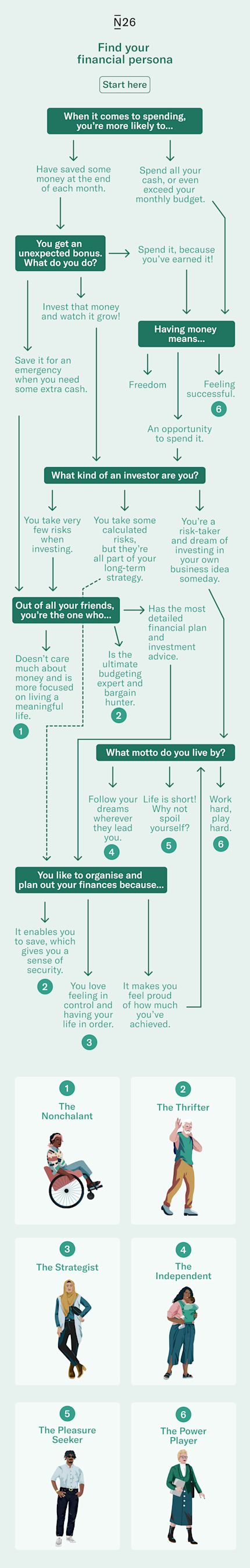

We all have our strengths and weaknesses when it comes to money management. But did you know that most of us fit into six distinct financial personas that shape our relationship to and values around money? Plus, these personas affect how we spend and save. Read on to learn more about the different financial personas.

Learn how you intuitively spend and save

Ever wondered why you’re an impulsive spender? Or why you love making a five-year savings plan? Well, although we all manage our money differently, most of us fit into distinct personas. These are influenced by everything from our personality type and background to our age and culture — and each financial persona has unique characteristics and strengths. At N26, we believe that learning how you instinctively save and spend helps you better manage your money. We teamed up with financial educator and author Alice Tapper to learn more about different financial personas. Alice has interviewed over 1,000 people on their finances. Plus, Rashmi Dsouza, Product Lead at N26, has tailored recommendations for N26 products and features to match each and every personality type.The six definitive financial personas

The Nonchalant

While others want to make their money work for them, the Nonchalant asks: How can it help me live a more meaningful life? Their finances take a back seat to their values — they prioritize money enough to get by, but prefer more lasting pleasures. Nonchalants see earning and saving as a means to an end: backpacking through Asia, a yearlong sabbatical, or more time with family. As long as their carefree attitude doesn’t become too extreme, the Nonchalant reminds us that money isn’t everything.

Read more

The Thrifter

Thrifters have something to teach us all about saving. Always hunting for a bargain, they’re willing to sacrifice short-term pleasure for long-term financial gains. Want to know where to score a cheap meal or catch a free concert? They’ll know the place. Risk-taking or enjoying the occasional indulgence can be a challenge for a Thrifter, but what they lack in abundance they more than make up for in self-control — a real asset when it comes to money-management.

The Strategist

When it comes to money, Strategists love a plan. They understand instinctively how to spend responsibly, and are always clued-in to the best ways to save and build wealth. Though they can get thrown off by unforeseen expenses, Strategists are pragmatists when it comes to money — always playing the long game. Preferring quality over fads or trends, they use their organizational know-how to achieve their financial goals while spicing up their tight schedules with a little well-planned fun.

The Independent

Independents dream of a successful life — on their own terms. For them, success means being their own boss, and they might aspire to be entrepreneurs or save for early retirement and travel the world. They spend less on themselves and more on investing in their future, whether that’s startup capital or a “freedom fund.” They may need to get their heads out of the clouds sometimes — or pause their night hustle to get some sleep — but their hunger to achieve their dreams is nothing short of visionary.

The Pleasure Seeker

When it comes to living life to the fullest, Pleasure Seekers have the upper hand. They’re all about seizing the moment, and that’s where they focus their finances. From a bougie meal to a fancy vacation, this type tends to live on the financial edge — treating money as a ticket to all of life’s delights. They may spend beyond their means, but as long as they avoid debt and make a good savings plan, the Pleasure Seeker’s spirit is a crucial reminder that money is, in part, made to be enjoyed.

The Power Player

Does money equal power? The Power Player certainly thinks so—and why not? Harnessing money’s potential to be a key to the most luxurious things and experiences has its merits. These types are driven to always earn more, and their ambition affords them a decadent life full of adventure. They have an astonishing work ethic, and know how to grow their wealth and provide for those they love. It’s important to know when to reign in that lust for wealth, but a healthy dose of ambition doesn’t hurt.

About the experts

About Alice Tapper

Financial Educator and Author

Alice Tapper is a financial campaigner, certified debt advisor, and the author and creator of Go Fund Yourself (GFY), a financial news and education platform. Since its launch, GFY has become infamous for its Financial Confessions interview series, featuring anonymous stories and secrets. Alice studied behavioral economics and also works with the Living Wage Foundation as one of 12 industry experts tasked with devising the U.K.’s Living Pension program.

About Rashmi D'Souza

N26 Product Lead

As Product Lead at N26, Rashmi D'Souza is responsible for building intuitive financial products and features that enable the best possible user experience. She has over 10 years of experience in credit solutions and debt management across strategy, data, and risk. At N26, Rashmi works with teams of designers, engineers and data scientists to drive growth, solving user problems via automation, and product development, relentlessly advocating for the customer’s needs.

Any Information provided in this blogpost does not constitute investment advice, including on a specific investment strategy, or on using or buying financial services or any financial instruments. Information is provided for illustrative purposes only and reflects exclusively the opinion of the authors. No liability can be assumed for its accuracy. Should the readers adopt the offered contents as their own, make use of any information or follow any opinion referred to in the article, they act at their own risk.