N26 Mastercard debit card—accepted worldwide

Your premium bank account comes with a Mastercard debit card in a choice of colors. Sign up in minutes, and enable mobile payments to start spending right away—even before your physical card arrives in the mail.

24

markets

~8 million

customers

280k+

5* ratings across both iOS and Android app stores

1,500+

Team members

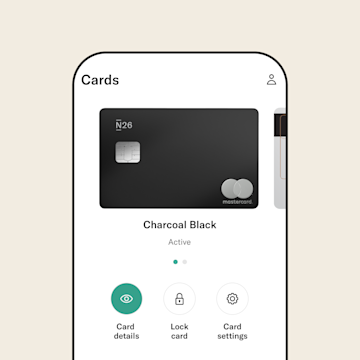

Mastercard designs suited to your taste

No matter which account you choose, we’ve got a sleek debit Mastercard just for you.

- N26 Smart customers can choose from five lush card colors: Ocean, Sand, Rhubarb, Aqua, or Slate

- As an N26 Metal customer, you’ll get an 18 gram stainless steel debit card in one of three stunning shades—choose a Charcoal Black, Slate Gray, or Quartz Rose

- N26 Standard customers can also order our signature transparent debit Mastercard for a one-off €10 delivery fee

Click to Pay — safe, simple online shopping

Mastercard Click to Pay stores your card details in an encrypted profile, letting you check out securely without your card.Enroll to enjoy:

- Protection from identity theft — your details are safe with Mastercard ID Theft Protection

- Zero Liability Insurance — you’ll never be held responsible for fraudulent transactions

- Faster payments — Mastercard remembers your card details

- Not needing a password — a secure, one-time code is all you’ll need

Pay with your Mastercard, worldwide

Your perfect travel companion, Mastercard debit cards are accepted worldwide and offer zero foreign transaction fees when spending abroad—with no mark ups or extra charges. Want to shop while traveling the world? Use your debit Mastercard to pay in stores, online, and in-app while abroad—no matter where you are. Enjoy fee-free ATM withdrawals in any currency included with your N26 Go and Metal account. Simply use the handy Mastercard ATM locator in your app to find your nearest cashpoint.

Security

3D Secure from Mastercard

All your online payments are protected thanks to Mastercard SecureCode technology, which provides an extra layer of security for your online purchases.

NFC technology

Your Mastercard N26 contactless is compatible with NFC technology, so you can pay for your purchases securely and quickly in physical stores, online or in apps.

Push notifications

Thanks to real-time push notifications after every transaction, you are always up to date on what's going on in your bank account.

Deposit protection

With our European banking license, your money is protected up to 100.000 € by the German Deposit Guarantee Fund.

Stay in control—24/7

You’re always in the driver’s seat with N26. Add your Mastercard debit card to your mobile wallet to make payments with your smartphone. With a few taps in the app, you can also lock or unlock your card, change your PIN or set daily spending and withdrawal limits—at home and abroad. Always misplacing your card? Order an extra to use with your N26 account, and never lose access to your money.

Your Mastercard, your way

Business or personal? Standard or premium? Whichever type of bank account you opt for, choose a Mastercard debit card that’s right for you. Go premium to pick your card’s color, or order a transparent debit card for a one-off delivery fee.FAQ

All N26 bank cards are Mastercard debit cards that come with contactless NFC technology—even our bespoke-design metal Mastercard. Shop or withdraw money anywhere in the world, and keep your money safe with 3D Secure from Mastercard. Plus, add your card to Apple Pay or Google Pay to spend and save with confidence—right from your phone.

You can choose your physical Mastercard when you open an N26 premium bank account. Pick from a choice of 5 colors if you’re an N26 Smart, Business Smart, or N26 Go and N26 Business Go customer. If you’ve signed up for an N26 Metal or Business Metal bank account, you can get a metal Mastercard available in three metallic shades.

If you’re a premium customer, your N26 Mastercard is included with your membership. Simply open a bank account in minutes, and pick your favorite color.

The free N26 Standard bank account comes with a virtual card—simply add it to your mobile wallet to pay in stores, online or in-apps from your smartphone. You can also order a physical Mastercard to use with your bank account for a one-off €10 delivery fee.

Your N26 premium account offers many benefits, including Spaces sub-accounts for easier saving and Shared Spaces to manage money together with others. On top of this, enjoy a wide range of deals and offers from partner brands, and much more.

At present, we don’t offer credit cards. As a premium customer, your bank account comes with a Mastercard debit card.

No, your N26 Mastercard is not a prepaid card. It is a Mastercard debit card that is accepted worldwide, letting you carry out transactions with the money available in your account.

Learn here the difference among credit, debit, and prepaid cards

Mastercard and Visa are both payment networks. They don’t, however, issue cards—only a bank can do that. Mastercard and Visa cards don’t differ much on their own and are accepted by most merchants, but the kind of card you have can differ when it comes to your APR, perks and benefits, and more, depending on your bank account.

All N26 debit Mastercards allow you to spend money directly from your account via your physical or virtual card, and include all the Mastercard security features. N26 premium account holders have different benefits based on their plans, from Spaces sub-accounts to comprehensive insurance. Visit our compare accounts page to learn more.

Mastercard Click to Pay is an additional layer of security for online shopping that lets you check out, safely and instantly, without needing your card.

To use Click to Pay, you’ll first need to add your card. To do this, go to the ‘Cards’ tab, choose the card you’d like to add and select ‘Mobile and online wallets’. Choose ‘Click to Pay’ and follow the instructions from there.