How to choose the right type of savings account

Ready to take advantage of high interest rates and watch your money grow? Then you’ll need to choose the right savings product to suit your needs. We can help.

10 min read

The times of low interest rates appear to be coming to an end. Since the European Central Bank raised its interest rates to fight inflation, more and more customers are setting their money aside in savings and interest-bearing checking accounts. Whether you’re 21 or 49, have a lot of cash or just a little, it’s always the right time to start saving. In this article, we’ll discuss common myths about saving, the differences between savings and checking accounts, and how to choose the best financial products to fit your needs.Before we dive into the different types of interest-bearing accounts, it’s worth taking a minute to bust some myths about saving. You may have heard you have to start early, or that investing is too complex. Let’s set the record straight. As you can see: It doesn't matter how old you are, what previous knowledge you have, or how much money you have at your disposal. Saving is as individual as you are. It’s important that you find the model that is right for you. Keep reading for a comparison of different savings accounts.There are many other types of investments, such as building savings contracts, real estate, precious metals like gold and silver, life insurance, and stocks or cryptocurrencies. But in Germany, no investment product is as popular as a simple savings account. According to Statista, in 2023, 42% of respondents had a savings account, 20% invested their money in the stock market, and only 12% in cryptocurrencies. Why?It’s true that playing the stock market can earn you a bigger windfall. However, stock prices fluctuate a lot, meaning that you can also lose money. A savings account offers more security. As you’ve already learned, the statutory deposit protection applies up to €100,000. Across the EU, customers who deposit their money at banks with a full banking license are insured by the German Deposit Protection Fund. Plus, you can access your money (up to a certain amount) whenever you need it.It is also very easy to open a savings account. You’ll just need to meet the same conditions as when opening an account, and need a reference account (usually your checking account). The two accounts don't even have to be at the same bank. This means you can look for a savings account with attractive interest rates and no account management fees, regardless of your bank.A classic passbook or savings account also has a few disadvantages. Again, you can only withdraw a maximum of €2,000 at a time. If you need more, you’ll have to contact your bank at least three months in advance and pay early account closure penalties. With an easy-access savings account, you’re more flexible — which is why it’s sometimes called a “flex account.” Choosing the right option for you depends on your circumstances and preferences. If you can do without a certain amount of money for a long time, a classic savings account or a fixed-term deposit account is a great choice. If you want to earn interest on your money and still have full access to it, an easy-access savings account is probably better for you. For example, if you want to take a sabbatical or move, you could face unexpected costs. Unplanned circumstances such as a job loss or a broken car could also change your financial prospects. In cases like these, waiting months for your cash could be a massive headache. Besides the flexibility, your financial goals and routines are also factors. Do you want to grow your money quickly or save it over the long term? Do you want to actively manage your savings or would you prefer not to bother with it at all? Asking yourself questions like these will help you find the account that's right for you. Depending on the bank, there are different conditions to be aware of — so make sure they work in your favor rather than your bank’s.Let's assume you receive 4% interest (p.a.) on your easy-access savings account. That’s great — but remember to look closely at the time period. As a rule, banks only offer a given interest rate for a certain period of time, for example six months. This means that your deposits will only earn interest at 4% in the first half of the year. The interest rate then drops to the bank's applicable base interest rate, perhaps something like 1.2%. It’s also important to know how often the interest is credited to your account. If your money earns interest every six months, you’ll only benefit from the attractive interest rate once. Here’s an example:In addition to the interest rate and deposit term, you’ll also need to consider a few other points:

Whatever your savings goals are, we want you to have the tools you need to achieve them. For that, you need a bank account that you love to use, and where you can manage your money flexibly and securely. Sounds good so far? Use our interest calculator and find out how your savings will grow over time. Then, compare our 100% mobile accounts today and find the one that fits you and your lifestyle best.

Myth busting: 5 things you need to know about saving

- It’s never too late. No matter what anyone tells you, you can start investing at any time – even if you’re not in your 20s anymore. The only caveat: Starting to save later in life means you won’t have as many years (or decades) to benefit from compound interest. On the other hand, you may have more capital to invest if you wait until you’re a bit older.

- It’s never too early. You may not be thinking about retirement or old age yet. But even if you’re just starting out in life, you still need to think about your financial future. Whether you want to save for retirement now, pay off your student loans, or simply get a head start on building your wealth, a financial cushion is worth its weight in gold. And the earlier you start, the more you’ll earn.

