what you can do to grow your money at any age or stage.

10 min read

What is options trading? The different types, strategies, and risks

It's complex, but it doesn't have to be. Understand what options trading is, how it works, and the potential risks and rewards.

6 min read

6 min read

What to know before you start investing

10 min read

N26 x Bolt — Get cashback on your rides

If you’re looking for smart mobility solutions in one app, then Bolt has you covered. And as an N26 customer, you can now claim up to 10% cashback on your rides.

2 min read

Reflecting on 2022 and looking ahead at what’s to come for N26

Founders Valentin Stalf and Maximilian Tayenthal reflect on key challenges and accomplishments of 2022, and look at what’s to come for N26 in the years ahead.

2 min read

Student savings accounts: 7 things you need to know

Student savings accounts help you stash away your cash during your studies. Our guide will show you how, and much more.

7 min read

COVID-19 gives rise to a new generation of money-savvy students

Faced with a tough economic landscape, European students are finding new ways to manage their money. We explore how digital tools are enabling students to seize control of their finances.

2 min read

N26 Chief Growth Officer reflects on his 9-year journey at Europe’s leading digital bank

11 min read

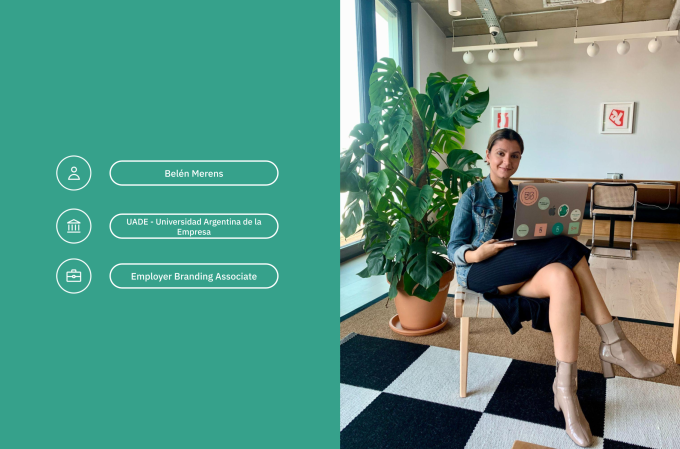

Employer Branding Associate Bel Merens on uni, travel, and living your dreams

Team spotlight: Bel shares how she made her dream—moving to Europe to work for a popular FinTech—a reality.

9 min read

Vacation inspiration: 5 unique travel ideas for any budget

Looking to up your vacation game but don’t know where to begin? We’ve put together a list of inspiring travel ideas to match any season, style, and budget.

7 min read

Everything you need to know before you travel to Ireland

From adventure travel and city breaks to family-friendly trips, Ireland does have it all. Discover your perfect Irish travel destination so you get the most out of your trip to the Emerald Isle.

9 min read

The how, where, and what of Bitcoin's upcoming 2024 halving event

How this pivotal moment could influence crypto market trends and inform investment decisions.

6 min read

What is Bitcoin halving — and why should you care?

One of the most anticipated events in cryptocurrency is nearly here: the next Bitcoin halving. But what is it — and why should you care?

5 min read

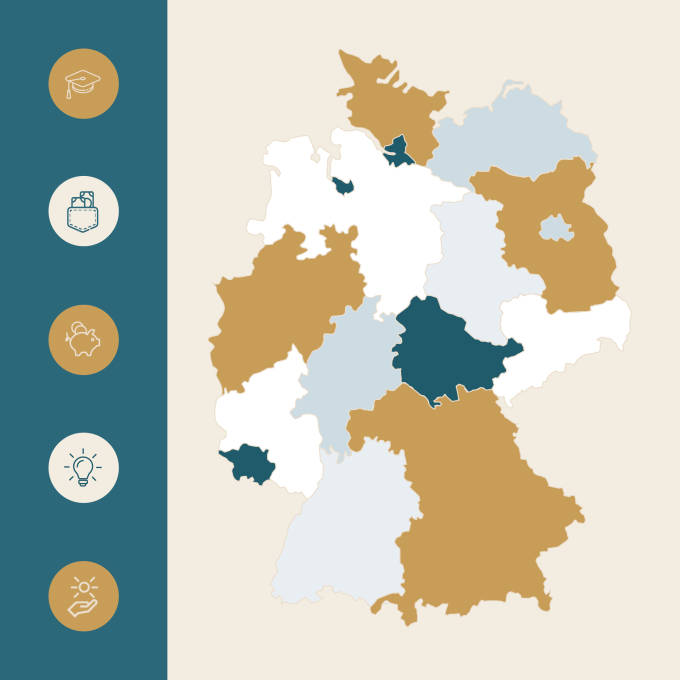

How expensive is it to live in Germany? An overview of (almost) every cost

From rent and food to transportation and leisure, many of us might not know exactly how much we spend each month. Here’s a simple breakdown of everything that goes into the cost of living in Germany.

13 min read

Working remotely with the digital nomad visa in Italy

Remote work from Rome, anyone? The new digital nomad visa in Italy is launching soon. Find out here who can apply, what the requirements are, and which Italian cities are best for digital nomads.

5 min read

Freelancers

For freelancers, self-employment means flexibility, independence — and some hustle. Learn how to level up as a freelancer with helpful tips from N26.

How much do freelancers make? A guide to the average freelancer salary

Salary is a big consideration when thinking about going freelance. Read our guide to find out average hourly rates for a number of industries.

6 min read

Your ultimate guide to being self-employed in Spain

Itching to start your own business in Spain? Here, you’ll learn what paperwork you have to complete, where to do so, and what you need to bear in mind on your journey into freelancing.

6 min read

Self-employed in Germany? Taxes, tips, and more

Thinking about working for yourself? Our guide will break down what you need to know about taxes when you're self-employed in Germany.

6 min read

A simple guide to taxes in Germany

Germany is home to more than 40 different types of taxes. This article will highlight the ones that are relevant to you—and explain why they exist in the first place.

6 min read

What is a term deposit and how does it work?

If you’re looking for a secure investment for your money, term deposits might be a great option for you. Here, we’ll dive into what term deposits are, how they work, and much more.

9 min read

How to choose the right type of savings account

Ready to take advantage of high interest rates and watch your money grow? Then you’ll need to choose the right savings product to suit your needs. We can help.

10 min read