Indicador de riesgo correspondiente a todas las cuentas N26.

1/6

Este número es indicativo del riesgo del producto, siendo 1/6 indicativo de menor riesgo y 6/6 indicativo de mayor riesgo.

Entidad adherida al Fondo de Garantía de Depósitos Alemán. El fondo garantiza los depósitos de dinero hasta 100.000 euros por titular de la Unión Europea y entidad.

Compara las cuentas bancarias N26 disponibles en España

Encuentra la cuenta perfecta para ti

N26 Smart

La cuenta premium que te ayuda a controlar mejor tu dinero

4,90 €/mes

N26 You

La cuenta premium para tu día a día y para viajar al extranjero

9,90 €/mes

N26 Metal

La cuenta más premium con ventajas exclusivas y una tarjeta de acero inoxidable

16,90 €/mes

N26 Smart

La cuenta premium que te ayuda a controlar mejor tu dinero

4,90 €/mes

N26 You

La cuenta premium para tu día a día y para viajar al extranjero

9,90 €/mes

N26 Metal

La cuenta más premium con ventajas exclusivas y una tarjeta de acero inoxidable

16,90 €/mes

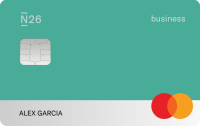

Encuentra la cuenta perfecta para tu negocio

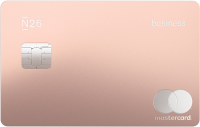

N26 Estándar

La cuenta gratuita* para autónomos con un reembolso del 0,1 % en compras

0,00 €/mes

N26 Smart

La cuenta premium para autónomos que te da mayor control sobre tu dinero y un 0,1 % de reembolso en compras

4,90 €/mes

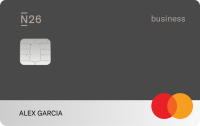

N26 You

La cuenta premium para autónomos con ventajas exclusivas para viajar y un 0,1 % de reembolso en compras

9,90 €/mes

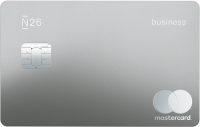

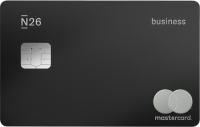

N26 Metal

La cuenta más exclusiva para autónomos, con un 0,5 % de reembolso en compras y una tarjeta de acero única

16,90 €/mes

N26 Estándar

La cuenta gratuita* para autónomos con un reembolso del 0,1 % en compras

0,00 €/mes

N26 Smart

La cuenta premium para autónomos que te da mayor control sobre tu dinero y un 0,1 % de reembolso en compras

4,90 €/mes

N26 You

La cuenta premium para autónomos con ventajas exclusivas para viajar y un 0,1 % de reembolso en compras

9,90 €/mes

N26 Metal

La cuenta más exclusiva para autónomos, con un 0,5 % de reembolso en compras y una tarjeta de acero única

16,90 €/mes

Smart: TIN 0 %, TAE: -1,17 % para un supuesto en el que se mantenga de forma constante durante un año un saldo diario de 5.000 €, aplicando un tipo de interés nominal anual de 0 % y el coste mensual de la cuenta bancaria de 4,90 €/mes. La liquidación de la cuenta se realiza con periodicidad mensual.

You: TIN 0%, TAE: -2,35% para un supuesto en el que se mantenga de forma constante durante un año un saldo diario de 5000€, aplicando un tipo de interés nominal anual de 0% y el coste mensual de la cuenta de 9,90€/mes. La liquidación de la cuenta se realiza con periodicidad mensual.

Metal: TIN 0%, TAE: -3.98% para un supuesto en el que se mantenga de forma constante durante 1 año un saldo diario de 5.000€, aplicando un tipo de interés nominal anual de 0% y el coste mensual de la cuenta de 16,90€/mes. La liquidación de la cuenta se realiza con periodicidad mensual.

