Compare every detail

Virtual card

First one free

6

6

6

Virtual card

First one free

6

Physical card

Physical card

Spaces sub-accounts with IBAN and card pairing

10

10

10

Spaces sub-accounts with IBAN and card pairing

10

Shared Spaces

Shared Spaces

Joint account

Joint account

Card for under 18s

Card for under 18s

Free ATM withdrawals in euros

Unlimited

Unlimited

Unlimited

Unlimited

Free ATM withdrawals in euros

Unlimited

Unlimited

Cash26 deposits and withdrawals

1.5% deposit fee

1.5% deposit fee

1.5% deposit fee

1.5% deposit fee

Cash26 deposits and withdrawals

1.5% deposit fee

1.5% deposit fee

Budgeting automations

Budgeting automations

Credit

Credit

Overdraft

Overdraft

Installments

Installments

Savings interest rate3

Savings interest rate3

Stocks and ETFs4

Trade for free

Trade for free

Trade for free

Trade for free

Stocks and ETFs4

Trade for free

Trade for free

Ready-made funds

0.55% management fee

0.55% management fee

0.39% management fee

0.29% management fee

Ready-made funds

0.55% management fee

0.39% management fee

Crypto5

1.5% for Bitcoin and 2.5% for other coins

1.5% for Bitcoin and 2.5% for other coins

1.5% for Bitcoin and 2.5% for other coins

Lower fees — 1% for Bitcoin, 2% for other coins5

Crypto5

1.5% for Bitcoin and 2.5% for other coins

1.5% for Bitcoin and 2.5% for other coins

Savings plans

Savings plans

Travel cashback1

Travel cashback1

Worldwide card payments

Free

Free

Free

Free

Worldwide card payments

Free

Free

ATM withdrawals outside the eurozone

1.7% fee

1.7% fee

Free

Free

ATM withdrawals outside the eurozone

1.7% fee

Free

Airport lounge access6

€33 per visit

€33 per visit

First annual visit €15,

then €30

First annual visit free, then €30

Airport lounge access6

€33 per visit

First annual visit €15,

then €30

Travel eSIM7

Travel eSIM7

Travel and baggage delays8

Up to €500

Up to €500

Travel and baggage delays8

Up to €500

Baggage cover8

Up to €2,000

Up to €2,000

Baggage cover8

Up to €2,000

Emergency medical and dental8

Up to €1 million for medical and €250 for dental

Up to €1 million for medical and €250 for dental

Emergency medical and dental8

Up to €1 million for medical and €250 for dental

Emergency medical transport8

Up to €2,300

Up to €2,300

Emergency medical transport8

Up to €2,300

Trip interruption8

Up to €10,000

Up to €10,000

Trip interruption8

Up to €10,000

Trip cancellations8

Up to €10,000

Up to €10,000

Trip cancellations8

Up to €10,000

Personal liability8

Up to €500,000

Up to €500,000

Personal liability8

Up to €500,000

Mobile phone insurance8

Mobile phone insurance8

Purchase protection8

Purchase protection8

Partner offers

+15

+20

Partner offers

+15

24/7 chat support

24/7 chat support

Phone support

Phone support

Deposit protection

Up to €100,000

Up to €100,000

Up to €100,000

Up to €100,000

Deposit protection

Up to €100,000

Up to €100,000

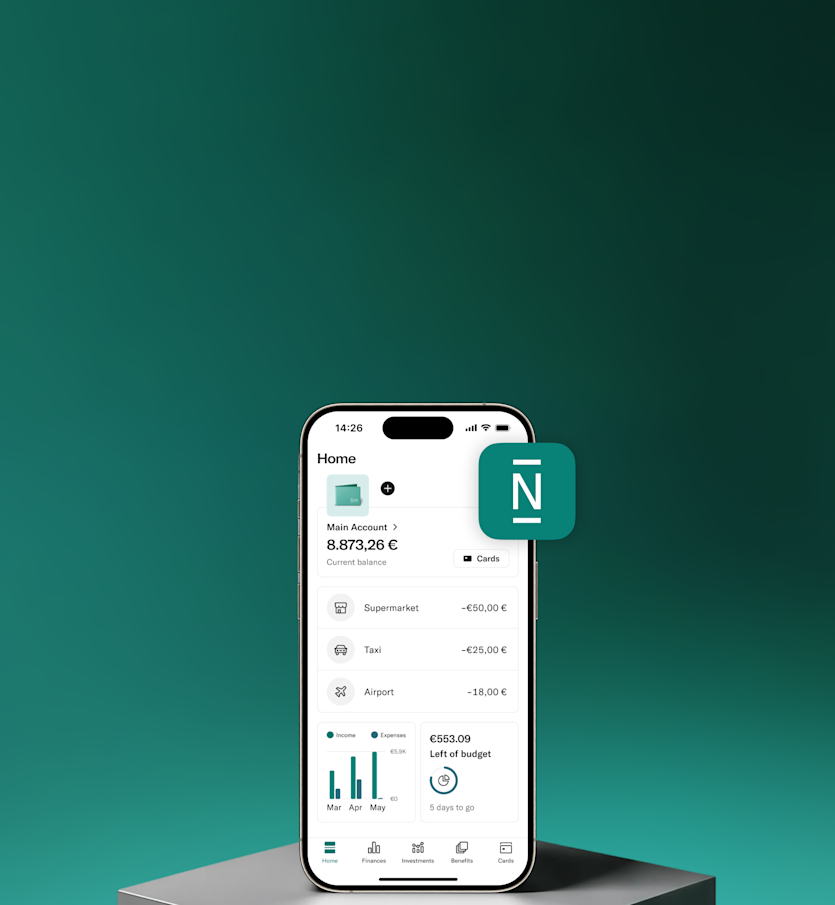

Switch banks in minutes

Open your N26 account and move your recurring payments in just a few taps.

FAQ

To open an N26 account, download the N26 app. Sign up by confirming your email address, verifying your ID directly in the app, and pairing your smartphone with your N26 account.

To be eligible for an N26 account you must be at least 18 years old, living in one of these countries, and you must own a compatible smartphone.

The standard N26 bank account is free — you won’t pay any opening or maintenance fees. No deposit or minimum income is required to open any N26 account.

The N26 Smart account costs €4.90 per month, N26 Go costs €9.90 per month, and N26 Metal costs €16.90 per month.

You must be 18 or over to open a bank account with N26.

Your virtual debit card will be available as soon as you have successfully opened your N26 account. Add it to Google Pay or Apple Pay and start spending immediately.

