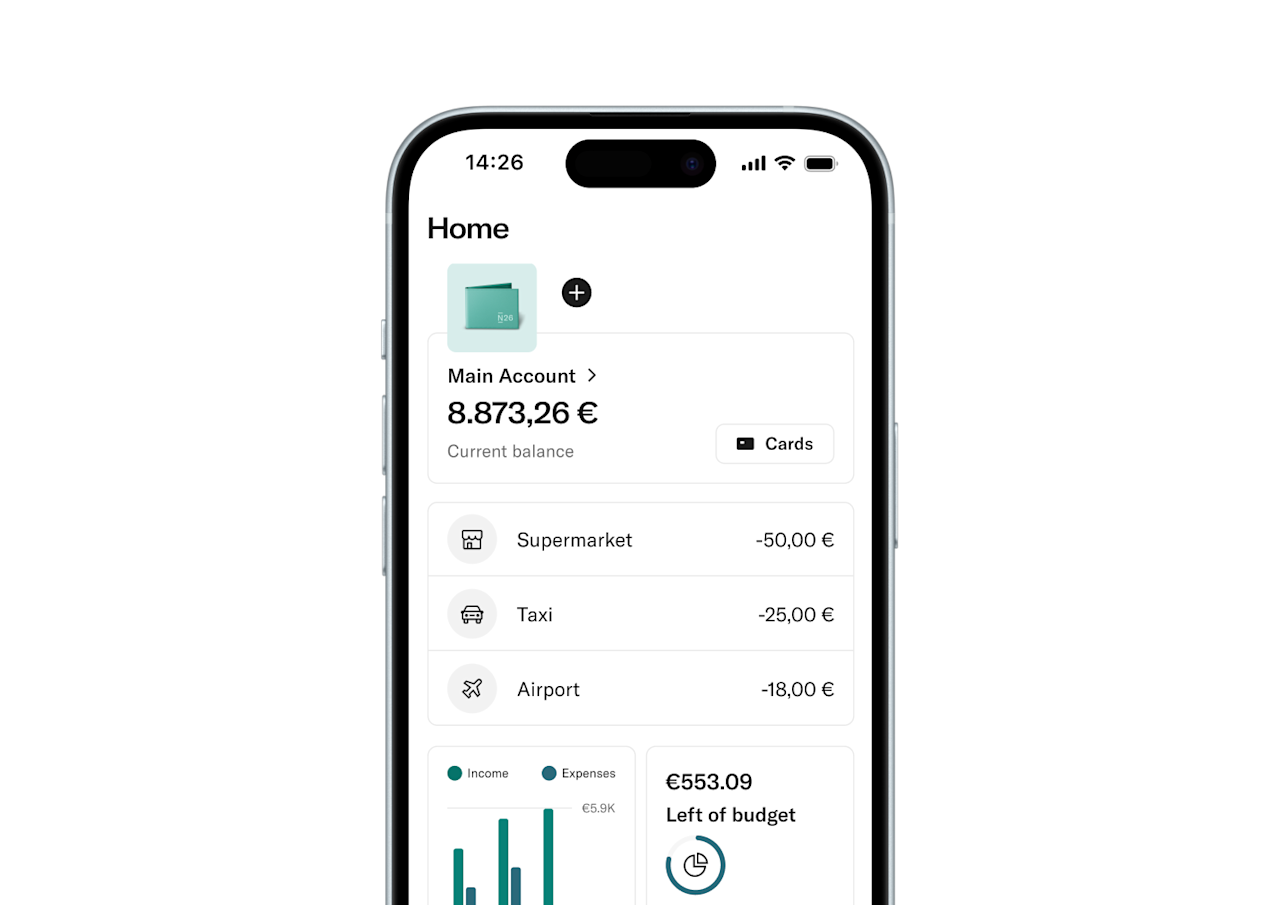

Bank with no hidden fees

Open your account in minutes and enjoy 100% mobile banking. Get a free virtual card and three free domestic ATM withdrawals every month.

Save with Spaces

Go premium and get up to 10 Spaces sub-accounts to save for your goals and stay on top of your bills.

Open your N26 account in minutes

Open your N26 account and move your recurring payments in just a few taps.

Open bank account

The N26 Standard current account includes zero fees for the maintenance of the account, the issuance of a virtual debit card and the authorization of virtual debit card transactions, ordinary SEPA transfers in Euros, standing transfer orders, SEPA direct debits, three cash withdrawals a month at ATMs in the Euro area. Fees and charges are applicable for services other than those indicated. For complete contractual and economic conditions, see the information sheets.

Advertising message for promotional purposes. Please see the Terms & Conditions for more information.

N26 is the first 100% mobile bank to be granted and operate with a full German banking license from BaFin. That means your money is fully protected — both in your bank account and Instant Savings account — up to €100,000 by the German Deposit Protection Scheme. We currently operate in 24 markets worldwide and have over 8 million customers.

N26 is a German bank with a full banking license. By law, each customer’s funds are protected up to €100,000 by the German Deposit Protection Scheme. With 3D Secure, Mastercard Identity Check, and fingerprint and face recognition, the security of our customers' online payments is always guaranteed.

To open an N26 account, you must be over 18 years old and reside in Italy. You also need to have a compatible smartphone. You’ll be asked to provide a valid form of ID as well as valid proof of residence.

The standard N26 bank account is free and doesn’t charge any opening or maintenance fees. The N26 Smart bank account costs €4.90 per month, the N26 Go bank account costs €9.90 per month, and the N26 Metal account is available for €16.90 per month. To open an N26 account, no deposit or minimum income is required.

In order to open a bank account with N26, you must have a government-issued ID and a Tax ID code (codice fiscale). Don’t worry, there’s no fussy paperwork or long wait times involved — just present your valid ID during a quick call and you’ll be up and running. It’s worth noting that you’ll also need a smartphone to use your account, and must live in an eligible country where N26 operates.

You can open your mobile N26 account online in minutes from your smartphone or the N26 website — with no paperwork or waiting times. But best of all: once your N26 bank account is active, you can start using it right away. This means you can start spending with your virtual card as soon as your account is set up, and you don't have to wait for your physical card to arrive.

To open an N26 account with an Italian IBAN, you must live in Italy, be at least 18 years old, have a compatible smartphone, a valid supported document and a Tax ID code (codice fiscale).

With N26, your card payments are always free worldwide. N26 Go and N26 Metal account holders can also withdraw abroad for free, while with the N26 Standard account customers pay a 1.7% fee on the amount withdrawn.

To close your N26 account, you will need to log in to the N26 app to verify your identity, after which the app will guide you through the process of closing your account.