*Valid only for new customers who open a new N26 Metal account from 19/02/2025 onwards. Deposits made into Instant Savings earn interest at an annual gross nominal rate of 2%, which is currently aligned with the European Central Bank deposit facility rate (starting on 11/06/2025). This interest rate may be subject to change at any time at N26's discretion, regardless of fluctuations in the ECB rate. Interest is taxable and subject to social security contributions. Terms and conditions of the Instant Savings apply. Reserved for non-Business customers of N26 Bank SE, Succursale France.

For existing customers: deposits into N26 Instant Savings accounts earn interest at an annual gross nominal rate of 1.50% with N26 Metal, 0.55% with N26 Go, and 0.25% with N26 Smart and N26 Standard from 11/06/2025 onwards. These may be subject to change at any time by N26. Interest is taxable and subject to social security contributions. Reserved for non-Business customers of N26 Bank SE, Succursale France.

The money in your bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme.

**Investments in stocks and ETFs carry a risk of capital loss. N26 Stocks and ETFs is provided by N26 Bank SE in partnership with Upvest Securities GmbH. Learn more N26 Stocks and ETFs on this page.

Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

***Investments in digital (crypto) assets carry a high risk of total or partial loss of capital due to the specific volatility of digital asset prices and cybersecurity risks. N26 Crypto is provided by N26 Bank SE in partnership with Bitpanda GmbH. Learn more about risks and N26 Crypto on this page.

****All investments carry a risk of capital loss. The PEA account is managed by Upvest Securities GmbH. N26 Bank SE provides reception and transmission of orders and PEA account access through the N26 app for customers of N26 Bank SE with a German IBAN, and of the French Branch of N26 Bank SE with a French IBAN. Learn more on: https://n26.com/en-fr/pea.

N26 is the first 100% mobile bank to be granted and operate with a full German banking license from BaFin. That means your money is fully protected — both in your bank account and Instant Savings account — up to €100,000 by the German Deposit Protection Scheme. We currently operate in 24 markets worldwide and have over 8 million customers.

N26 has been granted a full German banking license from BaFin. By law, each customer’s funds are protected up to €100,000 by the German Deposit Protection Scheme. With 3D Secure, Mastercard Identity Check, and fingerprint and face recognition, the security of our customer's online payments is always guaranteed.

As a bank, N26 is supervised by the Federal Financial Supervisory Authority (BaFin). Our clients' funds are guaranteed up to €100,000 by the German Deposit Protection Scheme. In addition, the N26 app has many features to ensure the security of its users' bank accounts and data.

To open an N26 account, you must be over 18 years old and reside in France. You also need to have a compatible smartphone. You’ll be asked to provide a valid form of ID as well as valid proof of residence.

In order to open a bank account with N26, you must have a government-issued ID. Don’t worry, there’s no fussy paperwork or long wait times involved — just present your valid ID during a quick call and you’ll be up and running. It’s worth noting that you’ll also need a smartphone to use your account, and must live in an eligible country where N26 operates.

