Get a quote instantly

See your individual, non-binding offer based on your profile and credit history in less than a minute, right in the app.

Pay back on your terms

Stay flexible with monthly payment plans from 12 to 60 months.

Credit you can trust

You can apply for a loan 90 days after opening your account. This helps us get to know you first, so we can offer credit that fits your needs.

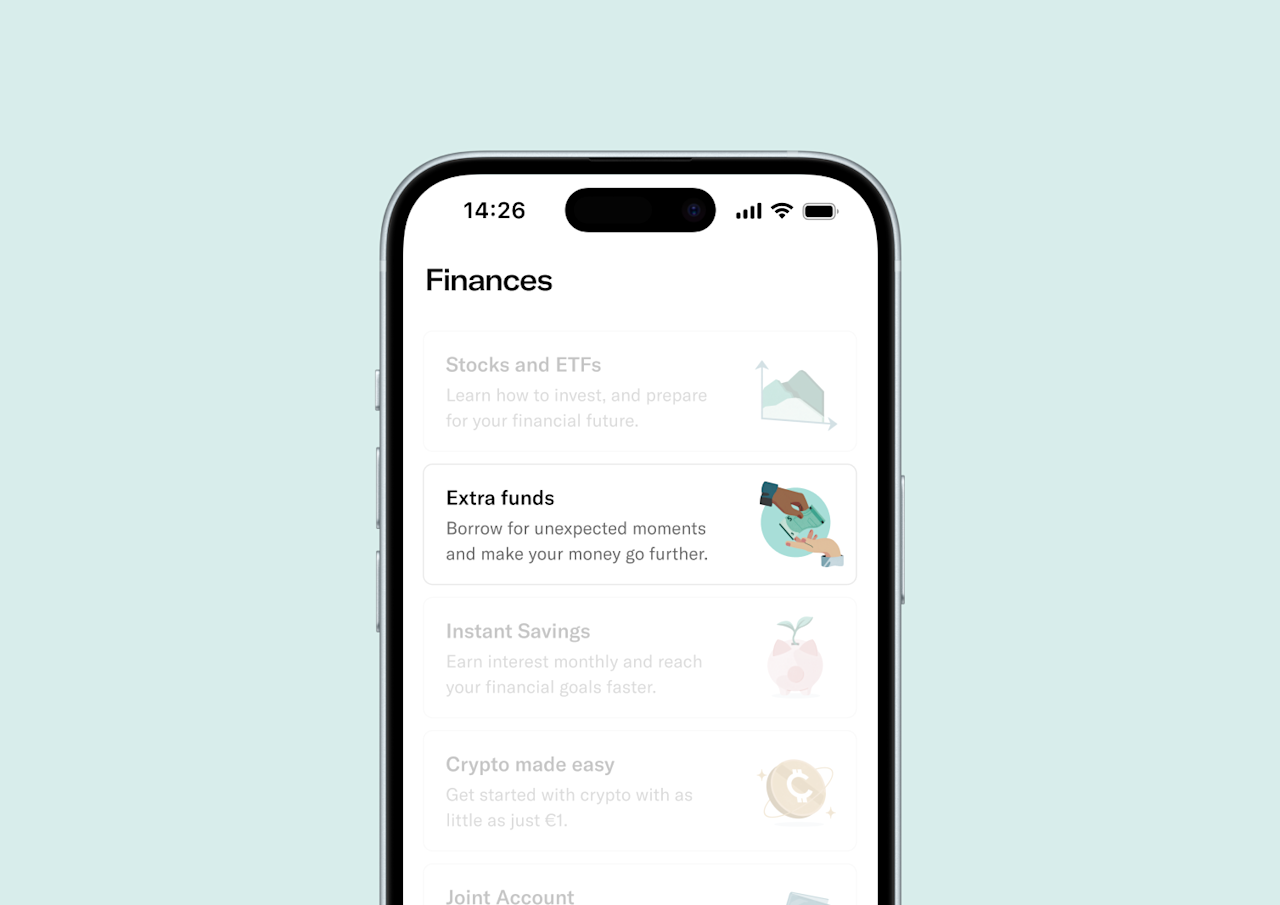

Extra money made simple

Transparent costs. Zero paperwork. Money in minutes.

The annual percentage rate will be calculated as per the legal provisions of Annex I to Law 16/2011.

The details contained in the standard information will be used as a basis (total credit amount, duration, part payments, borrowing rate, total costs). In particular, it is assumed that:

(i) the credit contract remains in force during its entire term, without early repayment; (ii) you do not breach your payment obligations and (iii) other financial conditions of this credit contract apply in relation to installments, term and interest rate.

The interest rate depends on the term and creditworthiness.

Example of APR for a loan amount of €1,000 over 24 months with an NIR of 8% / APR of 8.30%. Monthly installments: €51.33. No opening fees. Total amount owed: €1,077.83.

FAQ

A loan is an amount of money that you borrow, which is then paid back over time with added interest on top. When you first take out your loan, you can choose how many months your loan will last, and how much you’ll have to pay back each month. With N26 Credit, you can get a personal loan of €1,000 to €15,000 directly in the N26 app, and pay it back over 12 to 60 months.

Your personal loan offer is based on the amount you’d like to borrow, the repayment period, and your credit rating. Depending on these factors, N26 Credit offers effective interest rates ranging from 3.99% NIR (4.06% AER) to 12.90% NIR (13.69% AER). You can see your personal loan offer in the N26 app before making a decision.

No, we are legally required to assess your creditworthiness using both our internal data and information from external credit bureaus. This helps ensure responsible lending, protects you from taking on too much debt, and contributes to the overall stability of the financial system.

Yes, as part of our legal obligations and responsible lending practices, we may share certain information with external credit bureaus and the Bank of Spain's CIRBE (Central Credit Register). This helps us—and other financial institutions—assess creditworthiness accurately and supports transparency and financial stability. Additionally, in case of default, credit bureaus may be informed to maintain responsible credit management.

You can find more details in our Privacy Policy.

With N26, you can get credit fast. Please note that this is not an instant confirmation of your loan request. Once you’ve reviewed the offer and want to accept it, you can electronically sign the loan agreement — your N26 Credit loan will usually be paid into your account instantly.