How it works

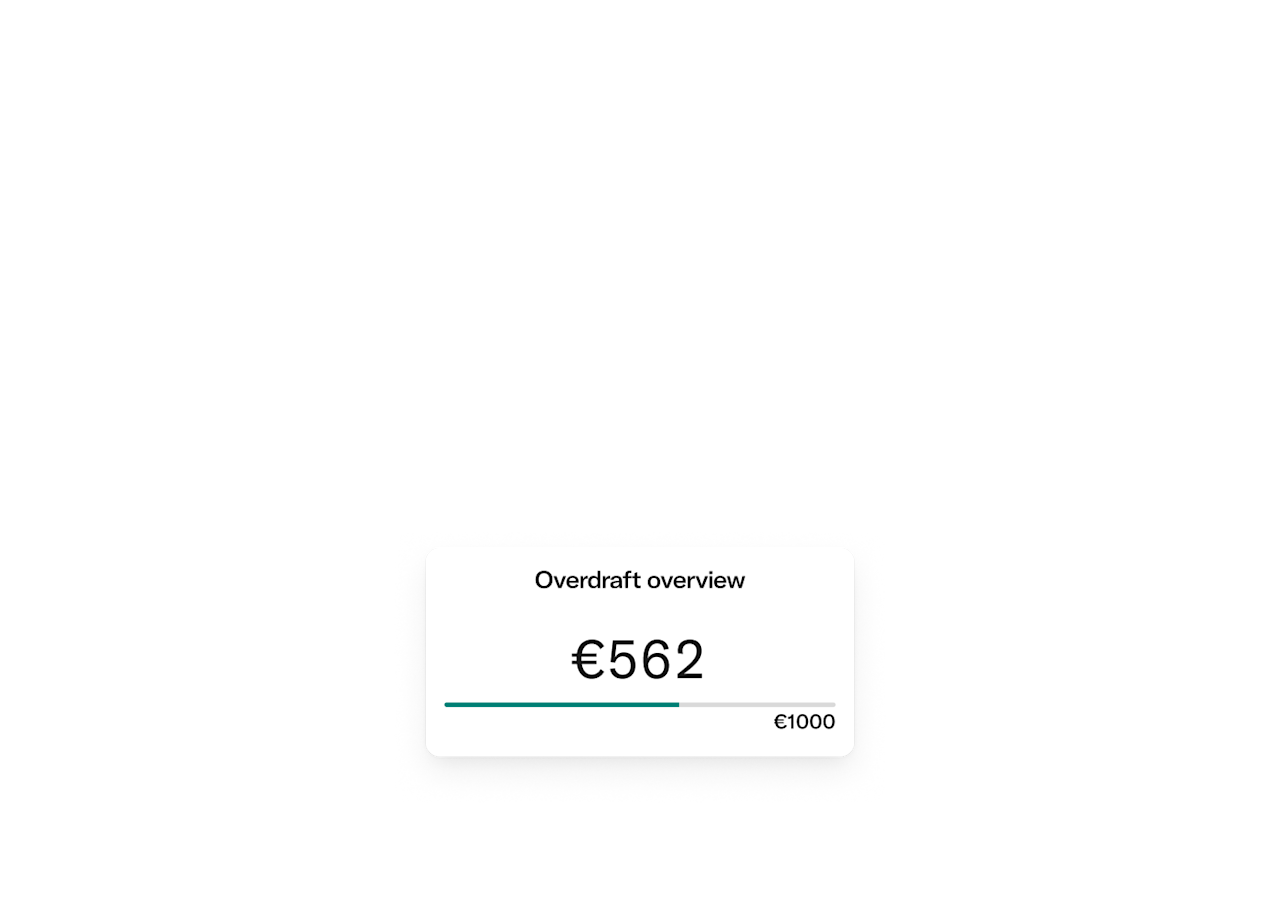

An overdraft lets you borrow money by overdrawing your account. You'll only pay interest* on the amount you borrow.

Why choose an overdraft?

Whatever unexpected expenses come your way, you stay in control with easily-adjustable limits to keep you going until your next direct deposit.

Extra money made simple

Transparent costs. Zero paperwork. Money in minutes.

*The annual percentage rate (APR or TAE) is 11,63%. TAE depends not only on the interest rate, but also on the actual amount used or the duration it remains outstanding. No commissions or fees are charged for the opening, maintenance, or any ancillary services related to the overdraft facility.

Representative rate arranged overdraft example: For an Overdraft of €500 with a nominal annual interest rate (NIR) of 11%, the monthly interest rate is 11% divided by 12, i.e., 0.9167%. This results in €46.76 per year if the amount remains fully drawn without changes. Since interest is capitalized monthly, the APR (Annual Percentage Rate) of the operation is approximately 11.63%.

This APR (TAE) has been calculated in accordance with Annex I of Law 16/2011, of 24 June, on consumer credit agreements.

FAQ

An overdraft allows you to borrow a certain amount of money through your bank account. For specific situations where you lack liquidity or have to deal with unexpected payments. For example, if you are waiting for a car insurance bill and your balance is too low at that moment.

To activate your overdraft, go to the Finances tab in the app. Select ‘Extra funds’ and then ‘Overdraft’. After a quick check of your credit history, we’ll let you know if you’re eligible for an overdraft. Then, you can go ahead and set your limit in the app. After a quick check of your credit history, we’ll let you know if you’re eligible for an overdraft. Then, you can go ahead and customize your amount in the app.

To get an overdraft, you need to have an N26 account. Of course, when applying, your creditworthiness plays a role. Further information about requirements can be found in our Support Center or in the Terms and Conditions.

You can apply for an overdraft of up to €10,000. Once approved, you can set your own limit.

The fixed interest rate we apply to your overdraft is 11% NIR (11.63% AER). *For example:

Overdraft of €500 with a nominal annual interest rate (NIR) of 11%. The monthly interest rate is 11% divided by 12, i.e., 0.9167%. This results in €46.76 per year if the amount remains fully drawn without changes. Since interest is capitalized monthly, the APR (Annual Percentage Rate) of the operation is approximately 11.63%.