Top up—add money to your bank account quickly and easily

What’s a top up?

When you make a top up, you’re depositing money into your bank account. You can also top up a prepaid card that isn’t connected to your bank account. In either case, you’re adding money to increase your existing balance. Top up in person, online, through an app—there are plenty of options to choose from. Read on to learn more.Ways to top up an account

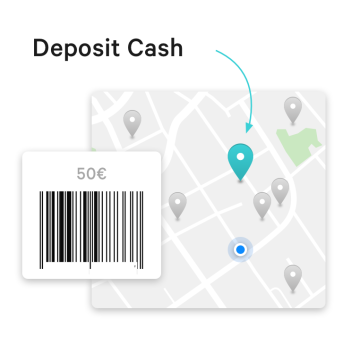

Topping up in person is usually as easy as going to a physical branch, an ATM, or a participating retail store and handing over the amount of cash you want to deposit. Digital top up methods include- mobile transfers,

- direct deposits,

- external bank transfers, and

- top up via debit and credit cards.

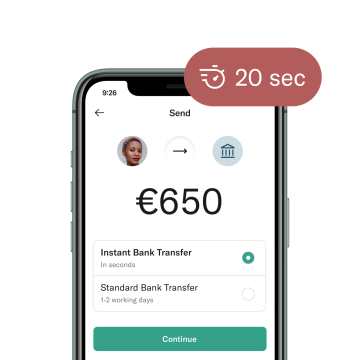

Top up processing times

It might take some time before your top up shows up in your account, depending on your top up method. Some might appear instantly in your account, while others might take up to 5 days. With N26, all top ups are either instant or take up to 2 days at most.Top up services and facilities

Top up at N26 with a debit or credit card

Top up instantly with Apple Pay and Google Pay

With Apple Pay or Google Pay, topping up your account is as simple as using a credit or debit card. Just tap ‘Add Money,’ in your N26 app, select ‘Apple Pay’ or ‘Google Pay,’ and follow the prompts. Again, add between €20 and €150 per top up, up to €5000 per month. When you open an N26 account, you can add money via Apple or Google Pay to your account instantly, and start making payments straight away.

SEPA top ups

Anyone with an EU bank account can make credit transfers, direct debits, and card payments to any other bank account within the Single Euro Payments Area (SEPA). This cross-border transaction service makes topping up between EU accounts as easy as a regular domestic transfer. If both banks are SEPA-registered, instant credit transfers are processed within 10 days and regular credit transfers are processed in one working day. Direct debits can take 2 to 3 days to process.

Top up in cash with CASH26