5 security features to help you keep your money safe this shopping season Think the only risk this shopping season is overspending? You might want to think again.

5 min read

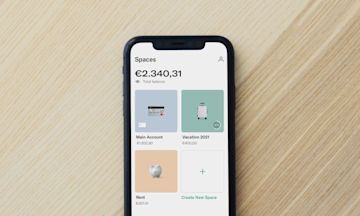

Unlock your best summer yet with Spaces

6 min read

N26 x Perlego: Save 50% on textbooks

1 min read

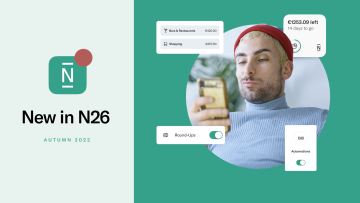

New in N26: Make your money work for you

4 min read

N26 app release notes—H1 edition

1 min read