Compare N26 bank accounts in Austria

Find the perfect plan for you

Find the perfect plan for your business

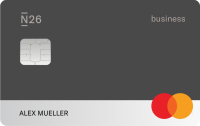

N26 Standard

The free* digital business bank account with cashback for freelancers

€0.00/Month

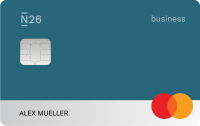

N26 Smart

The business bank account with cashback and financial tools for freelancers

€4.90/Month

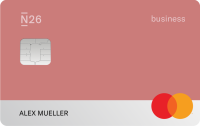

N26 You

The business bank account with cashback and travel perks for freelancers

€9.90/Month

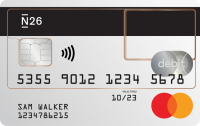

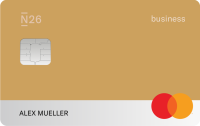

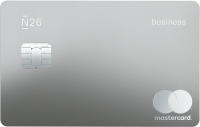

N26 Metal

The premium bank account with cashback and a metal card for freelancers

€16.90/Month

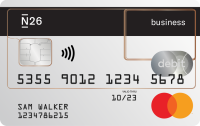

N26 Standard

The free* digital business bank account with cashback for freelancers

€0.00/Month

N26 Smart

The business bank account with cashback and financial tools for freelancers

€4.90/Month

N26 You

The business bank account with cashback and travel perks for freelancers

€9.90/Month

N26 Metal

The premium bank account with cashback and a metal card for freelancers

€16.90/Month

Bank Account for Freelancers FAQ

What’s the difference between a personal bank account and a business one?

The major difference between a personal bank account and a business account is what it’s used for. As the name suggests, personal bank accounts are designed for personal, day-to-day use. Conversely, business accounts are only intended for business transactions. A business account gives you a better overview of your business expenses and enables you to store the relevant receipts more easily. This blog post tells you more about the differences between these two kinds of accounts.

Can I have a personal and business account at the same time?

You can’t have two bank accounts with N26 at the same time. If you already have an N26 account but would like to open up an N26 business account, you’ll have to close your personal account first. Then you can open a business account through the N26 app or our website.

What are Eligibility Requirements?

- You will use the account primarily for business purposes.

- You’re not already an N26 user.

- You reside in a country where N26 operates: Germany, Austria, France, Italy, Spain, Portugal, Ireland, Greece, the Netherlands, Belgium, Luxembourg, Finland, Latvia, Estonia, Lithuania, Slovakia, Slovenia, Switzerland

Do I need a business account if I’m a freelancer?

N26 Business was created with freelancers in mind, and those offering their professional services in their own first and last name. The big advantage of having a business account is that you can easily separate business finances from personal finances—this makes tax declarations and tax refunds easier.

Can I open a business account in the name of my business?

No, you’ll have to open it under your own first and last name. We designed N26 Business specifically with freelancers in mind, and for those offering their services in their own name. This means that the name of your business won’t be visible on your bank account or N26 debit card.

*Please note that interest rates for each type of membership are subject to change.

**The money in your bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme.

Services and Fees for everyone who registers with an address in Austria.

For our detailed price list, view PDF here

For more information on Allianz Assistance insurance coverage, please see the General Conditions of N26 You, N26 Business You or N26 Metal account.