N26 Standard

The 100% digital bank account

Discover N26 Standard—the bank account that lives in one easy, intuitive app on your smartphone. Send, receive, and manage your money from anywhere, at any time. Open your account in just 8 minutes online, and get an Italian IBAN for everyday payments in Italy. No maintenance fees. No minimum deposits. No worries.

Get a free virtual debit Mastercard

N26 Standard comes with a free contactless Mastercard virtual card, compatible with Google Pay and Apple Pay. Pay with your smartphone anywhere in the world, and enjoy 3 free withdrawals each month from any contactless-enabled ATM in Italy and the Eurozone. Or, try CASH26 in your N26 app to withdraw cash for free at supermarkets across Italy!

Prefer to have a physical card on hand? Simply order a transparent Mastercard debit card for a one-off €10 delivery fee.

Make instant bank transfers in real-time

Forget the hassle of asking for bank details—instantly send, receive, and request money from other N26 customers for free with N26 MoneyBeam.

Need to transfer funds into your account from another bank? There’s no need to wait. Receive incoming bank transfers within seconds with SEPA Instant Credit transfers.

Learn about Instant payments

Enjoy fuss-free local payments in Italy

Simplify your daily payments. Pay postal slips, MAV, RAV, and car tax in Italy directly from your N26 app, using PagoPA. You can even top-up your mobile phone credit, too. That’s what we call convenient banking.

Deposit and withdraw cash while you shop with CASH26

Save yourself the trip to the bank! CASH26 lets you deposit and withdraw cash at more than 1000 supermarkets across Italy. Just generate a barcode in your N26 app, show it to the cashier and deposit or withdraw your cash—your account balance will update immediately.

Learn moreWith N26, you’re always in control

Protected up to €100,000

N26 operates with a full European banking license. That means your money is insured up to €100,000 by the German Deposit Protection Scheme.

Safely shop online with 3D Secure

Your N26 Standard bank account is equipped with 3D Secure (3DS), keeping your online payments extra secure with two-factor authentication.

Push notifications for every transaction

Track your account’s every move with instant push notifications on your phone. Know about all incoming and outgoing payments as they happen.

Log in quickly and securely

Tired of remembering passwords? Use fingerprint identification or Face ID to log in at lightning speed, and keep your account extra secure.

Wondering how to save money? Try N26 Spaces

Achieve your financial goals with N26 Spaces sub-accounts, available with every N26 premium subscription. Allocate a space for each goal, give it a name, and use intelligent features like Rules to automatically stash money aside from your main account.

Want to make saving up even easier? Turn on the premium Round-Ups feature in a space of your choice, and save up the spare change with every card transaction.

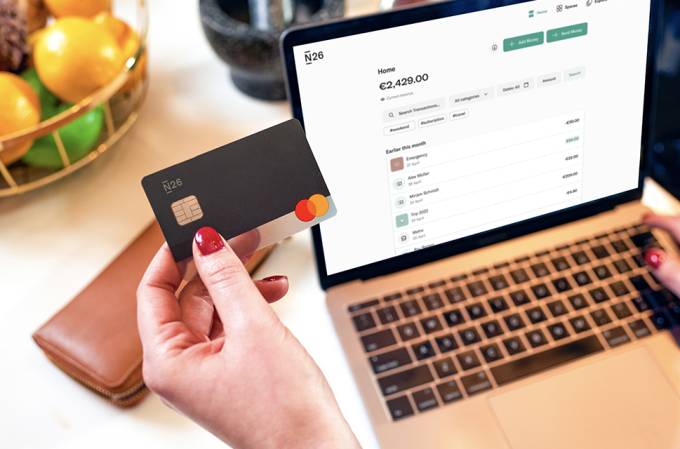

Manage your money with SpacesPrefer banking from your desktop?

Give your eyes a break from squinting at a phone screen. You can also access your N26 Standard bank account from the N26 WebApp for desktop.

Bank statements in a single tap

Preparing for your tax return? Easily export your transaction list in .csv or .pdf format via the N26 WebApp, or download your bank statement from the N26 app.

We’re here to help—in 5 languages!

