The best bank account for expats in France

- Free bank account

- English Customer Support seven days a week

- Invest in stocks and ETFs

- Free stock and ETF trading

- Earn up to 2,25% gross annual interest with Instant Savings

Why choose N26

Don’t get bogged down by old-fashioned banking, with its hidden fees and overly complicated transaction processes. The N26 app makes any transaction possible in just a few taps on your smartphone.Open your account in minutes and enjoy 100% mobile banking. Get a free virtual card and monthly ATM withdrawals.

2013

Market Launch

24

Markets

300,000+

5-star app ratings on iOS and Android

Everyday banking with a French IBAN

Open an N26 bank account with a French IBAN and discover a new and streamlined way of managing your finances.

- Pay for all of your subscriptions (streaming services, gym memberships...)

- Set up direct debits and other recurring bank transfers

- Receive your salary and social benefits by direct deposit

Start earning interest

No deposit limits**, no time limit, your interest paid every month, and full flexibility. Discover N26 Instant Savings, an interest-bearing deposit account available at no extra cost in the N26 app.N26 Standard customers get 0.75%* annual gross nominal rate on their savings. Prefer 2.25%*? Choose N26 Metal.

Discover Instant Savings

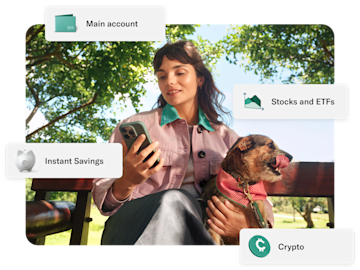

Invest in stocks, ETFs, and crypto

N26 combines everyday banking and investing in a seamless way. That means you can manage your stocks, ETFs***, and crypto portfolios**** without having to download another investment app. With N26, all the tools you need to build your financial wealth are in one place.

Explore Crypto

Travel the easy way with N26

From the beaches of Phuket to the Big Apple — and everywhere in between — N26 is the bank account that travels with you. All our accounts feature free card payments worldwide, as often as you like and with no foreign transaction fees.

Customer Support in 5 languages

You can chat with our Customer service agents in English, French, Spanish, Italian, or German, 7 days a week, from 7AM to 11PM, including on Sundays and on public holidays. Premium customers also get access to phone support. You can also reach out to us on X, Facebook and Instagram, and check out our FAQs and our Support Center.

Your finances — better together

Life is better shared, and your money is no exception. Manage all your finances in one place with your personal account and joint account at N26.N26 joint accounts come with dedicated IBANs, handy insights, and user-friendly features to make managing your own and your shared finances easier than ever.

Your safety is top priority

N26 is a real bank with a full banking license. This means that your N26 account is always protected up to €100,000 by the German Deposit Protection Scheme.We also believe in transparency. N26 has no hidden fees, and we send you push notifications for every incoming and outgoing transaction, so you always know what’s happening on your account.

What's next?

1. Register online2. Verify your identity in a short videocall3. Receive your N26 Mastercard4. Enjoy your N26 account

N26 accounts — your money deserves an upgrade

N26 Standard

The free online bank account

Virtual Card

€0.00/month

0.75% interest on your N26 Instant Savings

Worldwide payments and no foreign transaction fees

Up to 2 free domestic ATM withdrawals

- -

*Need a physical card? Order a transparent debit Mastercard card for an one-time €10 delivery fee.

N26 You

Travel with premium perks

€9.90/month

All benefits of N26 Smart, Plus

1.05% interest on your N26 Instant Savings

Unlimited free withdrawals in foreign currencies

Insurance for delay and theft of luggage

Medical emergency cover

N26 Metal

Our most premium plan

€16.90/month

All benefits of N26 You, Plus

2.25% interest on your N26 Instant Savings

An 18-gram metal card

Up to 8 free ATM withdrawals per month

Priority customer hotline

1 Valid only for new customers who open a new N26 Metal account from 19/02/2025 onwards. Deposits made into Instant Savings earn interest at an annual gross nominal rate of 2%, which is currently aligned with the European Central Bank deposit facility rate (starting on 11/06/2025). This interest rate may be subject to change at any time at N26's discretion, regardless of fluctuations in the ECB rate. Interest is taxable and subject to social security contributions. Terms and conditions of the Instant Savings apply. Reserved for non-Business customers of N26 Bank SE, Succursale France.

For existing customers: deposits into N26 Instant Savings accounts earn interest at an annual gross nominal rate of 1.50% with N26 Metal, 0.55% with N26 Go, and 0.25% with N26 Smart and N26 Standard from 11/06/2025 onwards. These may be subject to change at any time by N26. Interest is taxable and subject to social security contributions. Reserved for non-Business customers of N26 Bank SE, Succursale France.

The money in your bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme.

2 Investments in stocks and ETFs carry a risk of capital loss. N26 Stocks and ETFs is provided by N26 Bank SE in partnership with Upvest Securities GmbH. Learn more N26 Stocks and ETFs on this page.

Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

3 Investments in digital (crypto) assets carry a high risk of total or partial loss of capital due to the specific volatility of digital asset prices and cybersecurity risks. N26 Crypto is provided by N26 Bank SE in partnership with Bitpanda GmbH. Learn more about risks and N26 Crypto on this page.

4 All investments carry a risk of capital loss. The PEA account is managed by Upvest Securities GmbH. N26 Bank SE provides reception and transmission of orders and PEA account access through the N26 app for customers of N26 Bank SE with a German IBAN, and of the French Branch of N26 Bank SE with a French IBAN. Learn more on: https://n26.com/en-fr/pea.

5 Eligible spending: Detailed T&Cs for customers who sign up before July 17 and after October 15 can be found here: https://n26.com/hb-ex

Frequently asked questions

- Be over the age of 18

- Live in an eligible country

- Have your own smartphone

- Not yet have an online account with N26

- Have a valid ID

You must meet the following requirements to open an N26 Standard free bank account:

N26 has been granted a full German banking license from BaFin. By law, each customer’s funds are protected up to €100,000 by the German Deposit Protection Scheme. With 3D Secure, Mastercard Identity Check, and fingerprint and face recognition, the security of our customer's online payments is always guaranteed.

The free bank account lets you manage all your finances under one app, whether at home or traveling. In addition, we don’t charge you any hidden fees when withdrawing money from an ATM, or when making payments in foreign currencies. Alongside getting instant push-notifications after every transaction, benefit from Spaces sub-accounts for better saving, automatic spending categorization with Statistics, and the ability to make and receive immediate funds from other N26 customers with MoneyBeam.

With N26 You and N26 Metal you can also withdraw money at no fees worldwide, and enjoy exclusive benefits such as discounts. On top of this, premium accounts come with an extensive package of travel and lifestyle insurance, courtesy of Allianz.

The standard N26 bank account is free and doesn’t charge any opening or maintenance fees. The N26 Smart bank account costs €4.90 per month, the N26 Go bank account costs €9.90 per month and the N26 Metal account is available for €16.90 per month, with a 12-month commitment period. To open an N26 account, no deposit or minimum income is required.

If you meet all the requirements, you can open your checking account with N26 for free and within minutes. All you need is a smartphone and your photo ID. It's easy with our digital authentication process. Download our app to open an account—you don’t even need a minimum deposit amount.