Buy Stocks and ETFs with N26

Invest in your future

Want to live in the moment while planning for the future? With N26, buy stocks and ETFs right from your phone.

- Simple, intuitive, and easy to use

- Trade from 1 €

- Unlimited free trades*

- Automated flexible savings plans at no extra cost

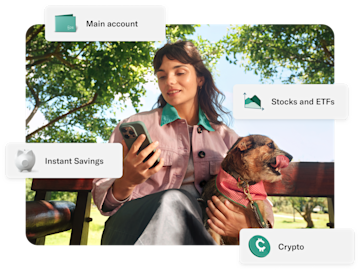

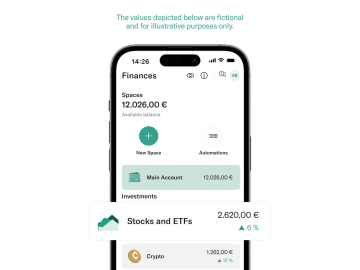

All in one app

With N26, all the tools you need to build your financial wealth are in one place.

Manage your stocks, ETFs, and crypto portfolios without having to download another investment app.

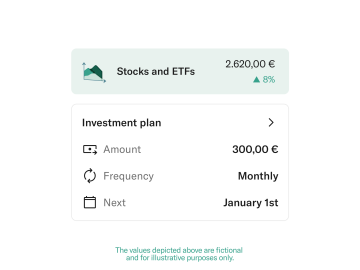

Make your future self proud with a plan

Investing can be stressful. Get some peace of mind with a fully-automated savings plan, available for all memberships at no extra cost in the N26 app. You decide how much and how often you want to invest. Start your plan any day you like with more than 3000 stocks and ETFs to choose from, and even more coming soon.Set up your first stress-free stock or ETF savings plan now, and make your money work for you.Investing involves risk of financial loss.

What are stocks and ETFs?

Stocks are like pieces of a company. When you buy a stock, you own a tiny part of that company. You can earn money from stocks in two ways: through dividends (a share of the company's profits) or when the stock price increases. ETFs, also known as'Exchange Traded Funds', are investment funds that consist of a diverse range of assets, including stocks and bonds.

Unlimited free trades

Say goodbye to hidden fees for good — trade stocks and ETFs for free*.Investing involves risk of financial loss. Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

Your investments — managed by experts

Skip the research. Invest in one of our ready-made funds and let the professionals do the hard work for you. Investing involves risk of financial loss.

More about funds

Pick and choose from 3000+ stocks and ETFs

Popular ETFs

From some of the largest ETF providers — such as iShares, Xtrackers and Amundi.

Stock market ETFs

Invest directly in a specific stock market of your choice, like S&P 500 or NASDAQ-100.

Emerging markets ETFs

Choose ETFs from specific regions or countries to invest in, such as iShares IV-MSCI China Tech.

Sector ETFs

Invest in ETFs from specific sectors �— such as AI, clean energy, or robotics.

Allianz

Offering solutions in insurance and asset management worldwide.

Tesla

The American multinational automotive and clean energy company.

Apple

One of the world’s largest technology companies by revenue.

Netflix

Part of the leading entertainment service providers worldwide.

These statements are intended to provide general information and do not constitute investment advice or any other advice on financial services and financial instruments such as Stocks, ETFs and Ready-made funds. These statements also do not constitute an offer to conclude a contract for the purchase or sale of Stocks, ETFs and ready-made funds. Stocks, ETFs and Ready-made funds can be subject to high fluctuations in value. A decline in value or a complete loss of the money invested are possible at any time. A portfolio transfer of fractional shares and ETFs is not possible, so a non-intended sale may be necessary. The values depicted are fictional and for illustrative purposes. The numbers of available Stocks and ETFs can vary per market.

*Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

N26 offers over 1500 ETFs in a variety of categories, including those tracking MSCI World, MSCI Emerging Markets or the S&P 500. We’ll continue to offer more ETFs as time goes on.

N26 offers over 1400 stocks in a variety of categories. We’ll continue to offer more stocks as time goes on.

Your purchases, sales, and portfolio with N26 are protected and secured. However, because stocks and ETFs include a wide range of securities that fluctuate with the market, we cannot guarantee returns or prevent losses.

ETFs are a basket of securities, and are traded on the stock market just like individual stocks. This means that prices fluctuate all the time, and N26 has no influence on the wins or losses in your portfolio. Diversification can reduce risks by spreading out investments across different financial assets rather than concentrating it all in one asset. Your deposits at N26 are protected up to €100,000 by the German Deposit Protection Scheme.

Every investment strategy is different, so there’s no governing principle on how to choose the right stock or ETF. In the N26 app, you’ll find detailed information on each stock and ETF we have on offer. Plus, our blog features helpful articles on investing in stocks and ETFs.

What you pay for an ETF is known as the “market price” — which is determined based on how many people want to buy or sell that ETF at a given time. The market price should be closely aligned with an ETF’s net asset value (NAV). This figure is calculated daily by adding up all the ETF’s assets and cash holdings, subtracting any liabilities, and then dividing by the number of outstanding shares. This may sound confusing, but the point of NAV is to serve as a reference point for people interested in purchasing shares of the ETF, ensuring that they’re paying a fair price.

To get more granular, investors may also reference the ETF’s intraday net asset value iNAV, which is measured throughout the day to keep up with price fluctuations. This figure is a more accurate measure to compare with the market value of the ETF you’re looking to buy, but it may not directly reflect the price you actually pay, as that figure may rise or fall depending on how high or low demand is.

A share price is the price of a single share of a number of saleable equity shares of a company. In simple terms, the stock price is the highest amount someone's willing to pay for the stock, or the lowest amount that it can be bought for.

N26 now offers unlimited free stock and ETF trading for all memberships. That means that, for every purchase or sale of a stock or ETF with N26, you’ll only pay the specific ETF management fee, if applicable.

If you sell all or a portion of your stocks or ETFs portfolio and earn a profit, those earnings are considered capital gains. In Austria, stocks and ETFs are subject to capital gains tax (KESt) of 27.5%. However, not only profits made in the course of a sale are taxed here, but also dividends, regardless of whether they are distributed or accumulated. The capital gains tax is usually withheld by the bank or brokerage and paid to the tax office directly.

When trading ETFs, you should also consider additional costs you might incur. At N26, you’ll never pay more than €0.90 cents per trade. However, when a sale is made, additional costs may be incurred by depository providers, also known as ‘order fees.’ Depending on the trading establishment, costs such as the trading margin (spread) or a (stock broker) commission may also be charged. The TER (Total Expense Ratio) are also ‘hidden’ costs that are part of trading ETFs. The TER states how many percentage points the running costs of a fund or ETF reduce your return per year. This includes the costs for administration and distribution of your chosen ETF. So, even if you don't see these costs deducted directly, be aware that trading ETFs may incur higher costs than what you see at first glance.

Absolutely. Our selection of stocks and ETFs will continue to expand across categories. Stay tuned!

At the moment, our stocks and ETFs product is only available to customers in Germany and Austria. In the coming months, we'll expand this offer to different countries — so check for email updates or follow us on social media!

This feature isn't available yet, but we’re working to make it possible soon.

Stock or ETF savings plans automate regular investments. A service that N26 offers at no extra cost for their customers. Simply pick the amount you want to invest and how often you want to invest it. You have over 4000 stocks and ETFs to choose from, with even more coming soon.

Yes, all stocks and ETFs savings plans are free at N26. That means you only pay for your stock or ETF shares, and neither any set up fee, nor any recurring fee.