Compare every detail

Cashback

Cashback

Virtual card

1

1

1

1

Virtual card

1

1

Physical card

Physical card

Spaces sub-accounts

10

10

10

Spaces sub-accounts

10

Shared Spaces

Shared Spaces

Free ATM withdrawals in Italy and eurozone

3 per month

Unlimited

Unlimited

Unlimited

Free ATM withdrawals in Italy and eurozone

3 per month

Unlimited

Budgeting automations

Budgeting automations

Worldwide card payments

Free

Free

Free

Free

Worldwide card payments

Free

Free

Free ATM withdrawals outside the eurozone

1.7% fee

1.7% fee

Free

Free

Free ATM withdrawals outside the eurozone

1.7% fee

Free

Travel and baggage delays1

Up to €500

Up to €500

Travel and baggage delays1

Up to €500

Baggage cover1

Up to €2,000

Up to €2,000

Baggage cover1

Up to €2,000

Emergency medical and dental1

Up to €1 million for medical and €250 for dental

Up to €1 million for medical and €250 for dental

Emergency medical and dental1

Up to €1 million for medical and €250 for dental

Emergency medical transport1

Up to €2,300

Up to €2,300

Emergency medical transport1

Up to €2,300

Trip interruption1

Up to €10,000

Up to €10,000

Trip interruption1

Up to €10,000

Trip cancellations1

Up to €10,000

Up to €10,000

Trip cancellations1

Up to €10,000

Personal liability1

Up to €500,000

Up to €500,000

Personal liability1

Up to €500,000

Mobile phone insurance1

Mobile phone insurance1

Purchase protection1

Purchase protection1

Partner offers

+15

+20

Partner offers

+15

24/7 chat support

24/7 chat support

Phone support

Phone support

Deposit protection

Up to €100,000

Up to €100,000

Up to €100,000

Up to €100,000

Deposit protection

Up to €100,000

Up to €100,000

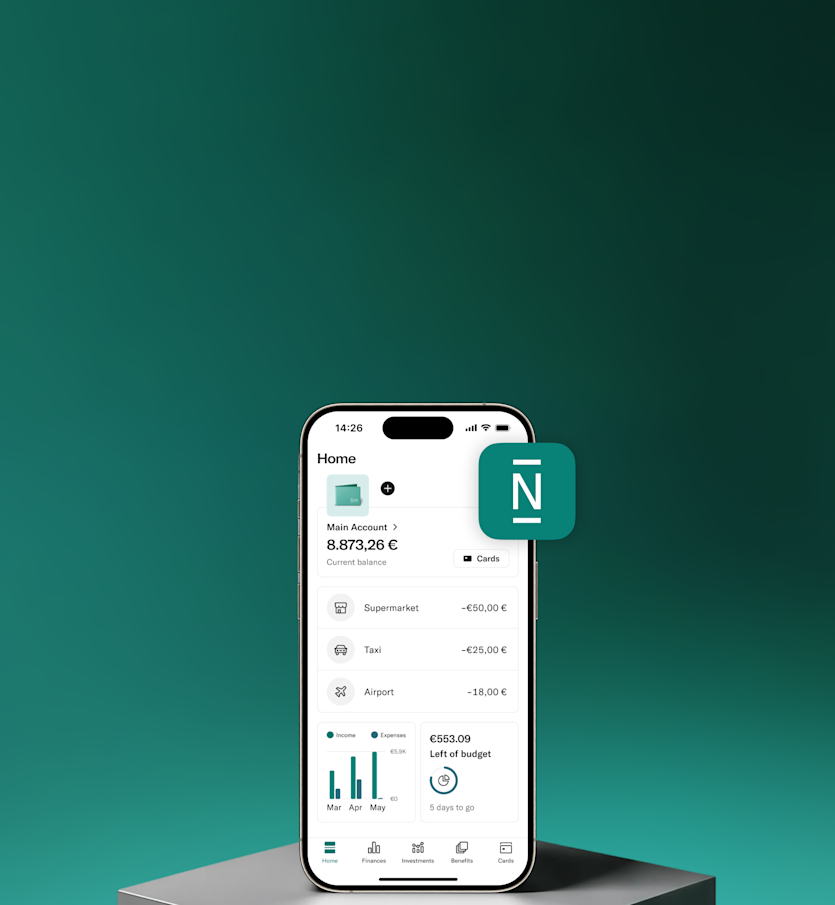

Start banking better

Open your N26 account and start enjoying beautifully simple banking.

1 Exclusions and restrictions apply. For more information, please see the Allianz Assistance Insurance Product Information Sheet (Business Metal | Business Go) and Conditions for Beneficiaries (Business Metal | Business Go). You can see all information you need to start a claim or call Allianz Assistance in case of an emergency in the N26 app and in the Conditions for beneficiaries. N26 Business Go and Business Metal feature comprehensive insurance coverage from Allianz Assistance (trade name of AWP P&C S.A. – Dutch Branch) one of Europe’s most trusted insurance companies. AWP P&C S.A. Dutch Branch is an insurer licensed to act in all EEA countries and operating in freedom of services, with corporate identification No 33094603, and registered at the Dutch Authority for the Financial Markets (AFM) No 12000535. AWP P&C S.A., which has its registered office in 7 rue Dora Maar, Saint-Ouen, France, is authorized by L’Autorité de Contrôle Prudentiel et de Résolution (ACPR) 4 Place de Budapest CS 92459, Paris Cedex 09, France. Please note that terms used may be defined according to the Conditions for Beneficiaries and can differ from everyday language.

FAQ

- Use the account primarily for business purposes

- Not already be an N26 user

- Live in a country where N26 operates: Austria, Belgium, Denmark, Estonia, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, and Switzerland

Download the N26 app and follow the steps to open an N26 business account. Once you’ve verified your identity your account will be ready to use. For more information on opening an N26 business bank account, as well as the documents that you need, visit our Support Center.

To be eligible for an N26 business account, you must:

Use your legal first and last name to sign up for an N26 business account. These accounts are made for self-employed people doing business under their own name. This means you can’t have your company’s name on the account or debit card.

Yes. If you’re self-employed, an N26 business account is a good way of separating your business finances from your personal banking. It makes accounting and bookkeeping easier as you grow your business.

You may use your business account for personal spending as long as you mainly use the account for business expenses. To be eligible for an N26 business account, you must use it primarily for business purposes.

No. You can’t have a business account and a personal account at the same time.

Yes. You earn cashback on all purchases made with your N26 Mastercard debit card. Cashback is calculated and deposited automatically on a monthly basis.

If you have an N26 Business Standard, Smart, or Go account you earn 0.1% cashback. Upgrade to N26 Business Metal to earn 0.5%.