Discover your N26 Metal debit card

Enjoy free payments and withdrawals abroad

Mobile phone insurance

Personal liability while traveling

Coverage up to €500,000 for Personal Liability in case you’re legally liable for damage to a third party or their property during a trip.

Purchase protection

Coverage up to €10,000 in 12 months for stolen or damaged eligible purchases bought with your N26 card

Emergencies when traveling

The N26 Metal policy provides cover for you, your spouse and children in case of a medical emergency abroad, including emergency dental care. You also get access to 24/7 medical phone assistance.

Baggage coverage and delay insurance

Get covered up to €500 for baggage delays over 4 hours, or up to €2,000 if your baggage goes missing.

Travel delay and cancellation

We know how inconvenient it can be when business trips don’t go to plan. Thankfully, if your trip is cancelled or delayed for more than 2 hours, you’ll be covered.

Trip interruption

Get covered up to €10,000 for unused non-refundable trip costs, plus additional accommodation and transportation.

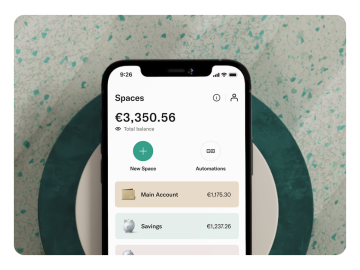

Save up for your projects with sub-accounts

Purchase protection

Coverage up to €10,000 in 12 months for stolen or damaged eligible purchases bought with your N26 card

Personal liability while traveling

Coverage up to €500,000 for Personal Liability in case you’re legally liable for damage to a third party or their property during a trip.

Dedicated customer service, always on-hand to help

A backup for your Metal card

What's next?

Get a discount when you pay annually

Choose to pay for your N26 Smart, You or Metal account annually and you’ll save 20% — that’s a premium N26 account at much less of a premium.N26 Metal

Our most premium plan

From €13.50/month

An 18-gram metal card

Up to 8 free ATM withdrawals per month

Purchase protection

Priority customer hotline

N26 Go

Travel with premium perks

€9.90/month

1,5% AER/NIR* interest on your N26 Instant Savings

Unlimited free withdrawals in foreign currencies

Insurance for delay and theft of luggage

Medical emergency cover

N26 Standard

The free online bank account

€0.00/month

1,25% AER/NIR* interest on your N26 Instant Savings

Worldwide payments and no foreign transaction fees

Up to 3 free domestic ATM withdrawals

- -

*Need a physical card? Order a transparent debit Mastercard card for an one-time €10 delivery fee.

Frequently Asked Questions

- Travel delays

- Baggage delay

- Baggage coverage

- Emergencies while traveling

- Trip cancellation

- Trip interruption

- Personal liability insurance

- Mobile phone coverage

- Purchase protection