Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

*Offer valid from 15/12/2025 to 06/01/2026, for eligible new N26 customers who open a bank account by 06/01/2026 and spend with their card by 01/02/2026. Eligible participants receive their reward in stocks randomly selected from the top 10 companies by market capitalization. Reward values in stiocks vary by market: €50 in Spain, €70 in France, €100 in Austria, €50 in the rest of the Eurozone (referred to as Greater Europe), and the equivalent of €30 in non-Euro countries. See full T&Cs. The values represented are fictional. Displayed logos are illustrative examples of potential stocks, not affiliations or investment advice.

**Offer is valid for up to 10 referrals made by 06/01/2026. To qualify, the referred friend must open an account and spend at least €150 with their N26 card by 01/02/2026. Both referrer and referee must have a trading account with N26. Once requirements are met, each receives a reward in stocks, randomly selected from N26’s list of the top 10 companies by market cap. Stocks cannot be chosen or exchanged; Value is determined at allocation and may fluctuate. T&Cs apply.

1 The new limited-edition festive virtual cards can be activated at no extra cost. Up to six virtual cards can be activated at one time.

There is no account management fee for N26 Standard. For other plans, a fee could apply. The current fees can be found in the List of Prices and Services.

2 Valid only for new customers who open a new N26 Metal account from 19/02/2025 onwards. The interest rate for the N26 Instant Savings account corresponds to the current European Central Bank deposit facility rate (2% starting on 11/06/2025) and is subject to change by N26 any time. Terms and conditions apply.

For existing customers, N26 Instant Savings account interest rates are based on their main N26 plan, for both personal and business accounts: from 11/06/2025 onwards, 0.30% p.a. for Standard and Smart, 0.50% p.a. for N26 Go, and 1.50% p.a. for Metal (before taxes). Please note that rates per plan can be changed by N26 over time. This offer is available at no extra cost in the N26 app in Estonia, Finland, Greece, Ireland, Latvia, Lithuania, Luxembourg, the Netherlands, Portugal, Slovakia, and Slovenia.

3 These statements are intended to provide general information and do not constitute investment advice or any other advice on financial services and financial instruments such as Stocks, ETFs and Ready-made funds. These statements also do not constitute an offer to conclude a contract for the purchase or sale of Stocks, ETFs and ready-made funds. Stocks, ETFs and Ready-made funds can be subject to high fluctuations in value. A decline in value or a complete loss of the money invested are possible at any time. The values depicted are fictional and for illustrative purposes. Stocks and ETFs are currently available for eligible customers in Germany, Austria, France, Spain, Ireland, Belgium Denmark, Estonia, Finland, Greece, Latvia, Lithuania, Norway, Poland, Portugal, Slovakia, Slovenia and the Netherlands. Using the N26 Broker service is always subject to eligibility.

Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

4 The market for crypto assets constitutes a high risk. A complete loss of the money spent is possible at any time. N26 Crypto is powered by Bitpanda.

5 Eligible spending: Detailed T&Cs for customers who sign up before July 17 and after October 15 can be found here: https://n26.com/hb-ex

