Risk indicator for all N26 accounts.

1

/6

N26 is a member of the German Deposit Guarantee Fund. The fund guarantees deposits up to 100,000 euros per account holder and entity.

RISK INDICATOR corresponding to the securities product offered by Upvest Securities GmbH

6

/6

The execution, administration and custody product of Equities and ETFs offered by Upvest in free provision of community services has the following Risk Indicator in accordance with the provisions of Order ECC/2316/2015: 6/6

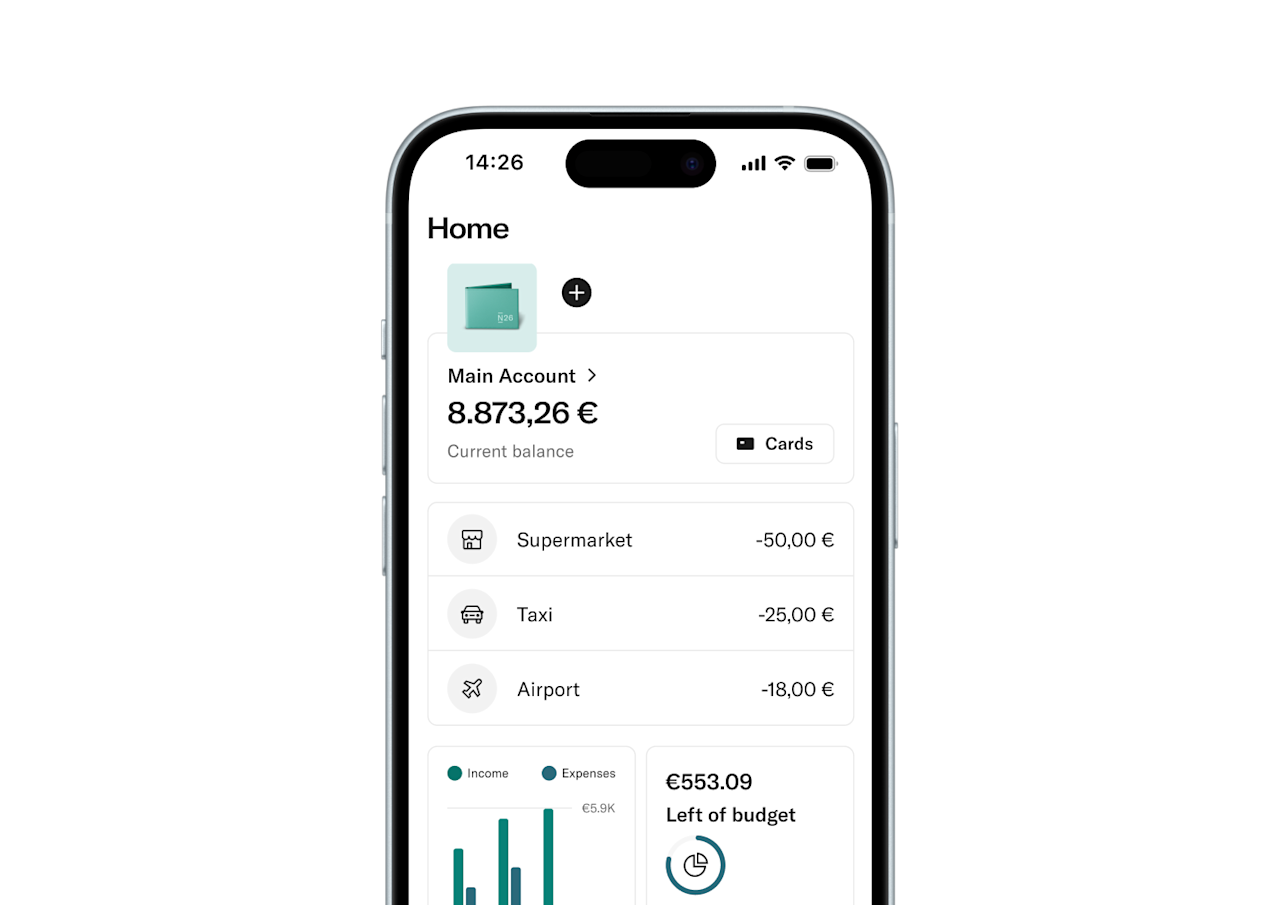

Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

N26 Bank SE, Sucursal en España with NIF W2765098E, is a permanent establishment in Spain of the German entity N26 Bank SE, registered at the Bank of Spain with entity number 1563 and head office at Paseo de la Castellana 43, 28046, Madrid. N26 Metal Instant Savings account from 0 euros and without limit of amount.

