Compare every detail

Virtual card

First one free

6

Virtual card

First one free

6

Physical card

Physical card

Spaces sub-accounts with IBAN and card pairing

10

Spaces sub-accounts with IBAN and card pairing

10

Shared Spaces

Shared Spaces

Joint account

Joint account

Free ATM withdrawals in euros

2 per month

3 per month

Free ATM withdrawals in euros

2 per month

3 per month

Budgeting automations

Budgeting automations

Crypto

1.5% for Bitcoin and 2.5% for other coins

1.5% for Bitcoin and 2.5% for other coins

Crypto

1.5% for Bitcoin and 2.5% for other coins

1.5% for Bitcoin and 2.5% for other coins

Worldwide card payments

Free

Free

Worldwide card payments

Free

Free

ATM withdrawals outside the eurozone

1.7% fee

1.7% fee

ATM withdrawals outside the eurozone

1.7% fee

1.7% fee

Airport lounge access1

€33 per visit

€33 per visit

Airport lounge access1

€33 per visit

€33 per visit

Travel eSIM2

Travel eSIM2

Partner offers

Partner offers

24/7 chat support

24/7 chat support

Phone support

Phone support

Deposit protection

Up to €100,000

Up to €100,000

Deposit protection

Up to €100,000

Up to €100,000

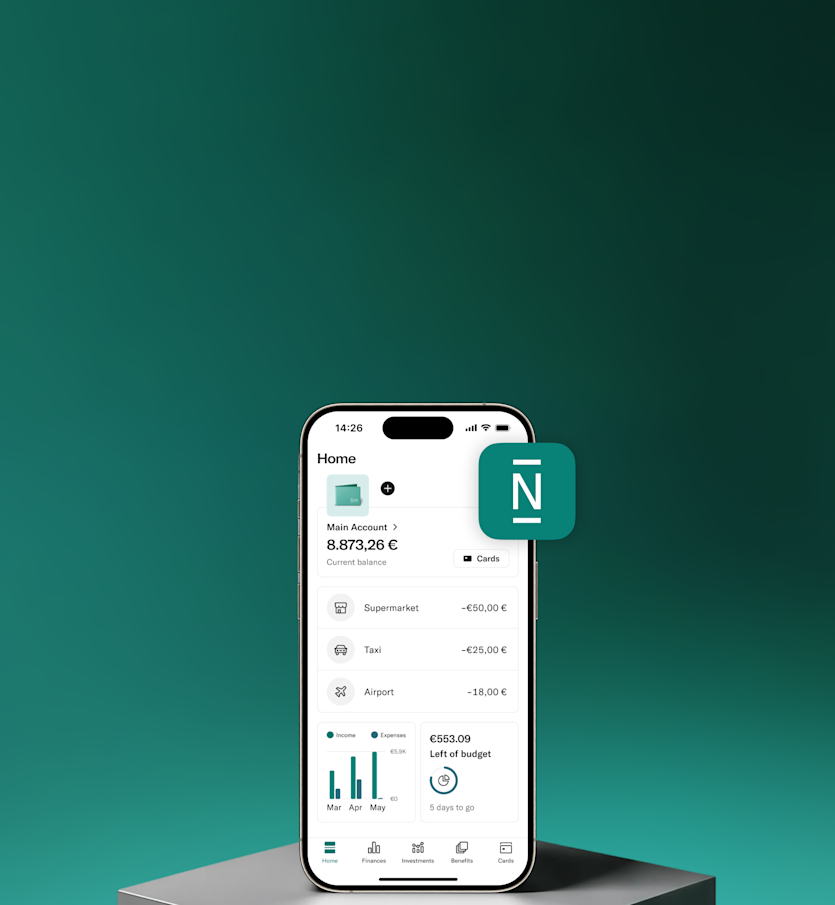

Start banking better

Open your N26 account and start enjoying beautifully simple banking.

Services and Fees for everyone who registers with an address in Switzerland. For our detailed price list, view PDF here.

1 Airport lounge passes are available for purchase in the app.

2 Purchase mobile plans in-app to enjoy affordable data in over 100 countries with your travel eSIM.

FAQ

To open an N26 account, download the N26 app. Sign up by confirming your email address, verifying your ID directly in the app, and pairing your smartphone with your N26 account.

To be eligible for an N26 account you must be at least 18 years old, living in one of these countries, and you must own a compatible smartphone.

The standard N26 bank account is free — you won’t pay any opening or maintenance fees. No deposit or minimum income is required to open any N26 account.

The N26 Smart account costs €4.90 per month.

You must be 18 or over to open a bank account with N26.

Your virtual debit card will be available as soon as you have successfully opened your N26 account. Add it to Google Pay, Samsung Pay or Apple Pay and start spending immediately.

If you ordered a physical debit card, this will arrive via post. The duration depends on whether you selected standard or express delivery, and can take longer in some locations, up to 14 days.

Yes. Give your N26 account IBAN to your employer so they can pay you directly to your account.