N26 Credit

Apply for an instant loan in Austria right in the N26 app — no paperwork needed.

N26 Installments

Buy now, pay later, and free up cash instantly.

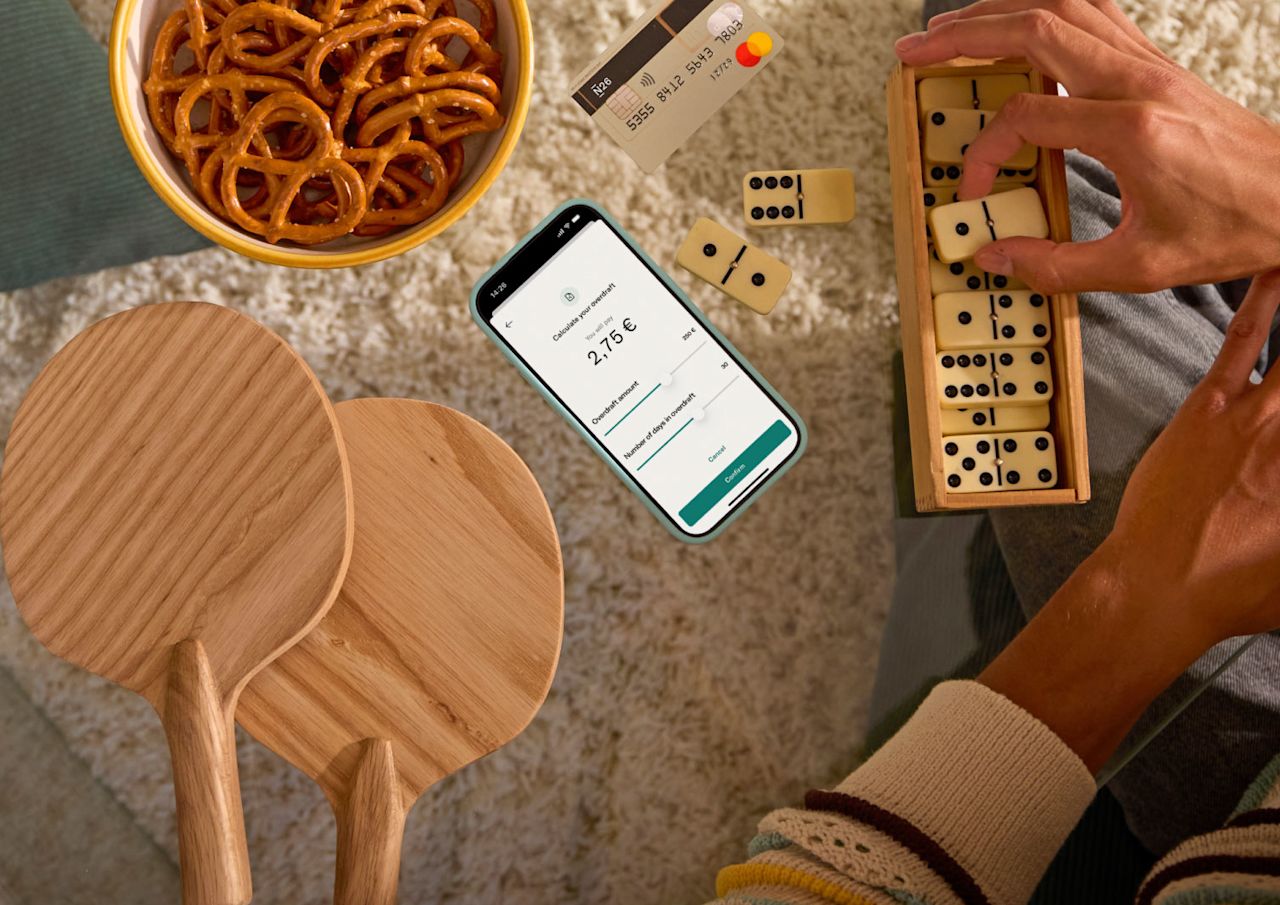

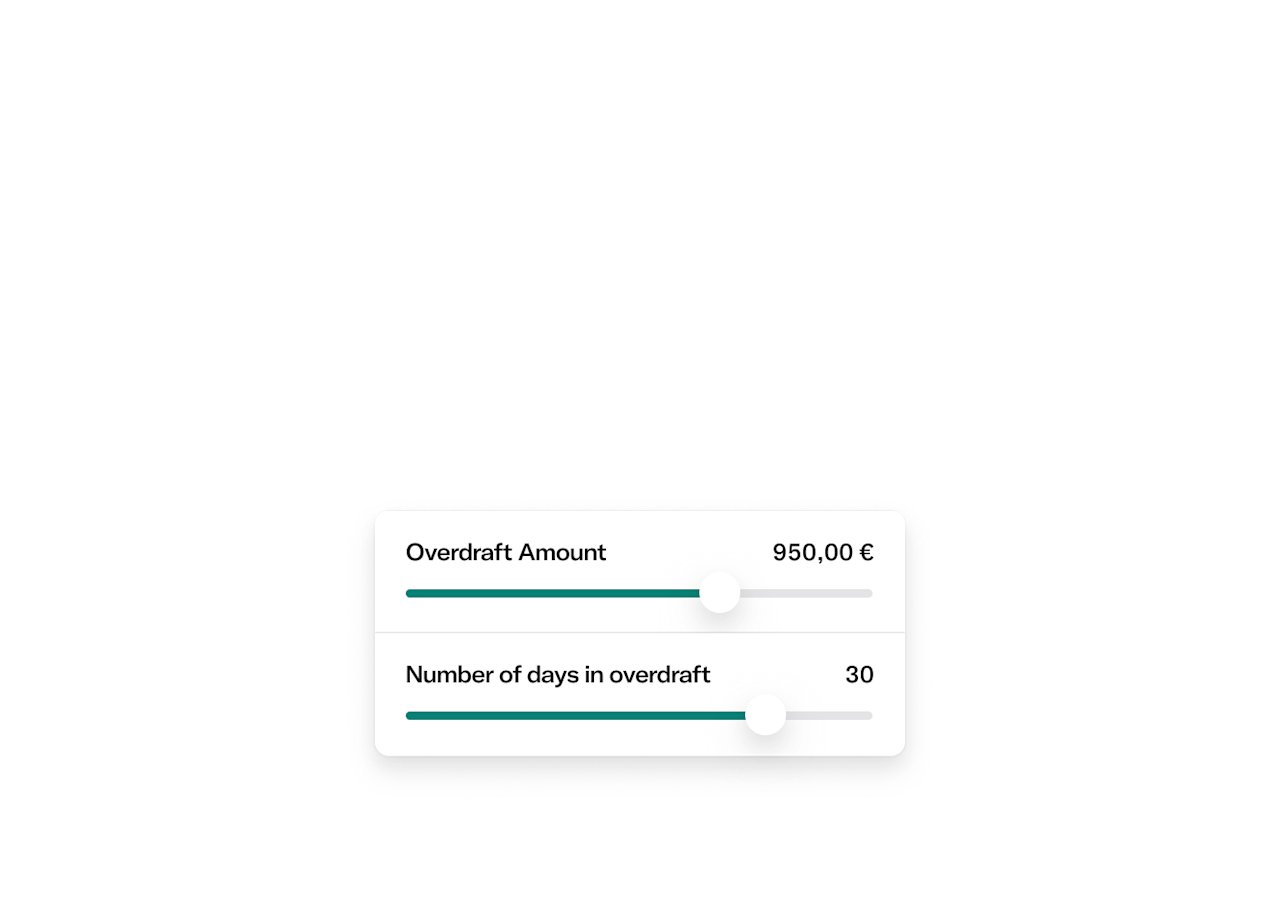

N26 Overdraft

Activate your overdraft in minutes. Stay in control with easily adjustable limits and transparent costs.

Extra money made simple

Zero paperwork. Transparent costs. Money in minutes.

Legal Notice

The lender is N26 SE, Voltairestr. 8, 10179, Berlin, Germany.

These credit and loans products are currently only available for eligible customers who opened their account in Austria. If you can’t find them yet, please update your app to the latest version, keep using your N26 account, and check again later to see if you’re eligible. For new customers, eligibility for credit and loan products can only start from 30 to 90 days after opening an account.

Credit and loan products are not free of financial risks. Make sure that you are financially able to repay the credit before you apply.

FAQs

A loan is an amount of money that you borrow, which is then paid back over time with added interest on top. When you first take out your loan, you can choose how many months your loan will last, and how much you’ll have to pay back each month. With N26 Credit, you can get a personal loan in Austria ranging from €1,000 to €15,000 directly in the N26 app, and pay it back over 12 to 60 months.

Your personal loan offer is based on the amount you’d like to borrow, the repayment period, and your credit rating. Depending on these factors, N26 Credit offers effective interest rates starting at 5.99% p.a. in Austria. You can request and compare your personal loan offers in the N26 app before making a decision.

