Compare N26 bank accounts

Find the perfect plan for you

Find the perfect plan for your business

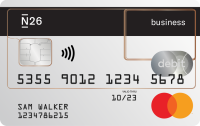

N26 Standard

The free* digital business bank account with cashback for freelancers

€0.00/Month

N26 Smart

The business bank account with cashback and financial tools for freelancers

€4.90/Month

N26 You

The business bank account with cashback and travel perks for freelancers

€9.90/Month

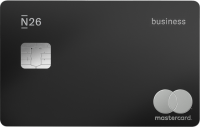

N26 Metal

The premium bank account with cashback and a metal card for freelancers

€16.90/Month

N26 Standard

The free* digital business bank account with cashback for freelancers

€0.00/Month

N26 Smart

The business bank account with cashback and financial tools for freelancers

€4.90/Month

N26 You

The business bank account with cashback and travel perks for freelancers

€9.90/Month

N26 Metal

The premium bank account with cashback and a metal card for freelancers

€16.90/Month

*Please note that interest rates for each type of membership are subject to change.

**The money in your bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme.

Services and Fees are for anyone who registers with an address in Belgium, Estonia, Finland, Greece, Ireland, Lithuania, Luxembourg, The Netherlands, Portugal, Slovakia, Slovenia, Sweden, Norway, Denmark, Poland, Iceland and Liechtenstein.

For our detailed price list, view PDF here

For more information on Allianz Assistance insurance coverage, please see the General Conditions of the N26 You, N26 Business or N26 Metal account.

Personal Bank Account FAQ

How do I open an N26 bank account?

You can open a N26 account if you’re at least 18 years old, living in one of these countries, and own a compatible smartphone. To start the sign-up, simply create an account in the N26 app or on the N26 website and confirm your email address. You can then introduce yourself with your ID directly in the app and then pair your smartphone with your account.

How much does it cost to open a N26 bank account?

The standard N26 bank account is free and doesn’t charge any opening or maintenance fees. The N26 Smart bank account costs €4.90 per month, the N26 You bank account costs €9.90 per month and the N26 Metal account is available for €16.90 per month, with a 12-month commitment period. To open an N26 account, no deposit or minimum income is required.

How old do you have to be to open an N26 bank account?

Anyone 18 or over residing in one of our 25 markets can open a bank account. N26 accounts are a great option for your first bank account, offering intuitive mobile features designed to help you save and spend with confidence. If your child is about to turn 18, check out our bank account options to find the one that’s right for them!

How long does it take to get an N26 debit card?

Once you have successfully completed the N26 account sign-up process, you will immediately have access to your virtual N26 debit Mastercard on your smartphone. Link this to Google Pay or Apple Pay to start spending immediately. If you ordered a physical card or your account includes one automatically, this will typically arrive via post in 5 to 7 business days.

Can I have a regular N26 bank account and an N26 Business account at the same time?

No. With N26, you can only have one active account in your name. Currently, it’s not possible to have two N26 accounts under the same name. This means that you can’t have a private N26 bank account and an N26 business account at the same time.

Can I receive my salary with N26?

Of course! As long as your employer accepts accounts with a German IBAN, you'll be able to have your salary deposited directly into your N26 account.