If you ordered a physical debit card, this will arrive via post. The duration depends on whether you selected standard or express delivery, and can take longer in some locations, up to 14 days.

Yes, you just need to open a personal account first. You can open a freelancer account under the Finances tab.

Yes. Give your N26 account IBAN to your employer so they can pay you directly to your account.

Services and Fees for everyone who registers with an address in Austria. For our detailed price list, view PDF here

1 This promotion is applicable for N26 Go and N26 Metal who signed up before July 17, 2025 and after October 15, 2025. Participate in the promotion by clicking on the in-app message, email or push notification and click ‘Enrol’ on the in-app landing page for the promotion. From the moment of successful enrollment, receive 1% cashback for a maximum of 12 months on the following qualifying transactions made with N26 Mastercard: transactions conducted outside the European Economic Area (EEA), Switzerland and the United Kingdom. The European Economic Area (EEA) includes all EU member states as well as Iceland, Liechtenstein, and Norway. See full T&Cs here: https://n26.com/hb-ex

2 Valid only for new customers who open a new N26 Metal account from 19/02/2025 onwards. The interest rate for the N26 Instant Savings account corresponds to the current European Central Bank deposit facility rate (2% starting on 11/06/2025) and is subject to change by N26 any time. Terms and conditions apply.

3 For existing customers, N26 Instant Savings account interest rates are based on your main plan with N26: from 11/06/2025 onwards. Please note that rates per plan can be changed by N26 over time. Interest is only earned on funds held in your Instant Savings account.

4 Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

5 The N26 Metal crypto fee discounts only apply to trading amounts up to €5,000 (including fees on purchasing and excluding fees on selling crypto) per calendar month. Above this amount, standard fees apply: 1.5% on Bitcoin and 2.5% on all other coins (fees are always rounded up to the nearest full cent — to a maximum of one cent — which may lead to a slight increase of the fee percentage shown in the order preview. Deviations for special coins are possible). The fees and cryptocurrency prices shown on the N26 app for every transaction and including a possible spread are not determined by N26 but provided by Bitpanda Asset Management GmbH. N26's liability is expressly excluded for any claim or damage arising from the formation of the prices of the assets offered by Bitpanda.

6 Airport lounge passes are available for purchase in the app.

7 Purchase mobile plans in-app to enjoy affordable data in over 100 countries with your travel eSIM.

8 Exclusions and restrictions apply. For more information, please see the Allianz Assistance Insurance Product Information Sheet (Metal | Go) and Conditions for Beneficiaries (Metal | Go). You can see all information you need to start a claim or call Allianz Assistance in case of an emergency in the N26 app and in the Conditions for beneficiaries. N26 Go and Metal feature comprehensive insurance coverage from Allianz Assistance (trade name of AWP P&C S.A. – Dutch Branch) one of Europe’s most trusted insurance companies. AWP P&C S.A. Dutch Branch is an insurer licensed to act in all EEA countries and operating in freedom of services, with corporate identification No 33094603, and registered at the Dutch Authority for the Financial Markets (AFM) No 12000535. AWP P&C S.A., which has its registered office in 7 rue Dora Maar, Saint-Ouen, France, is authorized by L’Autorité de Contrôle Prudentiel et de Résolution (ACPR) 4 Place de Budapest CS 92459, Paris Cedex 09, France. Please note that terms used may be defined according to the Conditions for Beneficiaries and can differ from everyday language.