N26 Flex

The bank account, without the Schufa minimum requirement

A full banking experience, without the minimum credit requirements usually needed for current accounts in Germany. With N26 Flex, sign up to a bank account that doesn’t take your Schufa score into consideration and tap into smart, flexible digital banking—right on your smartphone.

Banking that won’t take your Schufa score into account

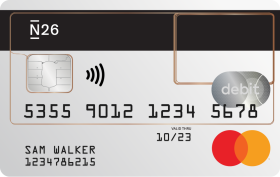

Your N26 Flex bank account comes with a Mastercard, alongside our standard banking features. Send and receive money with SEPA transfers and online payments, enjoy a detailed overview of your spending habits with Insights, and set aside funds with Spaces sub-accounts for better budgeting. You can get started from just €6 per month, and we won’t take your Schufa score into account.

Smart, flexible banking on your smartphone

With mobile banking, manage your money on-the-go. Open your bank account in minutes right from your smartphone, and start spending before your physical card arrives. It’s a full banking experience that gives you full control over your finances, even if you have a negative Schufa.

Go global with your Mastercard

Get your Mastercard debit card without an additional Schufa check, and make payments online or in-store anywhere in the world—without hidden fees and at Mastercard’s best exchange rate. Use your Mastercard to withdraw money at ATMs and for depositing and taking out funds with CASH26 at one of our partner stores. It’s the only card you need for all your transactions, and it’s accepted worldwide.

Dream big, and save money with Spaces

Find a better way to budget and set aside money with N26 Spaces, sub-accounts that sit alongside your main account and help you manage your money. With just a few taps, create a space and start stashing away your pennies for the things that matter. Keep track of your progress and monitor how close you come to reaching your financial goals.

Security you can count on

As N26 is a German bank with a full German banking license, we guarantee that your funds are secured up to €100,000 by the German Deposit Protection Fund. Alongside 3D Secure—which adds an additional layer of security to your online transactions—stay up-to-date thanks to instant push notifications. Track where your money goes 24/7—whether it’s an ATM withdrawal, a CASH26 deposit at over 11,500 shops in Germany, or a MoneyBeam sent to another N26 user.

Get to know your financial habits with Insights

Thanks to Insights—our automatic categorization feature—familiarize yourself with your spending habits all in one place. Divided into smart sub-categories, learn what you spend on groceries each month, or just how much you order takeout from your favorite restaurant.

We’re here for you—in several languages

If you have any questions or run into any problems, our Customer Service team will be on hand to help you in English, German, French, Spanish and Italian. Just reach out to an agent via the in-app chat function, and get answers to your questions with a few taps.

Sign up to N26 Flex in minutes

Open an N26 Flex bank account from your smartphone or desktop—it’s fast and easy, and only takes a few minutes. No hassle, and no paperwork required.

Frequently Asked Questions

Can I get an N26 account even if I have a negative Schufa score?

Yes, you can get an N26 Flex bank account even if you have a negative Schufa score. Nevertheless, you still need to meet our other terms and conditions.

Can I get a N26 Flex account with a positive Schufa score?

If you have a positive Schufa score, we’ll redirect you to sign up to another N26 account that’s better suited to your needs.

Does this N26 account come with a Mastercard?

Yes, your N26 Flex bank account comes with a Mastercard debit card as standard. This card is equipped with contactless NFC technology, and our statement debit card design.

How can I save money with Spaces?

Similar to savings accounts, Spaces are sub-accounts that sit alongside your main N26 account. Drag and drop funds over to save up and reach your personal savings goals, and keep track of your progress along the way.

Can I use Apple Pay and Google Pay with N26 Flex?

Yes, just add your card to your Apple Pay or Google Pay wallet and you are ready to go.

Is N26 secure?

N26 operates with a full European banking license, which protects your N26 account up to €100,000, under EU law directives. With 3D Secure, Mastercard Identity Check and fingerprint and face recognition, the security of your online payments is always guaranteed.

How do I open an N26 bank account?

If you meet all the requirements, you can open your bank account with N26 for free and within minutes. All you need is a smartphone and your photo ID—it's easy with our digital authentication process. Download our app to open an account—you don’t even need a minimum deposit amount.