The bank you’ll love

The standard N26 account: the essentials without fees

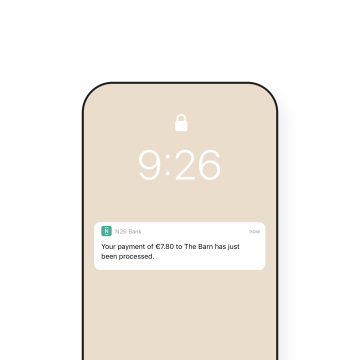

Real-time banking

Fuss-free foreign transfers with Wise

Travel without borders and without fees

Use your Mastercard, wherever you are

Benefit from zero fees on all your payments made with your virtual Mastercard debit card, even when you’re abroad.

Pack your bags, and take off

There’s no need to warn us. Lock and unlock your card, activate or deactivate payments abroad from your phone, and set your payments limits on-the-go.

Enjoy the best exchange rate

N26 applies the real exchange rate Mastercard on your foreign currency transactions, without markup. Our partner TransferWise also allows you to make international transfers in 38 currencies from your app, with fees that are x 6 times lower.

Our premium accounts get you covered

If you choose N26 You or N26 Metal, you’ll benefit from travel and lifestyle insurance to cover you daily needs, courtesy of Allianz.

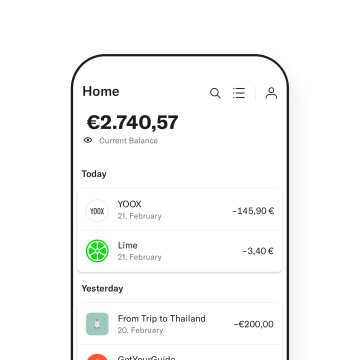

Automatic categorization of your expenses

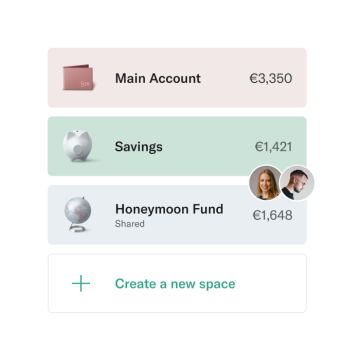

Save money with Spaces

N26 You: banking, personalized

Get cashback with N26 Business

Security is our priority

3D Secure

N26 uses 3D Secure technology to secure your online payments. When necessary, you can confirm your transactions from the phone paired with your account.

Full control of your account

Mobile banking allows you to control all the parameters of your account. Lock and unlock your card, activate and deactivate payments online or abroad, manage your payment limits or change your PIN in real-time.

Our banking license

N26 is a fully-regulated bank that holds a full German banking license and is controlled by the German banking regulator.

Your funds are insured

Your money is safe with us, thanks to deposit protection of up to €100,000 by the German Deposit Protection Fund.

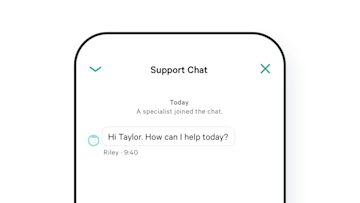

We’re here for you. In several languages.

Choose the perfect plan for you

Whether you’re looking for a flexible, free bank account or a more premium plan complete with extensive insurance and smart management tools, N26 offers a bank account for every lifestyle. Open yours from your smartphone in minutes.~8 Million

Customers

~1.8 B $

Funding

2013

Founded