N26 Business Smart

The intelligent business bank account for freelancers

Go global with a colorful Mastercard

Earn 0.1% cashback on all card purchases

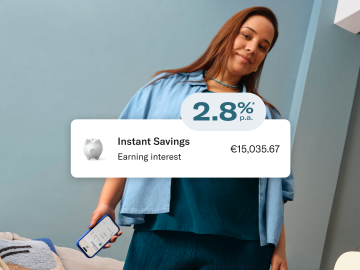

Start earning interest

A business bank account that's smarter

Track business expenses on-the-go

Get a monthly breakdown of incoming and outgoing payments with Statistics, an AI-powered tool that automatically categorizes your transactions into a handy business expenses list.

Save automatically with Rules

Set money aside for tax payments. Create Rules to set up automatic transfers between your main business bank account and your Spaces sub-accounts—daily, weekly, or monthly.

Bank from anywhere, 24/7

N26 Business Smart is a 100% mobile business bank account, accessible on mobile and web. Goodbye, last-minute bank runs. Hello, convenient business banking.

Easier tax returns and invoicing

Download your bank statements as PDF or CSV files via the N26 WebApp on your desktop. You can even add your own #tags to every transaction to quickly find them later.

Get paid instantly with MoneyBeam and SEPA Transfers

Secure business banking features

Mastercard 3D Secure

Add an extra layer of protection to your online purchases with Mastercard 3D Secure—an advanced two-factor authentication step.

Instant push notifications

Receive alerts on your smartphone after each transaction, and get notified immediately when you receive payments from clients.

Biometric identification

Keep your business banking logins extra safe and secure by verifying yourself with fingerprint identification or FaceID.

Deposit protection up to €100,000

As a fully-licensed European bank, your money is always protected up to €100,000 under the German Deposit Protection Scheme.

Customer support via chat and phone

Intelligent business banking at your fingertips

FAQ

- What are the benefits of the N26 Business Smart bank account?

- Do I need a business bank account if I’m self-employed?

- How do I open an N26 Business Smart bank account?

- Should I open a business bank account with my personal name or business name?

- How do I get my cashback on Mastercard purchases?

- Can I have a regular N26 bank account and an N26 Business Smart account at the same time?

- How do Spaces sub-accounts work, and what can I use them for?