The maximum amount of your loan depends on the lending product, the details you provide, your transaction history, as well as your credit rating. We offer personal credit loans in Austria ranging from €1,000 to €15,000. N26 Overdraft can provide you with a safety net of up to €15,000. And with N26 Installments, you can split eligible purchases of up to €3,000 in total into installments.

This depends on your financial situation. To calculate how much you can afford to pay back each month, try creating a budget based on your monthly expenses.

N26 Installments allows you to split eligible purchases that you've made in the last four weeks, and instantly free up cash. Split eligible past purchases with a value from €20 to €3,000 into smaller installments, and pay them back over three to six months with an annual interest rate ranging from 8.99% to 14.99%. We'll put the full amount into your account immediately, and you'll pay the first installment a month later.

N26 Installments are available in Austria for a wide range of eligible purchases ranging from €20 to €3,000 across multiple categories — such as electronics, fashion, furniture, flights, train tickets, and more. You’ll be notified in the N26 app once you’ve made an eligible purchase that can be split into installments.

An overdraft allows you to borrow a certain amount of money through your checking account.

The fixed interest rate we apply to your overdraft in Austria is 13.4% p.a.

Currently, N26 credit and loan products are available only to eligible customers who’ve opened their account in Austria. Eligibility is based on their transaction history of the past 90 days for N26 Credit and Overdraft, and 30 days for N26 Installments. If you’re eligible, you’ll find the products in the ‘Finances’ tab of your N26 app. If you can’t find it yet, keep using your N26 account and check again in a few months to see if you’ve become eligible.

Currently, N26 does not offer credit cards.