- Even small amounts can add up. There’s a common misconception that saving small amounts of money isn't worth it. But the math tells a different story. Imagine you put aside €20 every month. After ten years you’ll have €2,400 — not including interest or returns. That may not sound like much, especially considering inflation. But starting small helps you build strong financial habits. Plus, €2,400 is way better than nothing, right?

- Your money is safe. When the economy falters, such as during a bear market or a recession, many people worry about their money. That’s understandable! But did you know that your funds are protected up to €100,000 thanks to statutory deposit protection? And that there are lower-risk investment products to give you peace of mind? The more informed you are, the better — and more prudent — decisions you can make.

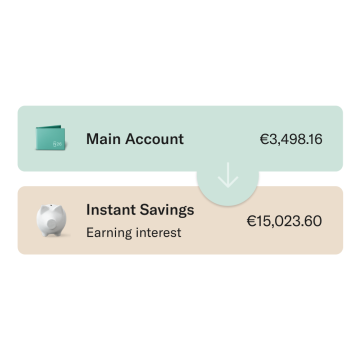

- Finance products aren’t as complex as you think. Financial education isn’t on the curriculum in many countries, and according to an OECD study from 2020, Germany is also doing a mediocre job. Many products are poorly explained or very complex. It's no wonder that building wealth feels out of reach for some people. But you have other options! Some banks, particularly digital ones, have intuitive savings tools and even let you easily invest money right within your banking app.

How to save responsibly with an account that suits your needs

- Savings account: This is the most common type of savings product in Germany. Savings accounts are interest-bearing accounts that you can deposit money into regularly, and they have their own IBANs. Thanks to the interest rate associated with the account, your money grows on its own when you store it here. But unlike your checking account, which lets you make payments for rent, utilities, and other day-to-day expenses, a savings account is only intended for saving money. If you do need to withdraw money, you can take out up to €2,000 without paying a fee. Learn more about this below.

- Passbook: In principle, a passbook is the same thing as a savings account. Both are issued by banks, and you’ll earn interest on your savings with both products. However, a passbook only exists in paper form, while a savings account is often accessible online.

- Easy-access savings account: An easy-access savings account, also called a money market account, is an interest-bearing account with its own IBAN. Unlike a classic savings account, however, you can freely access the money. There’s no €2,000 withdrawal limit and no overdraft for checking and savings accounts, so you can never end up in the red.

- Fixed-term deposit account: With a fixed-term deposit account, you’ll benefit from relatively high — and stable — interest rates. This means that the percentage at which your savings earn interest is usually higher than with a savings account. The interest rate also doesn’t change over a certain period of time — even if the key interest rate falls again. However, this security comes at a price: You can’t access your money until the term period is up. You have flexibility and choice about how long you set the term for, though. The maximum time period is ten years.

Why people choose a savings account

Savings accounts and easy-access savings accounts, compared

Easy-access savings accounts: comparing interest rates over time

- Starting savings deposit: €1,000

- Interest rate for the first six months: 4 %

- Balance after six months: €1,020

- Starting deposit: €1,000

- Interest rate for the first 12 months: 2.26%

- Balance after six Months: €1,011.35

- Balance after 12 Months: €1,022.84

Important things to consider when choosing an easy-access savings account

- Account management fees: Generally, easy-access savings accounts are free. But there are exceptions, so make sure to read the fine print.

- Premium conditions: With some banks you’ll receive one-time premiums or signup bonuses, but they often come with conditions. For example, if you’re not able to commit a certain amount of money for a certain period of time, you may not receive the bonus.

- Minimum deposits: For certain banks, a minimum deposit is mandatory for opening an account.

- Limits: With extremely high sums of money, your interest rate will actually be lower. For example, if you deposit €1 million into an easy-access savings account, you should expect a comparatively lower interest rate.

- New vs. current customers: Some banks offer attractive rates for new customers preparing to open an account — but not for existing ones. If you already have an account at the bank, you’ll generally just get the standard rate.

Your money at N26

Find similar stories

BY N26Love your bank

Related Post

These might also interest youBUDGETINGBudgeting tools to get your finances on trackBudgeting tools demystify the budgeting process. Read on to find out how.

7 min read

BUDGETINGWhat to include in your family budget Budgeting for the family can feel like a chore, but with a few simple adjustments, it can also be empowering! Read on to discover how to create a family budget the easy way.

5 min read

BUDGETINGMoving in together: tips to manage monthly expensesMoving in with your partner means budgeting together. Read our guide on how to budget for your new home and live in harmony.

5 min read