1 The new limited-edition festive virtual cards can be activated at no extra cost. Up to six virtual cards can be activated at one time.

There is no account management fee for N26 Standard. For other plans, a fee could apply. The current fees can be found in the List of Prices and Services.

2 Interest is settled monthly and applies to any amount deposited in the Instant Savings account, with no maximum limit. Under the current 1.30% AER (1.50% annual NIR) with N26 Metal (annual cost of the subscription of 202,8 euros), maintaining a daily balance of €100,000 in an N26 Metal Instant Savings account for 12 months would generate €1,500 in gross interest. With 0.50% AER (0.50% NIR) with N26 Go, 0.50% AER (0.50% NIR) with N26 Smart, and 0.50% AER (0.50% NIR) with Standard, maintaining a daily balance of €100,000 for 12 months would generate €500 in gross interest.

3 These statements are intended to provide general information and do not constitute investment advice or any other advice on financial services and financial instruments such as Stocks, ETFs and Ready-made funds. These statements also do not constitute an offer to conclude a contract for the purchase or sale of Stocks, ETFs and ready-made funds. Stocks, ETFs and Ready-made funds can be subject to high fluctuations in value. A decline in value or a complete loss of the money invested are possible at any time. The values depicted are fictional and for illustrative purposes.

Trading stocks and ETFs with N26 is fee-free. Product costs may apply, e.g. ETF management fees and third-party inducements.

4 Investing in crypto assets is not regulated, may not be suitable for retail investors and the entire amount invested may be lost. It is important to read and understand the risks of this investment which are fully explained in this link. The above statements do not constitute investment advice or any other advice on financial services or financial instruments. The values represented above are fictitious and are for illustrative purposes only. N26 Bank operates in Spain through N26 Bank SE, Sucursal en España, with CIF: W2765098E, as an entity authorized by the Bank of Spain with the financial entity code 1563 and registered in the Mercantile Registry of Madrid under Book 37931, page 122. , section 8, Sheet HM 675425 with establishment address at Paseo de la Castellana, 43, 28046 Madrid, Spain. N26 Bank does not offer or provide virtual currency to fiat currency exchange services or custody of electronic wallets by itself. N26 Bank offers a service for the reception and transmission of purchase and sale orders digital assets executed by Bitpanda GmbH (as a digital asset service provider, an investment firm licensed at the FMA, Austria FN423018k and located at Stella-Klein-Löw-Weg 17, 1020 Vienna, Austria).

5 Eligible spending: Detailed T&Cs for customers who sign up before July 17 and after October 15 can be found here: https://n26.com/hb-ex

N26 operates with a full European banking license, which protects deposits up to €100,000 under EU law. We currently operate in 24 markets worldwide and have over 8 million customers.

N26 operates with a full European banking license, which protects your money up to €100,000 under EU law. With features like 3D Secure, Mastercard Identity Check, and fingerprint and face recognition, we make your security our top priority.

As a bank, N26 is supervised by the Financial Markets Regulator and meets all European regulatory requirements. Our clients' funds are guaranteed up to €100,000 by the Deposit Protection Fund. In addition, the N26 app has many features to ensure the security of its users' bank accounts and data.

All N26 accounts opened after April 17, 2019 have a Spanish IBAN. This means that, in addition to using your account to withdraw money or make card payments, you can also use it to deposit your salary, direct debits or to manage your daily expenses from the app. Enjoy all the advantages of a 100% mobile account with a Spanish IBAN.

To open an N26 bank account, you must meet the eligibility criteria and an official identity document accepted in the country where you live. If you do, you can simply register via the N26 WebApp on desktop or the N26 app on your smartphone. It only takes a few minutes to open a bank account, and there’s no paperwork involved. You can start using your account right away once your identity is verified.

N26 Standard is a free bank account. There are no account maintenance fees or minimum deposit amounts for this online account. N26 Smart, N26 Go, and Metal premium accounts cost a monthly fee. Visit our website for more information and to compare accounts.

You can easily switch your bank account to N26 from almost every Spanish bank! Just type in the name of your current bank, whether it’s Bankia, BBVA, Santander, ING, Sabadell or CaixaBank. Discover how to switch banks with our tool to facilitate the process.

In Spain, the risk level of investment products is measured on a numerical scale from one to six. This means that the products marked as 1/6 are considered the safest, and those with 6/6 carry the most risk. As N26 is a member of the Deposit Guarantee Fund for Credit Institutions in Spain, all funds deposited into your N26 bank account — including Instant Savings — are always protected up to €100,000.