Bank for free: There is no account management fee for the N26 Standard Account. For all other account plans fees apply. See List of Prices and Services for current fees.

*Valid only for new customers who open a new N26 Metal account from 19/02/2025 onwards. The interest rate for the N26 Instant Savings account corresponds to the current European Central Bank deposit facility rate (2% starting on 11/06/2025) and is subject to change by N26 any time. Terms and conditions apply.

For existing customers, the interest rates on your N26 daily money account depend on your main membership with N26: 0.30% p.a. for Standard and Smart, 0.50% p.a. for N26 Go, and 1.50% p.a. for Metal (before taxes) until 10/06/2025. Starting on 11/06/2025: 0.30% p.a. for Standard and Smart, 0,50% p.a. for N26 Go, and 1,50% p.a. for Metal (before taxes).

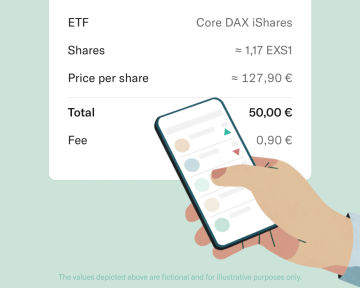

**These statements are intended to provide general information and do not constitute investment advice or any other advice on financial services and financial instruments such as Stocks, ETFs and Ready-made funds. These statements also do not constitute an offer to conclude a contract for the purchase or sale of Stocks, ETFs and ready-made funds. Stocks, ETFs and Ready-made funds can be subject to high fluctuations in value. A decline in value or a complete loss of the money invested are possible at any time. The values depicted are fictional and for illustrative purposes.

Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

***The market for crypto assets constitutes a high risk. A complete loss of the money spent is possible at any time. N26 Crypto is powered by Bitpanda GmbH.

N26 is the first 100% mobile bank to be granted and operate with a full German banking license from BaFin. That means your money is fully protected — both in your bank account and Instant Savings account — up to €100,000 by the German Deposit Protection Scheme.

N26 has been granted a full German banking license from BaFin. By law, each customer’s funds are protected up to €100,000 by the German Deposit Protection Scheme. With 3D Secure, Mastercard Identity Check, and fingerprint and face recognition, the security of our customer's online payments is always guaranteed.

As a bank, N26 is supervised by the German Federal Financial Supervisory Authority (BaFin). Our clients' funds are guaranteed up to €100,000 by the German Deposit Protection Scheme. In addition, the N26 app has many features to ensure the security of its users' bank accounts and data.

In order to open a bank account with N26, you must have a government-issued ID. Don’t worry, there’s no fussy paperwork or long wait times involved — just present your valid ID during a quick call and you’ll be up and running. It’s worth noting that you’ll also need a smartphone to use your account, and must live in an eligible country where N26 operates.

The standard N26 bank account is free and doesn’t charge any opening or maintenance fees. The N26 Smart bank account costs €4.90 per month, the N26 Go bank account costs €9.90 per month, and the N26 Metal account is available for €16.90 per month. To open an N26 account, no deposit or minimum income is required.

You can easily switch your bank account to N26 from almost every Austrian bank! Just type in the name of your current bank. Discover how to switch banks with our tool to facilitate the process.

You can open your mobile N26 account online in minutes from your phone or the N26 website — no paperwork or waiting times. But best of all: Once your N26 bank account is active, you can start using it right away. This means you can start spending with your virtual card as soon as your account is set up, and you don't have to wait for your physical card to arrive.

Thanks to Cash26, you can deposit and withdraw cash at over 2,000 shops across Austria with your N26 bank account, so you can skip the ATM line. Simply create a Cash26 barcode in your N26 app to deposit or withdraw cash at our partners Billa, Penny, and DM. Withdrawals with Cash26 are free, and we charge a 1.5% fee for deposits.

Find out more

What Is an ETF? An Overview for Beginner Investors Everyone is talking about ETFs. Here's why — and what you need to know before investing in them.

What is investing and how to easily get startedFrom purchasing real estate to buying stocks, investing is the key to a secure and stable financial future. In this guide, learn what investing is and what you need to know to get started.

Deposit protection scheme: why your money is protectedLooking for reassurance that your money is protected? Deposit protection schemes help secure the money in your bank account.