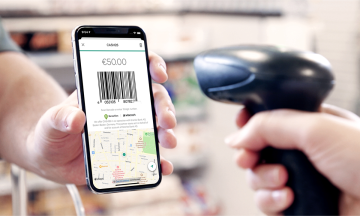

Use iDEAL | Wero with your N26 accountWant to pay with your N26 app using iDEAL | Wero? Here’s how.

3 min read

N26's best features for shared living

4 min read

Unlock your best summer yet with Spaces

6 min read

How to buy cryptocurrency with N26

7 min read

How to read crypto charts on N26

7 min read

New in N26: Make your money work for you

5 min read

Get an extra card for your N26 account

2 min read