Have a question? Visit the N26 Support Center for answers to our most frequently asked questions, or simply start a chat with our N26 Customer Support specialists in your N26 app. We’re here for you in English, Italian, French, Spanish, and German.

Visit our Support Center

N26 Smart—save and spend with confidence

Want to get even smarter about your spending and saving? Go premium with N26 Smart and access intelligent money management tools to save and budget better. Get unlimited ATM withdrawals in Italy and across the Eurozone, customer phone support, a unique colorful Mastercard, and up to 10 Spaces sub-accounts to make budgeting a breeze. Plus, enjoy bigger discounts from our partner brands, and access to Statistics, an AI-driven tool that automatically categorizes your spending in real-time.

Mobile banking that’s easy, secure, and convenient.

Over 8 million customers already bank with N26 around the world. Curious to discover why? Compare our premium banking subscriptions now, or open your N26 Standard bank account online in minutes—right from the comfort of home. No maintenance fees. No ATM withdrawal fees. No account fees. Just convenient banking at your fingertips, 24/7.

*The “N26 Standard” current account includes zero fees for the maintenance of the account, the issuance of a virtual debit card and the authorization of virtual debit card transactions, ordinary SEPA transfers in Euros, standing transfer orders, SEPA direct debits, three cash withdrawals a month at ATMs in Euro area. Fees and charges are applicable for services other than those indicated. For the complete contractual and economic conditions, see the information sheets.

Advertising message for promotional purposes. Please see the Terms & Conditions for more information.

FAQs

Is N26 a bank?

N26 is the 100% digital bank launched in 2015 with a German banking license and operating in Italy under the regime of establishment and provision of services pursuant to European law. Currently, N26 is present in 25 markets and has over 8 million customers worldwide.

Is N26 secure?

N26 has been granted a full German banking license from BaFin. By law, each customer’s funds are protected up to €100,000 by the German Deposit Protection Scheme. With 3D Secure, Mastercard Identity Check, and fingerprint and face recognition, the security of our customer's online payments is always guaranteed.

What do I need to open an N26 Standard bank account?

You can open an N26 Standard bank account if:

- You’re at least 18 years old

- You’re a resident of a supported country

- You have an ID from your country of residence

- You have a smartphone that’s compatible with the N26 app

- You don’t already have another N26 account

Want to learn more? See our full eligibility criteria.

How do I open an N26 Standard bank account?

To open an N26 Standard bank account, you must meet our eligibility criteria. If you do, simply register on our website, or download the N26 app on a compatible smartphone.

Opening an N26 bank account only takes a few minutes, and there’s no paperwork involved. All you need is a few minutes, your smartphone, and a valid ID on hand. You can start using your account as soon as your ID is verified!

What are the advantages of having an N26 Standard bank account?

N26 Standard is a fee-free bank account without any minimum opening deposits or ongoing maintenance fees. The 100% digital bank account is the perfect solution for managing your money on-the-go. Start making instant bank transfers, categorizing your expenses, and easily make local payments in Italy from one intuitive, easy-to-use app.

The N26 Standard account includes a virtual Mastercard that allows you to make mobile payments with Apple Pay or Google Pay. Pay in apps, in stores, and online with your virtual Mastercard, or simply order a physical card from your N26 app for a €10 one-off delivery fee. You can withdraw cash for free 3 times per month from contactless-enabled ATMs in Italy and across the Eurozone.

How much does the N26 Standard bank account cost?

The N26 Standard bank account is free of charge—there are no minimum opening deposits, no minimum account balance requirements, and no maintenance fees.

How do I top-up my N26 account?

You can immediately transfer money to your N26 account using a debit card, credit card, Apple Pay, or Google Pay as soon as your account is set up. You can subsequently top it up by having your salary credited to your N26 account, initiating a SEPA transfer from another bank or by using MoneyBeam, a feature that allows you to send, receive, and request money in real-time from other N26 customers—for free.

How often can I withdraw cash for free?

With the N26 Standard bank account, you can withdraw cash for free 3 times per month from any ATM in Italy and the Eurozone. Our premium bank accounts offer even more free withdrawals, such as unlimited free withdrawals within Italy with N26 Smart, and unlimited free withdrawals worldwide in any currency with N26 You and N26 Metal.