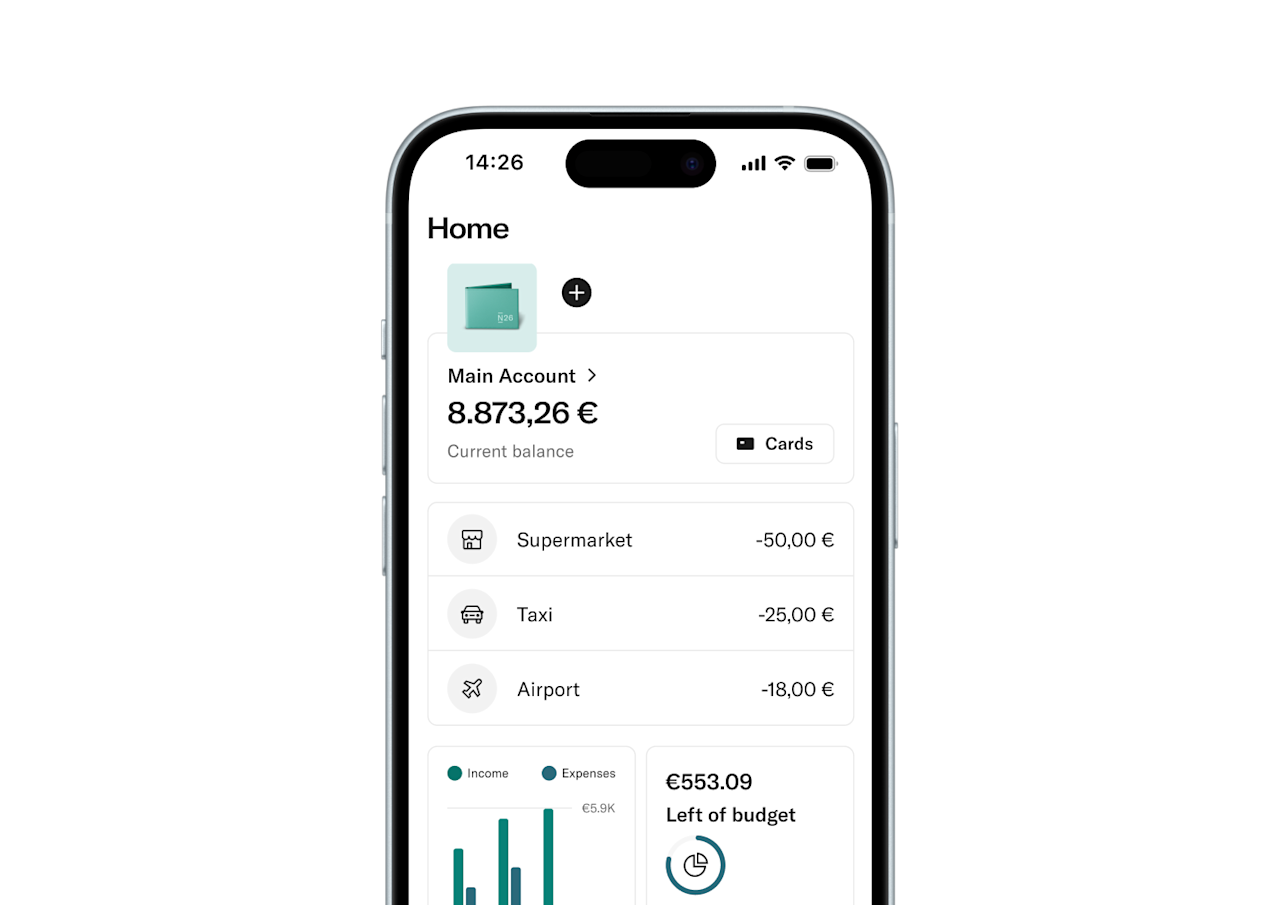

The standard N26 bank account is free and doesn’t charge any opening or maintenance fees. The N26 Smart bank account costs €4.90 per month, the N26 Go bank account costs €9.90 per month, and the N26 Metal account is available for €16.90 per month. To open an N26 account, no deposit or minimum income is required.

You can open your mobile N26 account online in minutes from your phone or the N26 website — no paperwork or waiting times. But best of all: Once your N26 bank account is active, you can start using it right away. This means you can start spending with your virtual card as soon as your account is set up, and you don't have to wait for your physical card to arrive.

From 29/06/2023, all N26 customers who open a bank account automatically get a RIB with a French IBAN, i.e. an IBAN beginning with the letters 'FR'.

To view your N26 IBAN in the N26 mobile app, head to the 'My Account' section via your initials in the top right corner of the 'Home' tab. From there, you can easily copy and paste your IBAN and share it. To download your N26 RIB, head to the N26 web app.