Hidden fees? Not our thing.

Save your cash with a free virtual card, two free ATM withdrawals a month, plus free card payments worldwide.

Your money, your control

Pay friends back in seconds, balance your bills, and set spending limits to keep it all in check.

Future-proof your finances

Make your first steps towards financial independence with savings*, crypto**, and free stock and ETF trading***.Investing involves risk of financial loss.

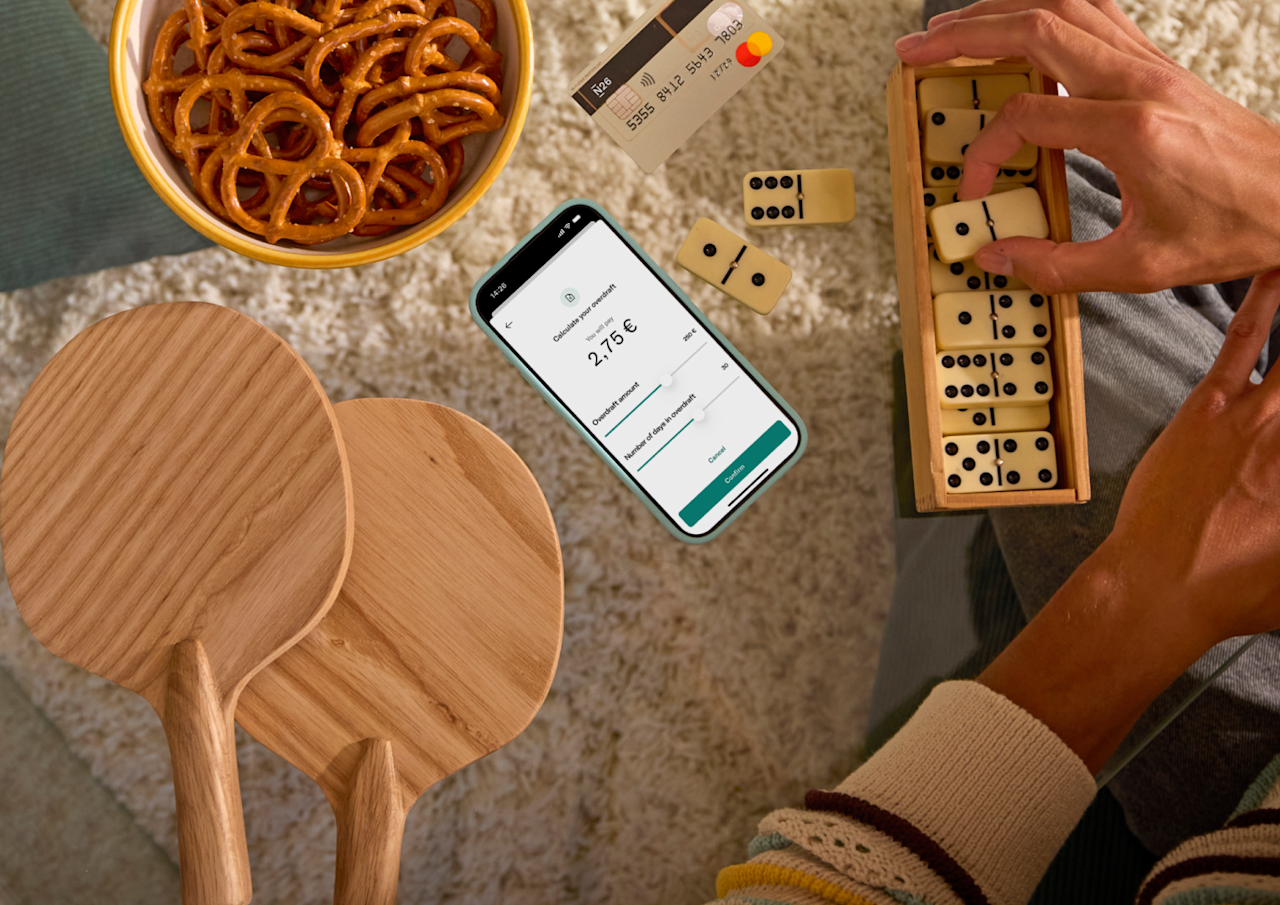

Get extra flexibility

Split payments into installments, or tap into your overdraft to keep you going.

Set it up between classes

Open your free account from your phone and use your virtual card right away.

*Instant Savings Account is subject to the Terms and Conditions, available here: https://n26.com/en-at/legal-documents/instant-savings. Interest rates may vary depending on your plan and over time. Interest earned is taxable under Austrian law. Interest is accrued daily and paid into your Instant Saving account on the first day of each month.

**The market for crypto assets constitutes a high risk. Crypto assets are subject to high fluctuations in value—declines in value or a complete loss of the money spent are possible at any time. Past performance is not a reliable indicator of future performance. N26 Crypto is powered by Bitpanda Asset Management GmbH (HRB 121696), licensed by the German Federal Financial Supervisory Authority and located at Friedrich-Ebert-Anlage 36, 60325 Frankfurt, Germany.

These statements are intended to provide general information and do not constitute investment advice or any other advice on financial services and financial instruments such as Stocks, ETFs and Ready-made funds. These statements also do not constitute an offer to conclude a contract for the purchase or sale of Stocks, ETFs and ready-made funds. Stocks, ETFs and Ready-made funds can be subject to high fluctuations in value. A decline in value or a complete loss of the money invested are possible at any time. A portfolio transfer of fractional shares and ETFs is not possible, so a non-intended sale may be necessary. The values depicted are fictional and for illustrative purposes. The numbers of available Stocks and ETFs can vary per market. Not all of the services mentioned may be available in your country.

***Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

FAQ

Yes! We’re a digital bank with a full German banking license and millions of customers across 24 countries.

By law, the funds in your account are protected up to €100,000 through the German Deposit Protection Scheme. We’re fully hosted in the cloud and use artificial intelligence to fight financial crime and card fraud. We also secure every transaction with passcodes and Face ID or Touch ID technology, as well as confirm every customer’s identity when opening an account. Learn more about our security here.

You’ll need government-issued ID, for example, a passport. You'll also need a smartphone to use your account, and must be a resident of a country we operate in.

The N26 Standard bank account is free and there are no opening or maintenance fees. N26 Smart costs €4.90 per month, N26 Go costs €9.90 per month, and N26 Metal is €16.90 per month. No deposit or minimum income is required to open an account.

Free up cash in seconds with N26 Installments. Paid for something in the last four weeks that costs between €20 up to €3000? Split eligible purchases into three to six monthly deferred payments, and pay them back over time with an effective annual interest rate of 8.99% to 10.49%, depending on your internal credit score. We'll put the money into your account straight away, and we'll take the first installment one month later. Unlike credit cards, there’s no need to fill out long application forms or even provide extra documents - N26 Installment loans are pre-approved for eligible customers,

Overdraft is the ability to overdraw your account, and setting up an overdraft is quick and easy. Just go to the Finances tab in your N26 app and select Extra funds > Overdraft to get started. After you’ve reviewed and agreed to the Terms and Conditions and we’ve done a quick eligibility check, you can activate your overdraft without any paperwork. New overdraft customers can receive an overdraft of up to €15,000 with fixed interest rate of 13.4% p.a.