N26 Standard

Your 100% mobile, free bank account

Transfer, receive, and manage your money via the mobile N26 app. Open your free bank account, including a Mastercard, in just 8 minutes—directly from your smartphone. No paperwork, stress, or waiting times. Just intuitive, easy mobile banking that works.

Start earning interest

No deposit limits,* simple conditions, and full flexibility. Discover N26 Instant Savings, the easy-access savings account available at no extra cost in the N26 app.N26 Standard customers get 1.26% p.a.** interest on their savings.

More about the Instant Savings account

*The money in your bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme.

**The interest rates vary based on your membership: 4% p.a. for Metal, 2.26% p.a. for You and Smart, and 1.26% p.a. for Standard accounts. Please note that regular rates per membership are subject to change over time.

Stocks and ETFs the simple way

How about investing in your future without having to leave your banking app? With N26, you can buy stocks and ETFs right from your phone. Get 15 free trades every month when you upgrade to N26 Metal — and 5 with N26 You.

Discover Stocks and ETFs

Your virtual N26 Mastercard, accepted worldwide

Your free bank account comes with a virtual N26 Mastercard—you can start using it as soon as your account is set up. Link it to Apple Pay or Google Pay to make payments in stores, online, or in apps. And if you need cash, make up to 3 free withdrawals per month—simply find your nearest ATM equipped with a contactless reader.

Prefer plastic? No problem. Order your own transparent N26 Mastercard straight from your N26 app for a one-time delivery fee of €10.

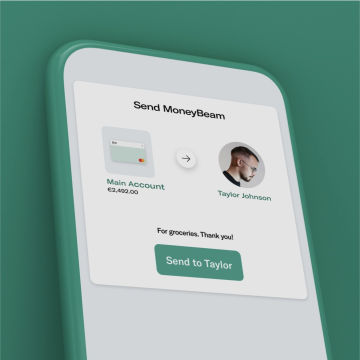

Instant bank transfers made easy

Your free bank account comes with MoneyBeam, the feature that lets you send, receive, and request money instantly with other N26 customers. You don’t even need their bank details—just a phone number or email address will do!Need to get money into your N26 account urgently? Your N26 Standard bank account is able to receive SEPA Instant Credit transfers from other banks, so you’ll have the money in your account in seconds.

Learn about Instant payments

Relax with full security

Mastercard 3D Secure

Shop online securely and comfortably with Mastercard 3D Secure—two-factor authentication keeps your account safe from unwanted transactions.

Push notifications in real-time

Get an instant push notification every time money enters or leaves your account, so you always know what’s going on with your balance.

Biometric authentication

Add an extra layer of security every time you log in to your N26 app with fingerprint identification or facial recognition.

Protection up to €100,000

N26 is a fully licensed German bank. Thanks to the statutory Deposit Protection Scheme, the money in your free bank account is protected up to €100,000.

+8 Million

customers

24

markets

300,000+

5-star app ratings on iOS and Android

Customer Support you can rely on

Do you have a question about your free bank account? Whatever the issue, our skilled Customer Support team is happy to assist you—in German, English, Spanish, French, or Italian! Just use the in-app chat function in your N26 app or browse through the FAQs in our Support Center.

Visit our Support Center

Understand your spending with Insights

Learn exactly where your money’s going every month with Insights. This feature categorizes all your expenses automatically and displays them to you in a neat overview, so you can learn how to optimize your budget and save money in the future.Plus, find out exactly where you spend the most every month with Monthly Wrap-Up, and adjust your spending habits to budget smarter and save even more.

Open online bank account

Free account switching

Many don’t switch their bank, even though they’ve been unhappy for a while. Why? Because it’s too complicated. Together with finleap we do all the work for you: finleap automatically transfers all your standing orders, direct debits and incoming payments to your new N26 account, for free! Discover how you can easily change banks in just a few steps.

An account that fits in with you

Ready to discover mobile banking? Compare our bank accounts now to find the one that fits you best. Choose between our free standard account and the N26 premium accounts, or opt for a business account if you’re a freelancer. Open your account directly on your smartphone in less than 8 minutes and discover modern banking.Frequently asked questions

- What do I need to open a free bank account with N26?

- How can I open a free bank account with N26?

- What are the benefits of the free bank account from N26?

- How much does the N26 Standard online account cost?

- Which German bank can I switch from?

- Which account is free at N26?

- Is N26 Standard a free bank account?

- I’m looking for a bank account with no fees. Is N26 Standard right for me?

- I’m looking for a bank that doesn’t charge account fees. Is N26 the right online bank for me?