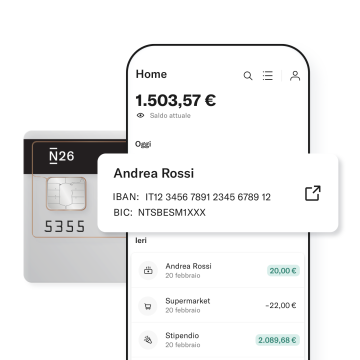

N26 with Italian IBAN

A full bank account that you control from your smartphone, all in real time. Choose the account that works for you and discover a new way of managing your finances.

What is an IBAN and how does it work?

Every bank account comes with a unique IBAN number, which is short for International Bank Account Number. It’s a designated number which identifies your bank account and allows you to send and receive money from your account to others and merchants, both in Italy and abroad.

N26 and Italian IBAN: what are my advantages?

Besides being able to have your salary credited to your N26 account as always, your bank account’s Italian IBAN enables you to:

- Manage your utility bills (water, electricity, gas)

- Manage your subscriptions, from your gym to your streaming services

- Manage your expenses, bills and direct debits from one simple app

Why choose N26

✓ A free bank account with Italian IBAN that you manage from your smartphone

✓ A contactless N26 Mastercard, accepted worldwide

✓ Free SEPA transfers and direct debits

✓ Instant push notifications after all account activity

✓ Safe online purchases with 3D secure and mobile payments

✓ Protection up to €100,000 from the German deposit protection scheme

✓ A contactless N26 Mastercard, accepted worldwide

✓ Free SEPA transfers and direct debits

✓ Instant push notifications after all account activity

✓ Safe online purchases with 3D secure and mobile payments

✓ Protection up to €100,000 from the German deposit protection scheme

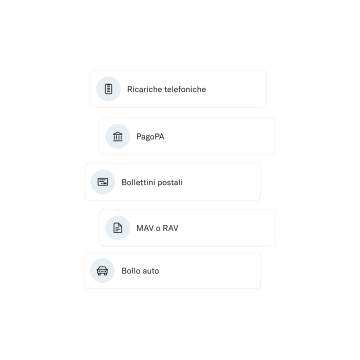

With N26, managing your payments in Italy is hassle-free

Discover the bank that makes your life easier. Pay your car tax, PagoPA, MAV and RAV with your N26 card directly from your smartphone, no matter where you are. You can even top up your mobile phone with a few taps—just open the N26 app and follow the steps to complete your transaction.

Join the bank you’ll love

Deals like this are just one of the many ways N26 empowers you to bank your way. Join N26 today and get 100% mobile banking with zero hidden fees, a free debit Mastercard, free online payments with Google Pay and Apple Pay, and 24/7 customer support.

We're here for you. In 5 languages.

Whenever you have a question or encounter a problem, our N26 Support team is always on-hand to help. They are available for you in 5 languages via email or chat.

Visit Help Center

2013

Founded

~1,500

Employees

~8 Million

Customers

~1.8 B $

Funding

Choose your N26 account

Business or personal? Standard or premium? Whichever type of bank account you opt for, there’s an N26 account with a Mastercard debit that’s just right for you. Plus, you can pick your card’s color when you choose any premium account.The N26 Standard current account includes zero fees for the maintenance of the account, the issuance of a virtual debit card and the authorization of virtual debit card transactions, ordinary SEPA transfers in Euros, standing transfer orders, SEPA direct debits, three cash withdrawals a month at ATMs in the Euro area. Fees and charges are applicable for services other than those indicated.

Advertising message for promotional purposes. For complete contractual and economic conditions, please see the information sheets in the Legal Documents section.

FAQs

You can find the IBAN and all the other details of your N26 account in your N26 app. Just tap the “My account” section on the upper right corner of the Home section.

The Italian IBAN number is made up of 27 characters. The first 2 letters denote the bank’s home country, while the 2 following ones are “check digits”. The following numbers identifies both the bank and your specific account. The last 12 digits correspond to your N26 bank account’s number.

Yes, you can have your salary credited to your N26 account. To find out how it works, visit this page.

Following the new provisions from INPS (Italian National Social Security Institute) it’s not possible to have your pension credited to an N26 account with an Italian IBAN, but we’re working to provide our customers with this service as soon as possible. If you’d like to have your pension credited to your N26 account with an Italian IBAN, contact our Customer Support from your N26 app—we’ll inform you as soon as this service is available to you.