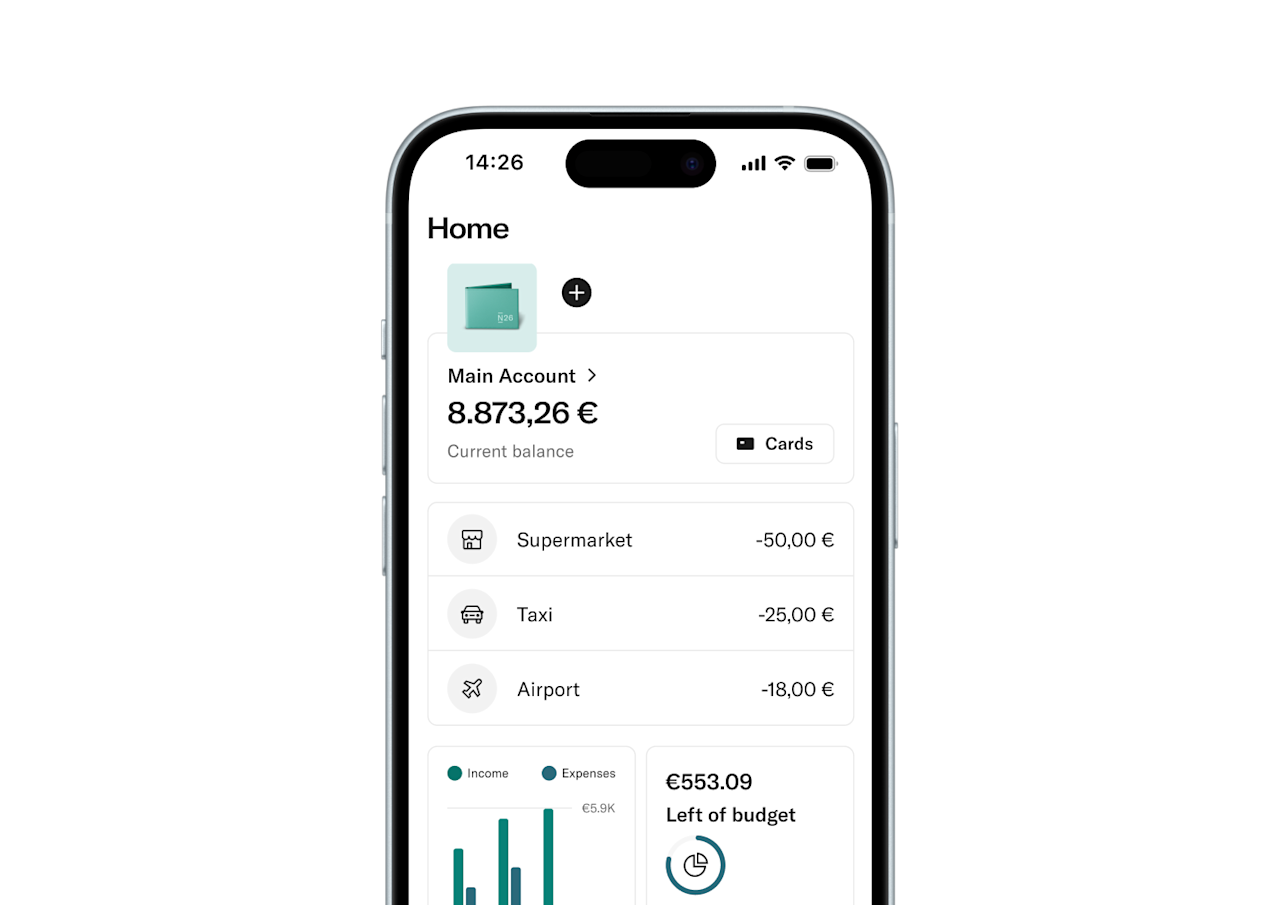

N26 is the first 100% mobile bank to be granted and operate with a full German banking license from the German Federal Financial Supervisory Authority (BaFin). That means your money is fully protected — both in your bank account and Instant Savings account — up to €100,000 by the German Deposit Protection Scheme. We currently operate in 24 markets worldwide and have over 8 million customers.

We offer our accounts in the following countries: Austria, Belgium, Denmark, Estonia, Finland, France (not available for residents in the French territories outside Europe), Germany, Greece, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, and Switzerland. You can open your account if you live in one of these countries and meet our requirements. Our products and services vary by country.

N26 has been granted a full German banking license from BaFin. By law, each customer’s funds are protected up to €100,000 by the German Deposit Protection Scheme. With 3D Secure, Mastercard Identity Check, and fingerprint and face recognition, the security of your online payments is always guaranteed.

As a bank, N26 is supervised by BaFin. Your funds are guaranteed up to €100,000 by the German Deposit Protection Scheme. In addition, the N26 app has many features to ensure the security of your bank account and data.

In order to open a bank account with N26, you must have a government-issued ID. See the list of List of accepted ID documents here. Don’t worry, there’s no fussy paperwork or long wait times involved — just present your valid ID during a quick call and you’ll be up and running. Note that you’ll need a smartphone to use your account, and must live in an eligible country where N26 operates.

The standard N26 bank account is free, with no opening or maintenance fees. The N26 Smart bank account costs €4.90 per month, the N26 Go bank account costs €9.90 per month, and the N26 Metal account is available for €16.90 per month. To open an N26 account, no deposit or minimum income is required.

You can open your mobile N26 account online in minutes from your phone or the N26 website — no paperwork or waiting times. But best of all: once your N26 bank account is active, you can start using it right away. This means you can start spending with your virtual card as soon as your account is set up, and you don't have to wait for your physical card to arrive.

Noteworthy reads

Articles and stories to help you make the most of your moneyA beginner's guide: What is trading and how does it work?Trading is more than a buzzword or an ‘80s throwback. This article covers what financial trading is and how it works, step by step.

How to save money fast: 17 tips to grow your savingsWhether your financial goals are big or small, these life hacks will help you save money faster.

The 50/30/20 rule: how to budget your money more efficientlyThe 50/30/20 budget is beautiful in its simplicity. It can help you divide your income into categories that make saving easy.