What are online payments and how can I make one?

Online payments are a fast, convenient way to send and receive money virtually, either via the web or a mobile device. As more consumers embrace digital banking, online transactions have become a popular choice for quick and secure payments.

What is an online payment?

An online payment is the electronic exchange of funds via a payment gateway or payment service provider. Online payments can be made via electronic bank transfer, debit or credit card payments, digital wallet transactions, and more. The online transaction process should always be secure and password protected, safeguarding the customer’s payment information.

How do online payments work?

With any type of online payment there are several steps involved. Once the payment is activated, the information is directed to a payment gateway. After that, the gateway encrypts the data and sends it to the card issuer, whose system checks the linked account for authorization. If accepted, the payment goes through and the funds are transferred. The gateway then confirms to the customer and payment recipient that the transaction has been processed, completing the online payment. The entire process usually happens in just a few seconds.Online payment methods

There are a range of online payment methods to choose from, including electronic bank transfer, credit cards, mobile payments, services like PayPal, and digital e-wallets. Payments can be made via web browser, or directly from your smartphone using a physical or virtual debit or credit card. New to virtual cards? No problem—read our guide to virtual cards and the technology behind them to learn more.

Online payment service provider platforms

A payment service provider, or PSP, makes it possible for companies to accept electronic payments. They act as a third party, setting up the transfer of funds between the sender and recipient. They enable multiple types of payments, including direct debit, bank transfer, credit card payments, and more. PayPal, Stripe, and Apple Pay are just a few of the many online payment service provider platforms available.Online payment digital wallet providers

Digital wallet platforms include PayPal, Apple Pay, Google Pay, Stripe, Amazon Pay, and Yandex. All are widely used online payment methods, securely storing card details for fast digital transactions. Payment information is kept safe in your digital wallet, and account information is encrypted, with some platforms verifying payment via touch or Face ID. Did you know that with an N26 account you can add your virtual debit Mastercard to virtually any platform for quick and easy online payments?How to use a debit card to make an online payment

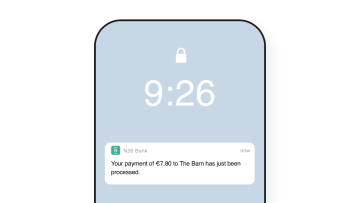

Using a debit card to make an online payment couldn’t be simpler. Just enter your 16-digit card number, expiration date, and CVV code at checkout. If 3D Secure requests additional verification, enter your one-time PIN or password. You should then receive a notification that your payment was successful. With N26, we make online payments a breeze with in-app payments via your virtual debit Mastercard.

Benefits of online payments

There are lots of advantages to using online payment services. For starters, they’re incredibly fast and efficient, and allow customers to access products and services from across the world. Plus, they’re much easier to manage than tedious cash payments. Online payments are also easy to track, offering extra security measures to reduce the risk of online card fraud.3DS online payments with N26

At N26, every debit card is 3D Secure-enabled with Mastercard SecureCode. Here’s how it works—the card issuer requests either a one-time PIN sent via SMS to the user’s smartphone, or a pre-set password. This added level of security confirms the identity of the cardholder, offering an added level of protection when making online payments. If you’re looking for the safest way to make online payments, sign up for an N26 account now to get your very own 3DS N26 debit Mastercard.

N26—security measures for every online payment

In addition to 3DS technology, N26 does even more to ensure that your money is protected. Every account is limited to one device pairing at a time, and is secured with password-protected login, as well as touch and facial recognition to verify every online payment. Plus, if you discover that your card has been compromised, you can lock it immediately and change the PIN right in the N26 app. Instant push notifications alert you of every transaction.

Online payment methods supported by N26

For extra convenience and security, N26 supports a range of online payment methods, such as:- Virtual debit Mastercard: Available with all N26 accounts, these virtual cards add a layer of protection and flexibility to online transactions.

- Digital wallet: Compatible with Apple Pay, Google Pay, Samsung Wallet, and Garmin Pay for seamless and easy payments.

- Direct bank transfer: Including SEPA transfers for sending and receiving money between bank accounts.

- Online transactions: Using the N26 app and debit Mastercard, with enhanced security features like 3D Secure authentication and instant push notifications.

- Bizum: A popular method in Spain for instant money transfers and online transactions.

- iDEAL: The leading payment method in the Netherlands for quick and secure bank transfers.

- Click to Pay: A secure online checkout option from Mastercard, without manually entering card details.

Your money at N26

With N26, each account type offers a variety of payment options, along with free online payments worldwide. Virtual debit Mastercards, included with every account, can be added to wallet apps like Google Pay and Apple Pay for effortless virtual payments. Plus, our MoneyBeam feature enables instant virtual payments to and from other N26 users, free of charge.Find a plan for you

N26 Standard

The free* online bank account

Virtual Card

€ 0,00/month

A virtual debit card

Free payments worldwide

Deposit protection

POPULAR

N26 Go

The debit card for everyday and travel

€ 9,90/month

Up to 5 free withdrawals in the Eurozone

Flight and luggage delay cover

Medical emergency cover

Winter activities insurance

Pandemic coverage

N26 Metal

The premium account with a metal card

€ 16,90/month

An 18-gram metal card

Up to 8 free withdrawals in the Eurozone

Purchase protection

Phone insurance

Dedicated N26 Metal line

FAQs

- Payment activation: The customer starts the payment on a website or app.

- Information transmission: Payment details are securely sent to a payment gateway.

- Data encryption: Sensitive financial information is encrypted for security.

- Authorization: The card issuer or bank verifies the funds and approves the transaction.

- Fund transfer: The money is transferred from the customer's account to the merchant's account.

- Confirmation: Both parties receive notifications confirming the transaction.

An online payment is a virtual exchange of money. Funds are transferred electronically through a variety of digital payment service platforms.

Les moyens de paiement en ligne comprennent les paiements mobiles, cartes de crédit et de débit, plateformes de paiement et applications wallet.

Online debit card payments can be made at checkout by entering your card number, expiration date, and CVV code. You may also be required to provide a one-time PIN or password if 3DS is enabled.

All online payment methods should be digitally encrypted, protecting your account and personal data. At N26, each transaction goes through several layers of security, and every Mastercard debit card is 3D Security-enabled with a Mastercard SecureCode.

With N26, you can make online payments with your debit Mastercard, or use MoneyBeam to send funds to other N26 users. Add your debit Mastercard to Google Pay or Apple Pay for quick digital payments wherever you are.

N26 is always working to keep our customers’ money safe. Online payments are protected with 3D Secure and instant notifications, and it’s easy to add your N26 payment details to digital wallets like Apple Pay, Google Pay, Samsung Wallet, and Garmin Pay. All of our accounts come with up to six free virtual debit Mastercards, giving customers separate card numbers for safer online shopping. And MoneyBeam enables instant transfers between N26 customers, without swapping any bank account details.

With N26, the online payment process happens in the blink of an eye. But behind the scenes, there are several steps:

N26 uses 3D Secure, biometric verification like touch and facial recognition, and instant push notifications for real-time alerts when money enters or leaves your account. The N26 app lets our customers lock or unlock their cards, change their PINs, and set transaction limits. Additional security features include two-factor authentication, location tracking, and identity verification, and we use AI and machine learning to detect and prevent fraud.

Yes, N26 virtual debit Mastercards work with Apple Pay, Google Pay, Samsung Wallet, and Garmin Pay. Create your virtual card in the 'Cards' tab in the N26 app, then add it to your digital wallet for online and in-store transactions. Your card information is tokenized for security. Virtual cards are available to all N26 account holders, for secure and convenient payments right from your smartphone.