*2,26 % TAE (2,26% TIN anual). Con este tipo de interés, si mantienes un saldo diario de 15.000 € en tu Cuenta de Ahorro N26 durante un periodo de 12 meses, obtendrás un interés bruto total de 339 €. Aplica a toda cantidad depositada en la cuenta de ahorro, sin límite máximo.

Cuentas personales - Preguntas frecuentes

¿Qué necesitas para abrir una cuenta en N26?

Para abrir una cuenta bancaria N26, debes cumplir con los criterios de elegibilidad y un documento de identidad aceptado en el país en el que resides. Si cumples estos requisitos, podrás registrarte a través de la app N26. Sin papeleos, solo te llevará unos minutos abrir tu cuenta bancaria. Una vez verifiquemos tu identidad, podrás empezar a usar tu cuenta inmediatamente.

¿A partir de qué edad puedo abrirme una cuenta N26?

Tendrás que tener al menos 18 años para abrir una cuenta bancaria N26.

¿Qué precio tiene la cuenta sin comisiones N26 Estándar?

Abrir la cuenta sin comisiones N26 Estándar es totalmente gratis y no tiene ninguna comisión de mantenimiento ni comisión de cierre.

Las suscripciones a N26 Smart, You y Metal tienen un coste mensual de 4,90 €, 9,90 € y 16,90 € respectivamente; todas ellas con una permanencia mínima de 12 meses y con una serie de ventajas adicionales que no tiene la cuenta estándar.

¿Tiene algún coste adicional para mí utilizar mi cuenta N26 para recibir o procesar pagos de la Seguridad Social?

No, no tiene ningún coste adicional cobrar tus prestaciones de la Seguridad Social o pagar tu cuota de autónomo a través de tu cuenta N26.

¿Desde qué bancos españoles puedo cambiar a N26?

Puedes cambiar de banco a N26 desde prácticamente cualquier otro banco español, ya sea Bankia, BBVA, Santander, ING, Sabadell o CaixaBank. Descubre cómo cambiar de banco con nuestra herramienta para facilitar el proceso.

¿Puedo tener una cuenta personal y una cuenta autónomos al mismo tiempo?

Por el momento no es posible tener dos cuentas bancarias N26. Si tienes una cuenta bancaria personal N26 y quieres abrir una cuenta autónomos N26 Business, primero debes cerrar la cuenta personal y luego abrir una cuenta autónomos.

¿Las cuentas N26 están sujetas a comisiones de mantenimiento?

No, las cuentas bancarias N26 no tienen comisiones de apertura, mantenimiento o cierre de cuenta. Si decides abrir una cuenta premium N26 Smart, N26 You o N26 Metal, tendrás que pagar una cantidad mensual en concepto de suscripción, pero no las comisiones anteriormente mencionadas. Además, con la cuenta N26 Smart tampoco pagarás comisiones por retirar efectivo en cajeros de Europa, y con las cuentas N26 You y N26 Metal podrás retirar dinero de forma gratuita en todo el mundo.

¿Qué pasa con mi tarjeta si cambio mi suscripción?

Si cambias a una cuenta premium, los beneficios de tu nueva suscripción se activarán inmediatanente y te enviaremos una nueva tarjeta Mastercard de débito por correo postal. Una vez que actives tu nueva tarjeta, la tarjeta asociada a tu antigua suscripción quedará bloqueada permanentemente. Si pasas de una suscripción premium a cuenta N26 Estándar, tu cuenta sólo incluirá una tarjeta virtual, pero puedes solicitar una tarjeta Mastercard de débito física por un pago único de 10 €.

¿Cuál es la diferencia entre el paquete de seguro incluído en N26 You y en N26 Metal?

Tanto las cuentas N26 Metal como N26 You ofrecen un completo seguro de viaje que incluye cobertura por retrasos de viaje, retraso de equipaje, cobertura por pérdida de equipaje, emergencias durante el viaje, cancelación e interrupción de viaje y seguro de responsabilidad civil. Sin embargo, con las cuentas N26 Metal, además podrás disfrutar de cobertura de teléfono móvil y protección en compras.