N26 Business Metal

Invest in yourself

The business bank account with 0.5% cashback, designed for entrepreneurs, freelancers and the self-employed. Open yours in minutes, and start using it before your physical card arrives.

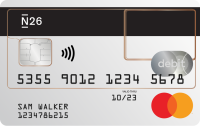

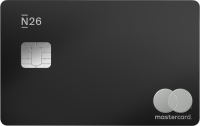

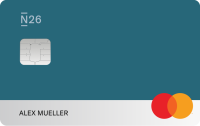

Stand out with Business Metal

Discover a beautiful banking experience, with N26 Business Metal’s premium Mastercard in 18-grams of stainless steel. Available in 3 distinct metallic shades that best suit your style, the engraved contactless debit card offers a stylish, minimalist aesthetic that means business—and delivers all the functionality you need.

Get rewarded with 0.5% cashback

Earn 0.5% cashback on all card purchases and get money straight back into your account on a monthly basis. A smart way to reinvest it in your business—no fuss, no strings attached.

Get an ECB-linked interest rate

Open a new N26 Metal account and earn 2% interest p.a.* with N26 Instant Savings — linked to the European Central Bank rate.

Discover Instant Savings

Extra peace of mind, wherever you are

Whatever your day throws at you and wherever your business takes you, rest assured that you’re covered with N26 Business Metal. Thanks to your account’s extensive package of travel, mobility and lifestyle insurance, enjoy that extra peace of mind—both at home and further afield.

Free stock and ETF trading

Trade stocks and ETFs for free*** in your banking app. Start investing in a few taps, and with as little as €1.

Discover Stocks and ETFs

Insurance for travel, mobility and lifestyle

Medical emergencies abroad

Up to €1 million coverage for emergency medical and up to €250 for emergency dental costs while traveling

Flight delay and cancellation

We know how inconvenient it can be when business trips don’t always go to plan. Thankfully, if your flight is cancelled or more than 4 hours delayed, you’ll be able to claim compensation for the time and money lost.

Loss and delay cover for your luggage

Similarly, if your luggage is held up or goes missing while you’re going away on a business trip, avoid getting stranded without your essentials away from home, and get compensated for the inconvenience.

Trip interruption

Coverage up to €10,000 in 12 months for stolen or damaged eligible purchases bought with your N26 card

Stay covered with mobile phone insurance

We've all been there, but losing your smartphone doesn't have to be a big deal. To avoid the unexpected, your Business Metal account covers your phone in case of theft or damage up to €2,000*, regardless of whether you paid for it with your N26 Business Metal card or not.

Go global with Mastercard, at no extra cost

Wherever your business takes you, make payments anywhere in the world with zero foreign transaction fees and at Mastercard’s best exchange rate. Plus, enjoy free unlimited ATM withdrawals abroad and stay up-to-date with instant push notifications that inform you of what comes in and out of your account.

Get organized with Spaces sub-accounts

Stay on top of your business finances with 10 Spaces sub-accounts, each with its own IBAN. Automatically set money aside from your main account with Rules, then pay your bills via direct debit, set up standing orders for recurring payments, send and receive SEPA transfers, or get paid from clients—directly in each sub-account. Saving up for future projects? Try Round-Ups to save up the spare change whenever you pay by card. With Shared Spaces, it's easy to pool money together with others, too.

Discover Spaces

Priority Customer Support, always at your service

Whatever you need, we’re here to help. Whether it’s a quick question about your account, guidance on using a feature, or urgent technical support, just reach out to a dedicated Customer Support specialist on the phone, or chat to the team directly via your N26 app.

Your card, your business style.

Join N26 or upgrade to Business Metal to redefine your banking experience.*Valid only for new customers who open a new N26 Metal account from 19/02/2025 onwards. The interest rate for the N26 Instant Savings account corresponds to the current European Central Bank deposit facility rate (2% starting on 11/06/2025) and is subject to change by N26 any time. Terms and conditions apply.

** The money in your bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme.

***Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

FAQ

To open a bank account with N26, you must meet the eligibility criteria. You can then register on our website or via the app—all you need is your smartphone and a photo ID to get started. The sign-up process only takes a few minutes and no paperwork is needed—and you don’t even need a minimum deposit amount.

You can find more information on how to open a business bank account at our Support Center.

Your N26 Business Metal bank account comes with a free contactless Mastercard debit in 18-grams of stainless steel. Once you’ve signed up and your identity has been verified, we’ll send your Business Metal card — in your choice of metallic shade — to the delivery address you’ve provided. Please note that we don’t currently offer credit cards at N26 for our business bank accounts.

Looking for a current account with cashback? With N26 Business Metal, earn 0.5% cashback on all your purchases made with your N26 Mastercard. This money is paid straight back into your account on a monthly basis.

Your N26 Business Metal account comes with travel insurance, courtesy of Allianz Assistance. Benefit from emergency medical coverage abroad for you, your spouse and your children, trip interruption or cancellation insurance, compensation for travel delays and baggage delays and baggage loss, mobile phone coverage in case of theft or damage, personal liability when travelling and purchase protection.

Find out more about what’s included in the Terms and Conditions.

Yes, it’s included with N26 Business Metal. You’re covered in case of theft or damage up to €2,000, regardless of whether you paid for your smartphone with your N26 card or not.

Yes, as a premium Business Metal customer, you can enjoy a wide selection of business-orientated perks from brands such as Fiverr, Dropbox, Taxfix, and NordVPN. On top of this, benefit from a range of lifestyle deals and offers that support your general wellbeing.

The N26 Business Metal account costs €16.90 per month, and it’s a yearly subscription.

How do Spaces sub-accounts work, and what can I use them for?

N26 Spaces are sub-accounts that sit alongside your main account, and are a practical way to organize your business finances. As a premium customer, create up to 10 Spaces sub-accounts with IBANs in your N26 app, then easily set money aside for your taxes, future projects, savings goals, and more. Each space can have its own unique IBAN, which you can use to pay your business expenses via direct debit, or to get paid via SEPA transfers directly into a sub-account. Of course, you don’t have to add an IBAN to your space if you don’t need one—the choice is yours.

Working with a team? Simply open a Shared Space, and manage your business funds together with up to 10 other N26 customers. Please note that an IBAN can’t be added to a Shared Space for now—but stay tuned for more exciting updates to come! Learn more about N26 Spaces and all its features here