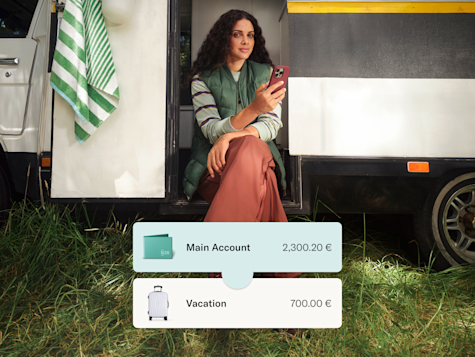

There’s a Space for every cent

Organize your money in up to 10 Spaces sub-accounts to plan, track, and budget better than ever. Available for N26 Smart, Go, and Metal plans.Open Bank Account

Shopping is simple with Spaces

Each Space can be linked to cards and IBANs so you can easily pay for bills, expenses, and travel.

Budget without the mental math

Set up rules like Income Sorter and Round-ups to automatically move money when and where you need it.

FAQ

N26 Spaces are sub-accounts that sit alongside your main account. Each Space can be linked or unlinked to an IBAN, physical card, or virtual card. Set up standing orders for recurring payments, pay with direct debit, and send or receive SEPA transfers.

We call them Spaces to intentionally keep their purpose undefined. It’s up to you to decide how to use your sub-accounts. Whether it’s saving, managing your bills, or organizing your finances.

N26 Smart, Go, and Metal come with 10 sub-accounts and can be deleted and linked or unlinked to cards and virtual cards at any time. Once an IBAN-linked Space is deleted, you lose that IBAN number and funds are returned to your main account. Note that only 10 IBANs may be created in total. Exceptionally, if you’re an N26 Standard customer who opened an account before March 18, 2021, you can create up to 2 Spaces sub-accounts.

Spaces allow you to pay directly with your N26 card, set up bank transfers, direct debits, and standing orders. To link a card to a Space, go to the Cards tab then select Card Settings and choose the Space. To pay by bank transfer, direct debit, or set up a standing order for regularly recurring payments, you’ll need to create a Space with its own unique IBAN.

Shared Spaces are only available for N26 Smart, Go, and Metal plans. Shared Spaces don't have a dedicated IBAN and you can't link a card to them. However, money can be moved from your Shared Space to your other Spaces or N26 accounts that are able to have linked IBANs. Each Shared Space can have up to 10 participants, but only the person who opened the Space is the legal owner of the funds within it.

Joint accounts are available to all N26 customers, regardless of their plan. They have a dedicated IBAN, and can be linked to a virtual or physical card in order to make direct payments. Only two people can share a joint account, but both account holders have full legal ownership of the shared funds within it.

We’ll immediately move the money back into your main account. If you’re deleting a Space with an IBAN attached, the IBAN will be blocked from future incoming or outgoing transfers, including existing direct debit payments. You can create up to 10 Spaces with IBANs — but once you delete an IBAN, it’s gone forever. To save an IBAN, you can repurpose Spaces with IBANs by giving them a new name and icon.