Make every trip pay off

Get 1% back when you pay abroad with your N26 Go or Metal card, with no limit to how much you can earn! Applies outside the EEA, the UK, and Switzerland — for up to 12 months.*

Your wallet deserves a holiday, too

Pay with your N26 card wherever you go — with the best exchange rates. Upgrade to N26 Go or Metal for free ATM withdrawals abroad.**

Travel insurance you can bank on

With N26 Go and Metal, get insurance coverage for travel delays, medical emergencies, baggage, and trip cancellations.

Your ticket to the lounge

Travel stress-free with access to 1,300+ airport lounges worldwide.*** Your first visit is free with N26 Metal.

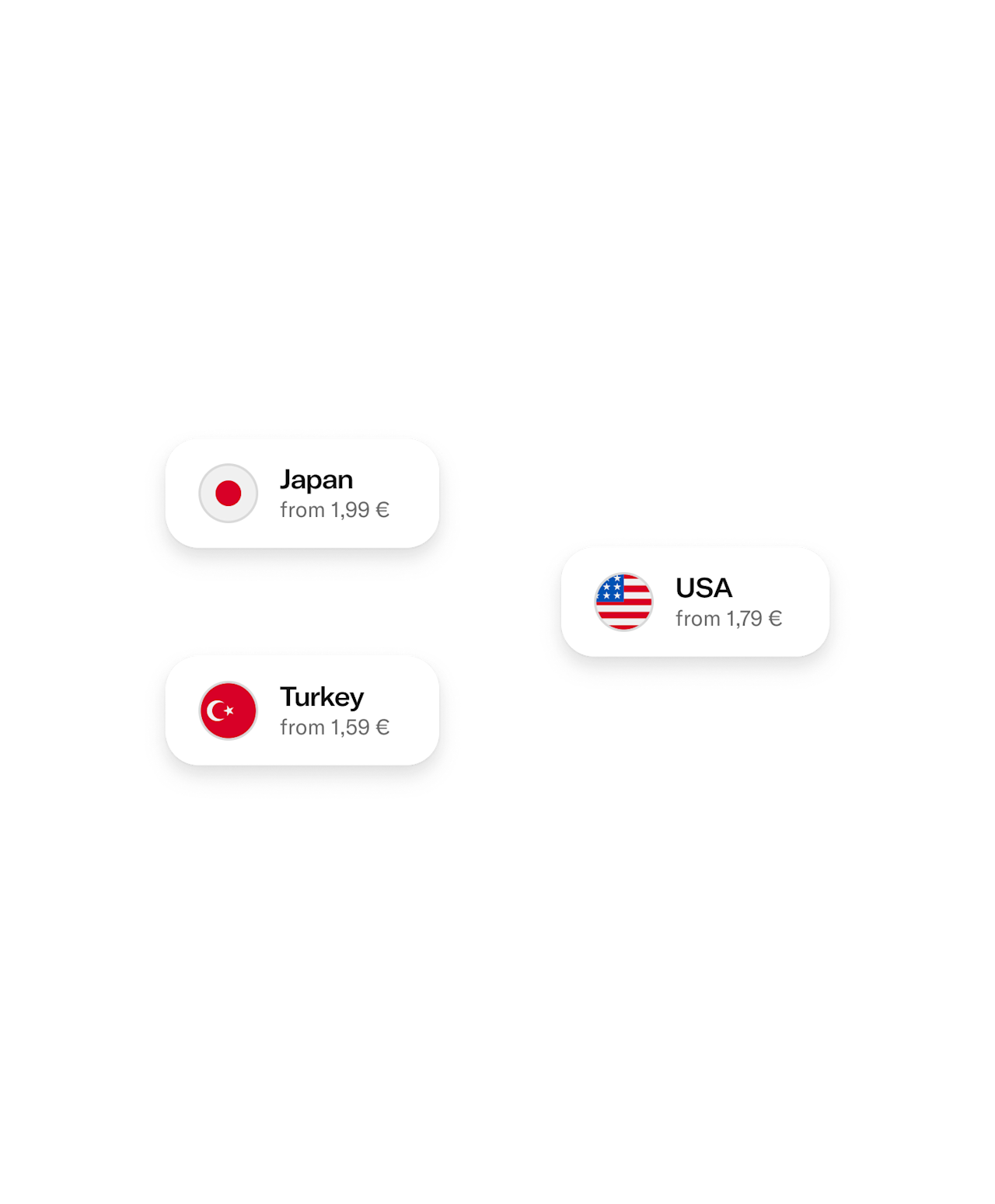

Travel the world with one eSIM

Set up your travel eSIM once and get affordable data for 100+ destinations.****

Trusted banking on the go

Stay in control wherever you go with a card you can lock instantly in the app, customizable security settings, and 24/7 chat support.

Switch banks in minutes

Open your N26 account and move your recurring payments in just a few taps.

Benefits vary by plan.

*Eligible spending: Detailed T&Cs for customers who sign up before July 17 and after October 15 can be found here: https://n26.com/hb-ex

**Unlimited free ATM withdrawals in the local currency outside the Eurozone is exclusive to N26 Go and Metal.

***Airport lounge passes are available for purchase in the app.

****eSIM data plans are available for purchase in the app.

FAQ

With N26, you can make free card payments worldwide — as often as you like and with no foreign transaction fees.

Outside of the Eurozone, N26 Go and N26 Metal customers don’t pay foreign exchange fees, while N26 Standard and Smart customers pay a 1.7% foreign currency fee on withdrawals. Within the Eurozone, N26 customers do not pay any additional fees.

Yes, your card is protected no matter where you travel. Easily lock and unlock your card in seconds right from your phone, and get instant notifications for every payment, so you can rest assured that your money is safe — even if your card goes missing. Plus, N26 has a full banking license, meaning your deposits are protected up to €100,000.

Yes! All N26 cards let you withdraw money at foreign ATMs. All plans include free ATM withdrawals within the Eurozone. N26 Go and Metal also have unlimited free ATM withdrawals abroad in the local currency, while Standard and Smart users only have to pay a 1.7% conversion fee.

Our premium plans, N26 Go and N26 Metal, offer various insurance packages. These cover events from accidents, to trip delays, cancellations, and baggage insurance. All alongside fee-free card payments, free global ATM withdrawals, and much more.